Moriroku Company (TSE:4249) Has Announced A Dividend Of ¥57.50

Moriroku Company, Ltd. (TSE:4249) has announced that it will pay a dividend of ¥57.50 per share on the 8th of June. This takes the dividend yield to 5.0%, which shareholders will be pleased with.

Moriroku Company's Distributions May Be Difficult To Sustain

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Moriroku Company is unprofitable despite paying a dividend, and it is paying out 2,525% of its free cash flow. This makes us feel that the dividend will be hard to maintain.

Recent, EPS has fallen by 42.4%, so this could continue over the next year. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

See our latest analysis for Moriroku Company

Moriroku Company's Dividend Has Lacked Consistency

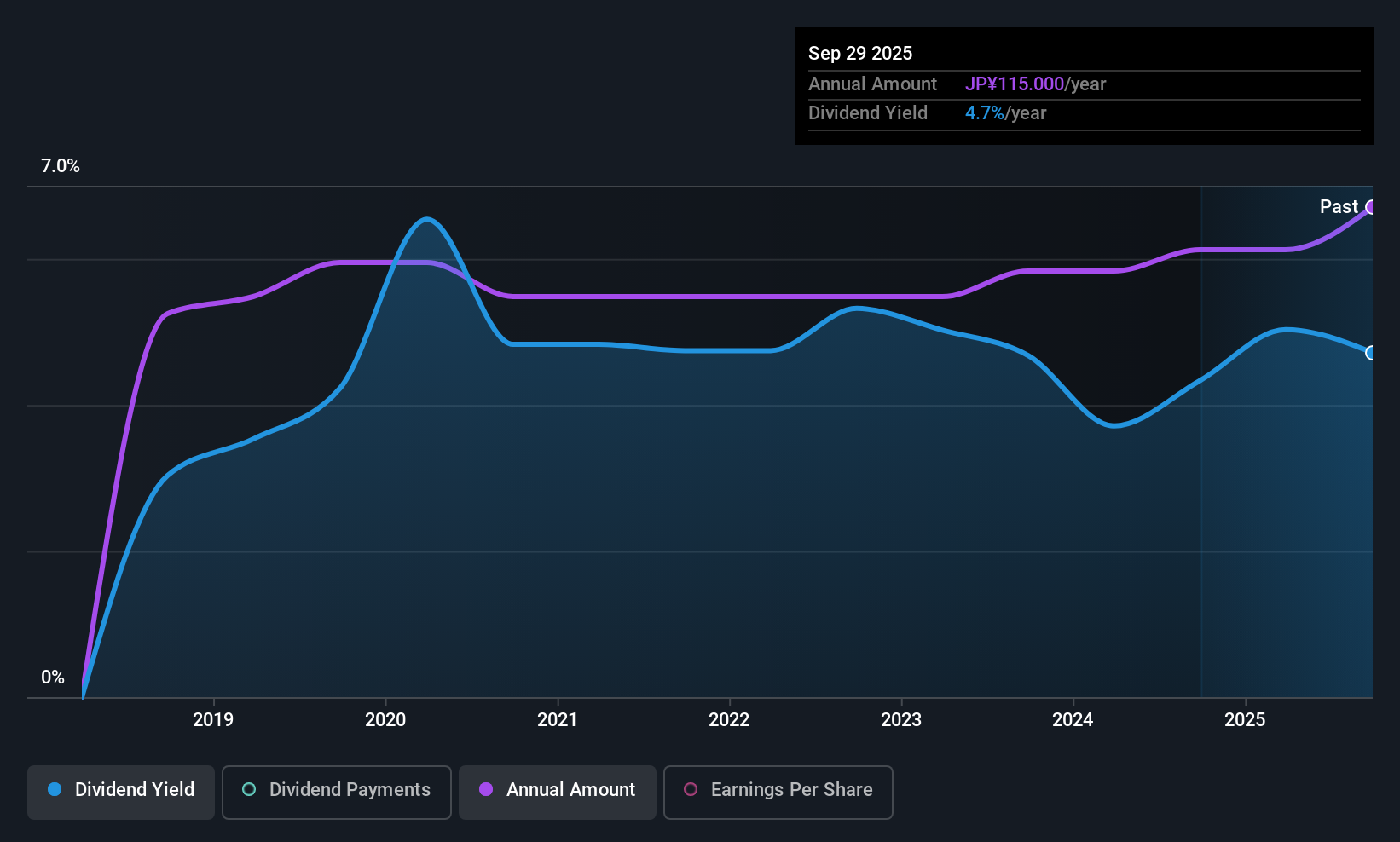

It's comforting to see that Moriroku Company has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The annual payment during the last 7 years was ¥90.00 in 2018, and the most recent fiscal year payment was ¥115.00. This means that it has been growing its distributions at 3.6% per annum over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been sinking by 42% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of Moriroku Company's Dividend

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Moriroku Company that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4249

Moriroku Company

Engages in the resin-processed products and chemicals businesses in Japan.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026