Kodama Chemical Industry Co.,Ltd.'s (TSE:4222) Popularity With Investors Under Threat As Stock Sinks 39%

Kodama Chemical Industry Co.,Ltd. (TSE:4222) shareholders won't be pleased to see that the share price has had a very rough month, dropping 39% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

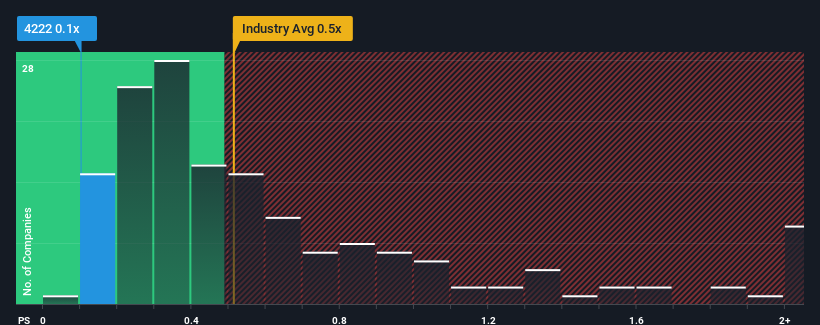

In spite of the heavy fall in price, it's still not a stretch to say that Kodama Chemical IndustryLtd's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Japan, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Kodama Chemical IndustryLtd

How Kodama Chemical IndustryLtd Has Been Performing

For example, consider that Kodama Chemical IndustryLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kodama Chemical IndustryLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Kodama Chemical IndustryLtd would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 6.7% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 6.9% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Kodama Chemical IndustryLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Kodama Chemical IndustryLtd's P/S?

With its share price dropping off a cliff, the P/S for Kodama Chemical IndustryLtd looks to be in line with the rest of the Chemicals industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Kodama Chemical IndustryLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kodama Chemical IndustryLtd (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kodama Chemical IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4222

Kodama Chemical IndustryLtd

Manufactures and sells plastic products in Japan and internationally.

Excellent balance sheet and good value.