Is Mitsubishi Gas Chemical (TSE:4182) Undervalued? A Fresh Look at Its Valuation After Recent Share Gains

Reviewed by Kshitija Bhandaru

If you have been keeping tabs on Mitsubishi Gas Chemical Company (TSE:4182), you may have noticed shares catching the eye of investors lately, even in the absence of a headline-grabbing event. Sometimes, market moves are less about new information and more about a shift in how investors think about value or future prospects, so it is not surprising for the stock to stir curiosity right now.

Over the past year, the company’s shares have edged up 4%. A longer look reveals a strong 50% gain over three years and a 65% lift for those who have held for five years. The past month alone saw the shares jump nearly 7%, suggesting that despite quieter headlines, investor sentiment may be building again. This comes at a time when annual revenue and net income have both grown, hinting at purposeful progress under the surface.

With steady gains and recent momentum, the question now is whether Mitsubishi Gas Chemical Company is a bargain waiting to be discovered or if the current price already reflects all its strengths and future prospects.

Price-to-Earnings of 12.7x: Is it justified?

Mitsubishi Gas Chemical Company is currently trading at a price-to-earnings (P/E) ratio of 12.7x, which is below both the Japanese Chemicals industry average of 13x and significantly below the peer average of 30.4x. This suggests the stock is valued cheaply compared to its peers and industry.

The price-to-earnings ratio is a widely used measure that compares a company’s share price to its earnings per share. For established companies in the chemicals sector, the P/E provides a sense of whether investors are paying a reasonable price for earnings generated now and in the foreseeable future. A lower P/E can signal a bargain, or it could reflect doubts about the company’s sustained performance relative to peers.

Mitsubishi Gas Chemical Company's lower multiple likely reflects market skepticism or conservatism, despite recent strong growth in earnings. Investors may be underestimating the company's future profit potential compared to other players in the sector.

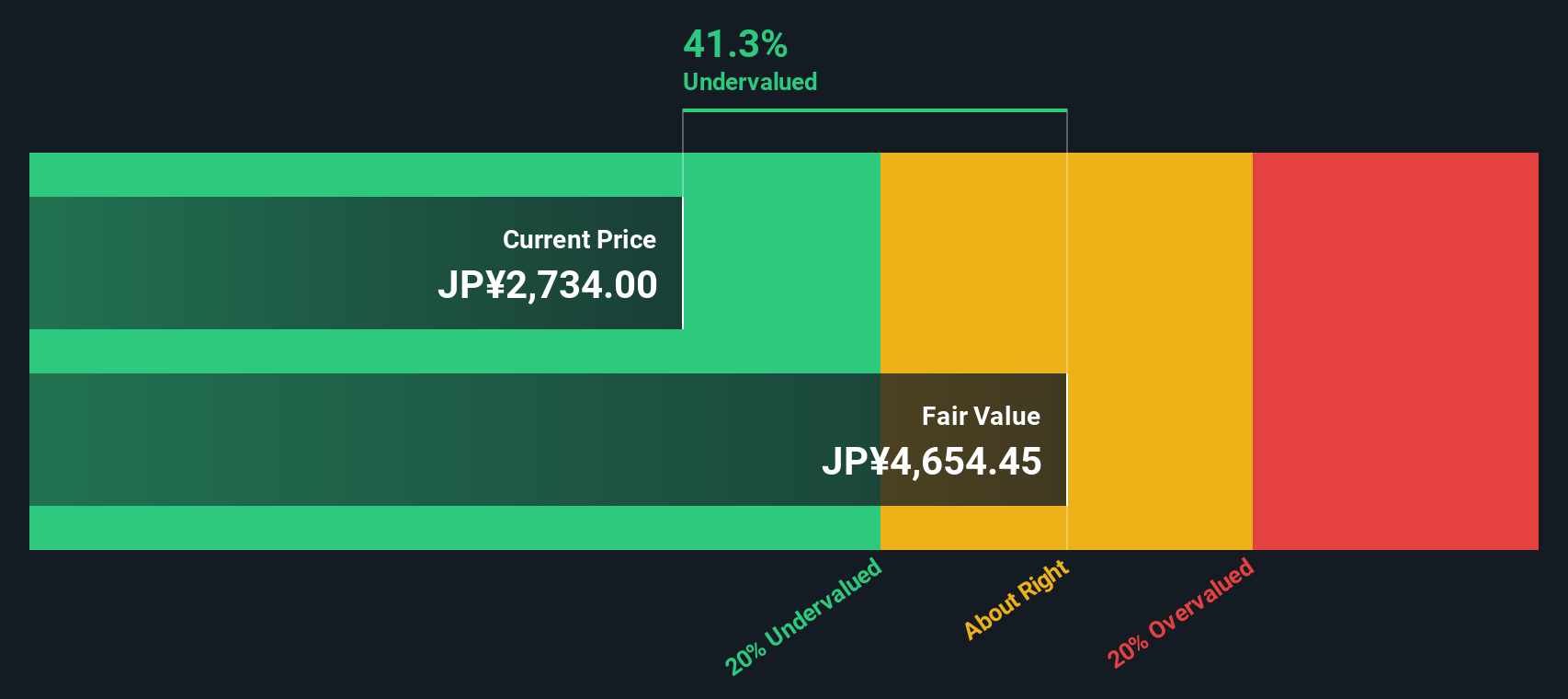

Result: Fair Value of ¥4,660.36 (UNDERVALUED)

See our latest analysis for Mitsubishi Gas Chemical Company.However, ongoing market skepticism and potential slowdowns in revenue growth could pose challenges. This may limit the upside investors might expect from current valuations.

Find out about the key risks to this Mitsubishi Gas Chemical Company narrative.Another View: What Does the SWS DCF Model Say?

Looking from a different angle, our SWS DCF model also suggests Mitsubishi Gas Chemical Company’s shares appear undervalued based on projected cash flows. While both value perspectives point in the same direction, could market sentiment be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mitsubishi Gas Chemical Company Narrative

If our assessment does not align with your perspective, or you enjoy drawing your own conclusions from the numbers, you can craft your own narrative in just minutes: Do it your way.

A great starting point for your Mitsubishi Gas Chemical Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at one opportunity. Uncover stocks with strong financials, future-focused industries, or reliable returns using these powerful tools from Simply Wall Street. Your portfolio will thank you.

- Spot undervalued companies poised for growth by heading straight to the undervalued stocks based on cash flows and see which businesses might be flying under the radar.

- Tap into the power of artificial intelligence with AI penny stocks to unlock possibilities shaping the future of automation, data insight, and innovation.

- Find stocks offering steady income and solid yields above 3 percent by checking out dividend stocks with yields > 3% for your next income-generating pick.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives