Despite the downward trend in earnings at Mitsubishi Gas Chemical Company (TSE:4182) the stock ascends 5.8%, bringing three-year gains to 70%

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. That's what has happened with the Mitsubishi Gas Chemical Company, Inc. (TSE:4182) share price. It's up 52% over three years, but that is below the market return. Looking at more recent returns, the stock is up 6.3% in a year.

The past week has proven to be lucrative for Mitsubishi Gas Chemical Company investors, so let's see if fundamentals drove the company's three-year performance.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, Mitsubishi Gas Chemical Company failed to grow earnings per share, which fell 3.4% (annualized).

Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Mitsubishi Gas Chemical Company at the moment. Therefore, it makes sense to look into other metrics.

We severely doubt anyone is particularly impressed with the modest 1.0% three-year revenue growth rate. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

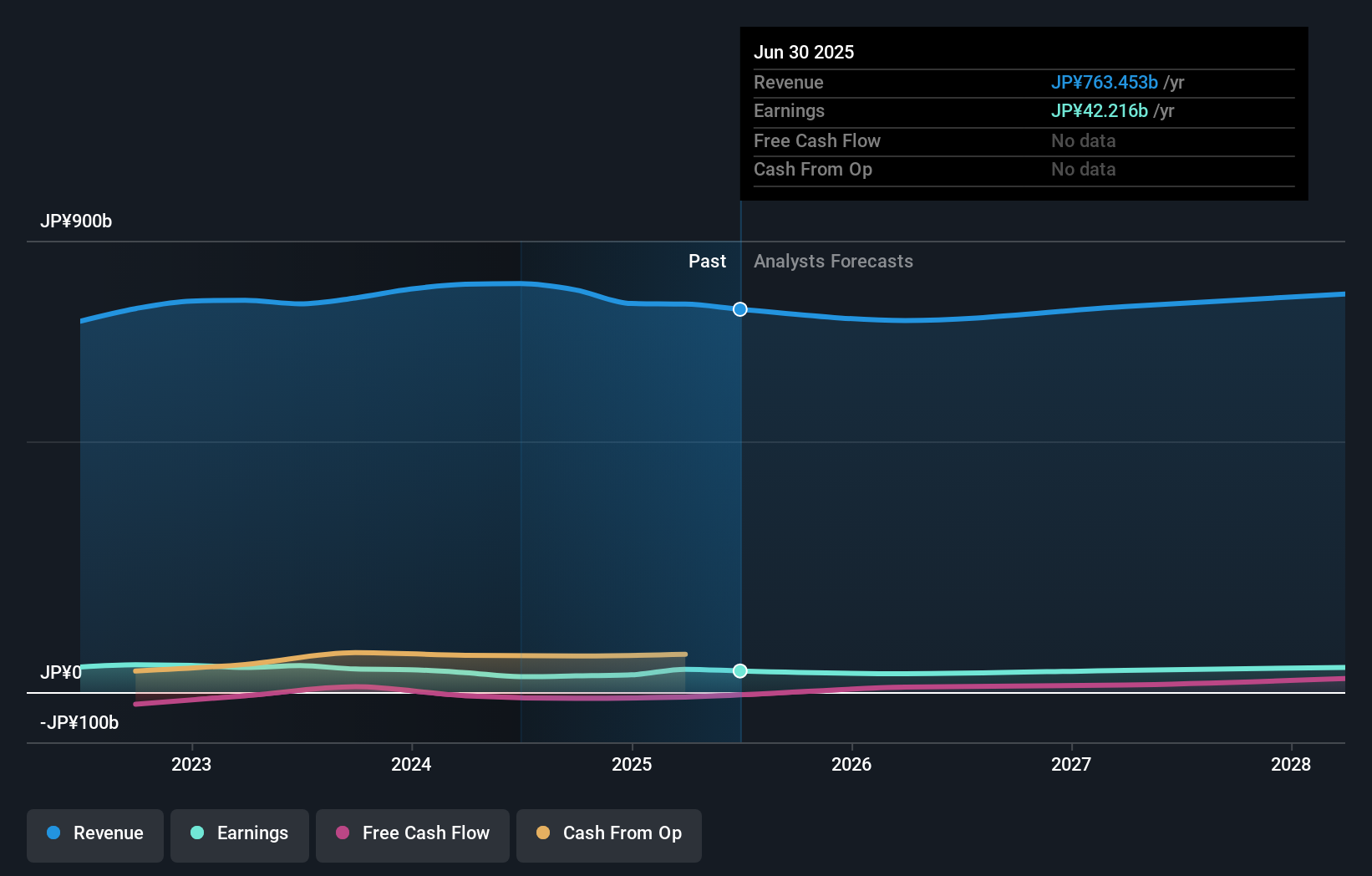

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Mitsubishi Gas Chemical Company is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Mitsubishi Gas Chemical Company, it has a TSR of 70% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Mitsubishi Gas Chemical Company provided a TSR of 11% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 11% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Mitsubishi Gas Chemical Company , and understanding them should be part of your investment process.

Of course Mitsubishi Gas Chemical Company may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives