Nippon Paint Holdings (TSE:4612): Assessing Valuation Following New Share Buyback Program Announcement

Reviewed by Simply Wall St

Nippon Paint Holdings (TSE:4612) announced a new share buyback program, with plans to repurchase up to 35,000,000 shares, or about 1.5% of its issued share capital. The buyback is scheduled to be completed by February 2026.

See our latest analysis for Nippon Paint Holdings.

After a rocky stretch over the past quarter, Nippon Paint Holdings’ buyback announcement comes at an interesting time for investors. Despite a roughly 17% dip in share price over the past three months, the company’s longer-term momentum appears steadier. The three-year total shareholder return is 12.6%, even though the one-year total return is just shy of flat. Moves like this buyback could help revive sentiment and suggest management sees value at current levels.

If you want to broaden your search beyond Nippon Paint, this is a great moment to discover fast growing stocks with high insider ownership.

But with shares trading at a sizeable discount to analyst targets and steady long-term returns, the key question is whether Nippon Paint is undervalued or if the market has already priced in its next chapter of growth.

Most Popular Narrative: 20.6% Undervalued

Nippon Paint Holdings’ most widely followed fair value estimate sits well above its last closing price. This signals that analysts see substantial upside potential under current assumptions.

Continued expansion in Asia-Pacific and other high-growth emerging markets through M&A and local partnerships, as highlighted by the full-year consolidation of India and AOC, positions Nippon Paint to capture gains from urbanization, rising middle-class consumption, and infrastructure build-out. These factors are expected to drive long-term top-line growth.

Urbanization, M&A ambitions, and a premium product push are just the tip of the iceberg. Which aggressive quantitative projections are fueling this higher valuation? The real story is in the analyst assumptions driving that sharp upside estimate.

Result: Fair Value of ¥1,284 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including sustained demand weakness in China or difficulties integrating recent acquisitions. Either of these factors could limit growth and pressure margins.

Find out about the key risks to this Nippon Paint Holdings narrative.

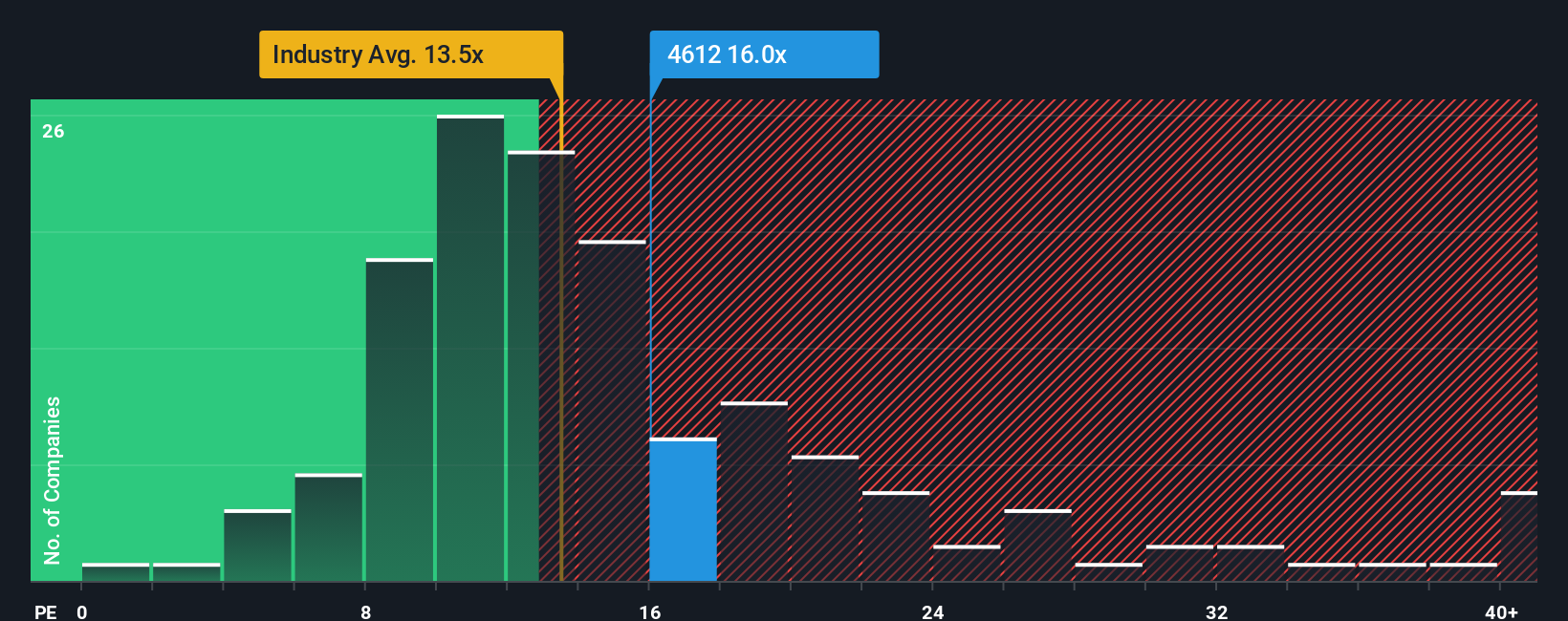

Another View: Multiples Tell a Different Story

Looking at Nippon Paint Holdings through the lens of its current price-to-earnings ratio shows a less convincing bargain. The stock trades at 16.1 times earnings, which is higher than the Japanese Chemicals industry average of 12.8 times earnings, but a bit lower than the peer average of 17.8. This suggests the market already prices in some optimism, but not quite as much as the analysts. With a fair ratio of 20.3, there is still potential upside if the market shifts, but could this premium also mean some valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nippon Paint Holdings Narrative

If you see things differently or want to investigate the numbers for yourself, you can quickly generate your own perspective in just a few minutes with Do it your way.

A great starting point for your Nippon Paint Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and access unique opportunities that others might overlook. Now is the time to target trends driving tomorrow’s returns. Don’t watch from the sidelines.

- Capture growth by targeting these 24 AI penny stocks, which are revolutionizing industries through real-world applications of artificial intelligence and machine learning innovation.

- Power up your portfolio with income by analyzing these 17 dividend stocks with yields > 3% that offer attractive yields above 3 percent and potential for stable returns in shifting markets.

- Ride the future of money and technology by leveraging these 79 cryptocurrency and blockchain stocks focused on blockchain breakthroughs and companies building the next wave in digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Paint Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4612

Nippon Paint Holdings

Engages in the paints and fine chemicals businesses.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives