Investors Still Aren't Entirely Convinced By Ishihara Chemical Co., Ltd.'s (TSE:4462) Earnings Despite 30% Price Jump

Ishihara Chemical Co., Ltd. (TSE:4462) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

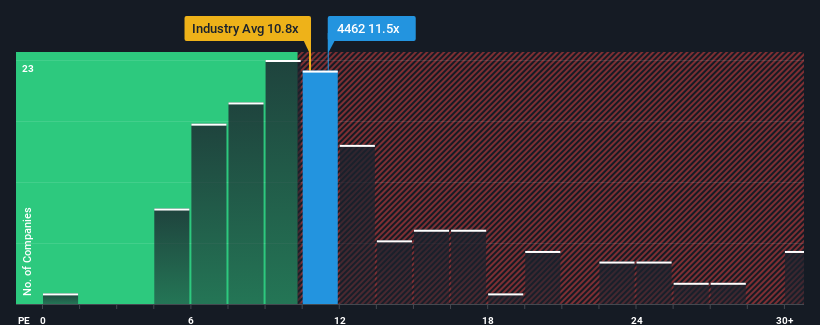

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Ishihara Chemical's P/E ratio of 11.5x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We check all companies for important risks. See what we found for Ishihara Chemical in our free report.Ishihara Chemical certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Ishihara Chemical

Is There Some Growth For Ishihara Chemical?

The only time you'd be comfortable seeing a P/E like Ishihara Chemical's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 48%. The strong recent performance means it was also able to grow EPS by 41% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 9.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's curious that Ishihara Chemical's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Ishihara Chemical's P/E?

Ishihara Chemical appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Ishihara Chemical revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Ishihara Chemical with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4462

Ishihara Chemical

Engages in the manufacture and sale of chemical products in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives