Nippon Paint Holdings (TSE:4612) Eyes Growth in India and China Despite Profitability Challenges

Reviewed by Simply Wall St

Nippon Paint Holdings (TSE:4612) has recently reported a record Q3 revenue of JPY 405.6 billion, marking a 3.2% increase year-on-year, driven by strategic acquisitions and expansion efforts. Despite this growth, the company faces challenges with a 13.1% decrease in operating profit and low return on equity, highlighting the need for improved operational efficiency. The following report will examine key areas such as financial performance, growth opportunities in India and Indonesia, and the competitive pressures in critical markets like China and France.

Get an in-depth perspective on Nippon Paint Holdings's performance by reading our analysis here.

Key Assets Propelling Nippon Paint Holdings Forward

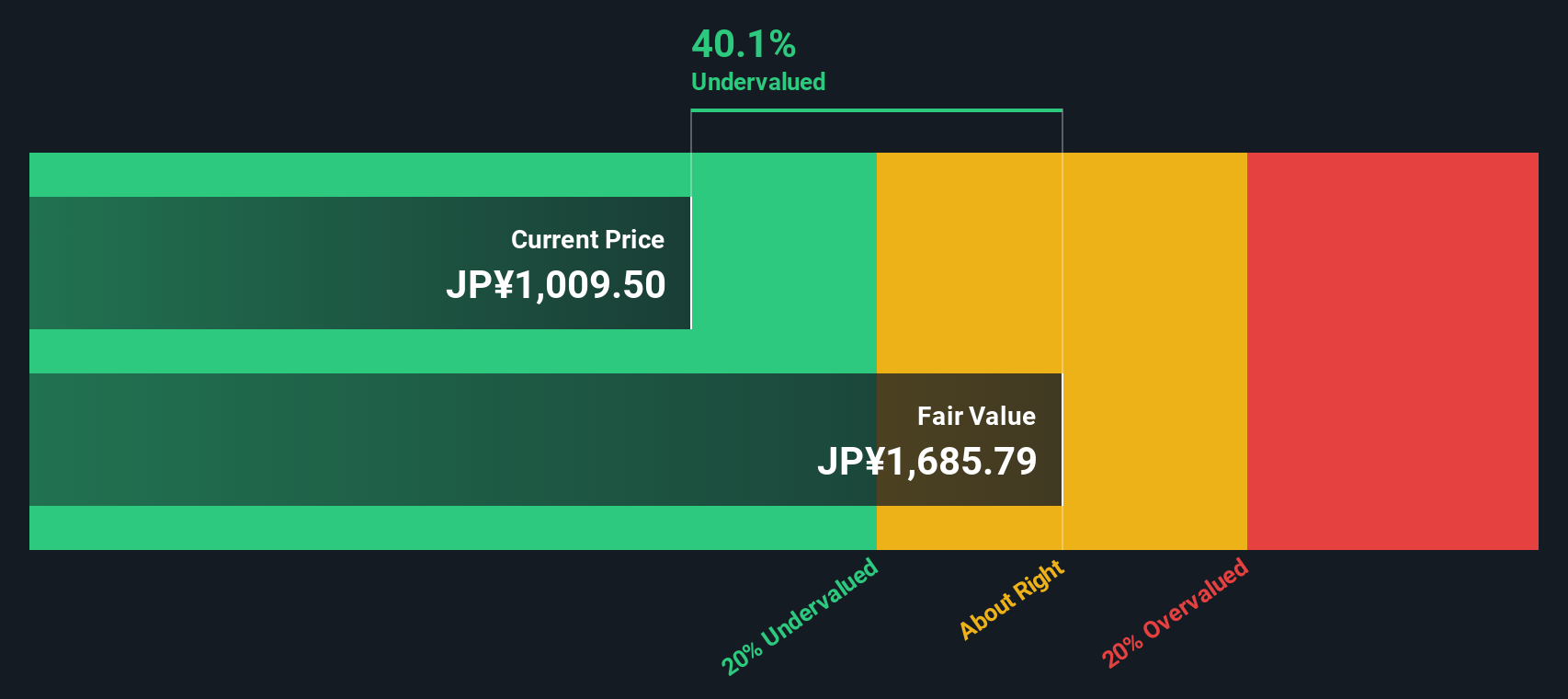

Nippon Paint Holdings has demonstrated significant growth, highlighted by a record Q3 revenue of JPY 405.6 billion, a 3.2% year-on-year increase. This achievement is attributed to increased paint volume, expansion in adjacencies, and the integration of new subsidiaries. Strategic acquisitions, particularly in the Pacific region, have enhanced performance, contributing to a 1 percentage point margin improvement. The company's earnings have grown significantly by 26.9% per year over the past five years, and they are forecasted to continue growing at 8.99% annually. Furthermore, Nippon Paint Holdings is trading at 27.4% below its estimated fair value, suggesting potential upside. The net debt to equity ratio stands at a satisfactory 34.7%, and interest payments are well covered by EBIT, with a coverage ratio of 37.7x. These financial metrics underscore the company's strong foundation and ability to leverage its assets effectively.

Critical Issues Affecting the Performance of Nippon Paint Holdings and Areas for Growth

Despite the positive revenue trajectory, Nippon Paint Holdings faces challenges in profitability, with a 13.1% decrease in operating profit on a non-GAAP basis. The return on equity remains low at 8.5%, and earnings growth over the past year did not outperform the broader Chemicals industry. Additionally, the company's current net profit margins have dipped to 7.8% from 8.3% last year. The valuation reveals that while the company trades below its fair value, it appears expensive based on its SWS fair ratio compared to industry peers. This highlights a need for operational efficiency improvements and strategic financial management to enhance profitability and shareholder returns.

Growth Avenues Awaiting Nippon Paint Holdings

The company is poised for expansion, particularly with regulatory approval for its Indian business, which is expected to contribute to consolidated earnings from Q4. Indonesia also presents a growth opportunity with a 7.9% recovery, indicating potential for further regional expansion. Nippon Paint Holdings is focusing on cost optimization, especially in China, where it plans to enhance margins through rigorous cost reviews and personnel optimization. These initiatives aim to bolster the company's market position and capitalize on emerging opportunities, aligning with forecasts of revenue growth at 5.8% annually, outpacing the JP market.

Competitive Pressures and Market Risks Facing Nippon Paint Holdings

The economic situation in key markets like China and France remains challenging, with weak consumer sentiment affecting growth prospects. Price competition in China necessitates price reductions, impacting margins, particularly for premium products. Additionally, potential regulatory changes and market dynamics, such as those in Turkey, pose ongoing risks, including the effects of hyperinflationary accounting. The company's share price volatility over the past three months further underscores the external pressures it faces, necessitating strategic adaptability to maintain its competitive edge and market share.

Conclusion

Nippon Paint Holdings has shown commendable revenue growth driven by strategic acquisitions and increased paint volume, yet it faces challenges in profitability, as evidenced by a 13.1% decrease in operating profit. Despite trading 27.4% below its estimated fair value, the company's high Price-To-Earnings Ratio compared to industry peers suggests that investors may be paying a premium for anticipated growth. The company's focus on expansion in India and cost optimization in China could enhance future earnings, but ongoing market risks in key regions like China and France necessitate careful strategic management. Overall, while the company's financial foundation is strong, with a satisfactory net debt to equity ratio and EBIT coverage, it must address operational inefficiencies to improve its return on equity and profit margins, ensuring sustainable long-term performance.

Summing It All Up

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Paint Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4612

Nippon Paint Holdings

Engages in the paints and fine chemicals businesses.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives