Mitsubishi Gas Chemical (TSE:4182): Assessing Valuation Following Pause on Key Netherlands Expansion Project

Reviewed by Kshitija Bhandaru

Mitsubishi Gas Chemical Company (TSE:4182) has paused construction on its meta-xylenediamine facility in the Netherlands, citing escalating costs, project delays, and shifting market conditions. This decision highlights the company’s international expansion efforts and future earnings outlook.

See our latest analysis for Mitsubishi Gas Chemical Company.

With construction delays abroad making headlines, Mitsubishi Gas Chemical’s share price has held steady overall, but its one-year total shareholder return sits at just 0.02%. That suggests momentum is cooling compared to the more robust gains seen in recent years. This hints that investors are weighing future growth against new uncertainties.

If this shift in momentum has you scanning for your next opportunity, now is a smart time to expand your search and discover fast growing stocks with high insider ownership

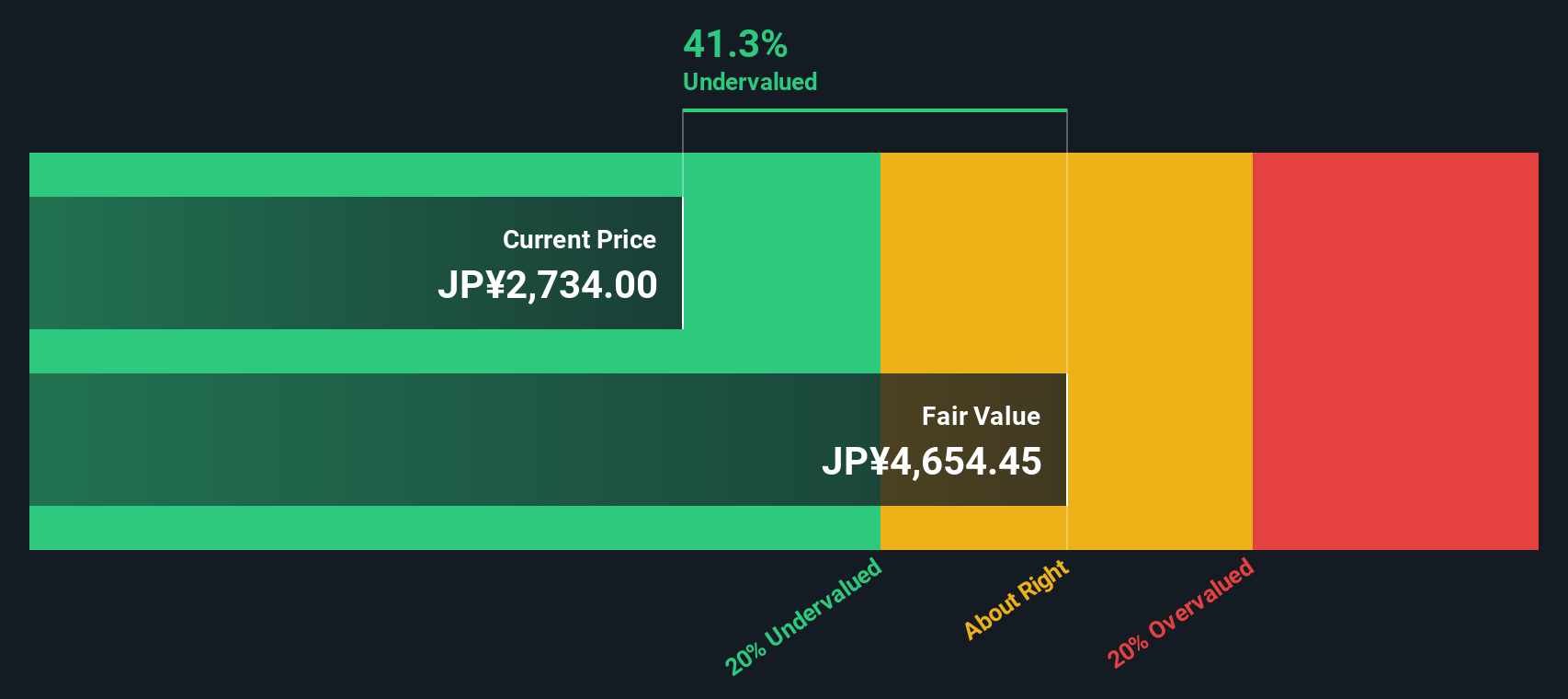

With profit still climbing and shares trading at a nearly 39 percent discount to intrinsic value, the key question is whether Mitsubishi Gas Chemical is undervalued or if the market is already pricing in future growth potential.

Price-to-Earnings of 12.6x: Is it justified?

The share price of Mitsubishi Gas Chemical Company closes at ¥2,739.5, and its price-to-earnings ratio of 12.6x signals a significant discount compared to its listed peers trading at 30.3x on average. This sharp divergence in multiples calls for closer scrutiny.

The price-to-earnings (P/E) ratio reflects what investors are willing to pay today for a yen of the company’s earnings. For Mitsubishi Gas Chemical, a lower P/E could indicate the market is cautious about future earnings growth or that the stock is overlooked relative to sector peers. In the chemicals sector, P/E is especially relevant since profit margins can fluctuate with commodity cycles and market demand.

Notably, Mitsubishi Gas Chemical’s P/E of 12.6x is not just below peer averages but also lower than the estimated fair P/E of 16.6x. This suggests that, even accounting for sector dynamics and the company’s own fundamentals, the market may be underestimating Mitsubishi Gas Chemical’s future profitability or growth trajectory. If sentiment shifts, there is room for re-rating toward this fairer level.

Explore the SWS fair ratio for Mitsubishi Gas Chemical Company

Result: Price-to-Earnings of 12.6x (UNDERVALUED)

However, external shocks to global demand or further cost escalations on delayed projects could challenge the current value narrative for Mitsubishi Gas Chemical.

Find out about the key risks to this Mitsubishi Gas Chemical Company narrative.

Another Perspective: Discounted Cash Flow Approach

While price-to-earnings suggests Mitsubishi Gas Chemical is undervalued, the SWS DCF model offers a different perspective and shows that the stock trades well below its estimated fair value of ¥4,474 per share. This indicates a significant potential upside, but does it account for all market risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi Gas Chemical Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi Gas Chemical Company Narrative

If you want to draw your own conclusions or dig deeper into the data, building a personalized view takes just a few minutes. Do it your way

A great starting point for your Mitsubishi Gas Chemical Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Expand your watchlist and catch emerging opportunities now, or you risk missing tomorrow’s market leaders.

- Tap into high-yield potential and secure steady passive income by evaluating these 19 dividend stocks with yields > 3% that consistently deliver impressive payout ratios.

- Stay ahead of industry shifts and track the frontrunners building medical breakthroughs with these 31 healthcare AI stocks before they gain wider attention.

- Capitalize on market mispricings by targeting these 910 undervalued stocks based on cash flows that show the strongest upside based on future cash flows and real fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives