As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are seeking stability in dividend stocks that offer reliable income streams. In this context, selecting stocks with strong fundamentals and consistent dividend yields can provide a measure of resilience amidst the current market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

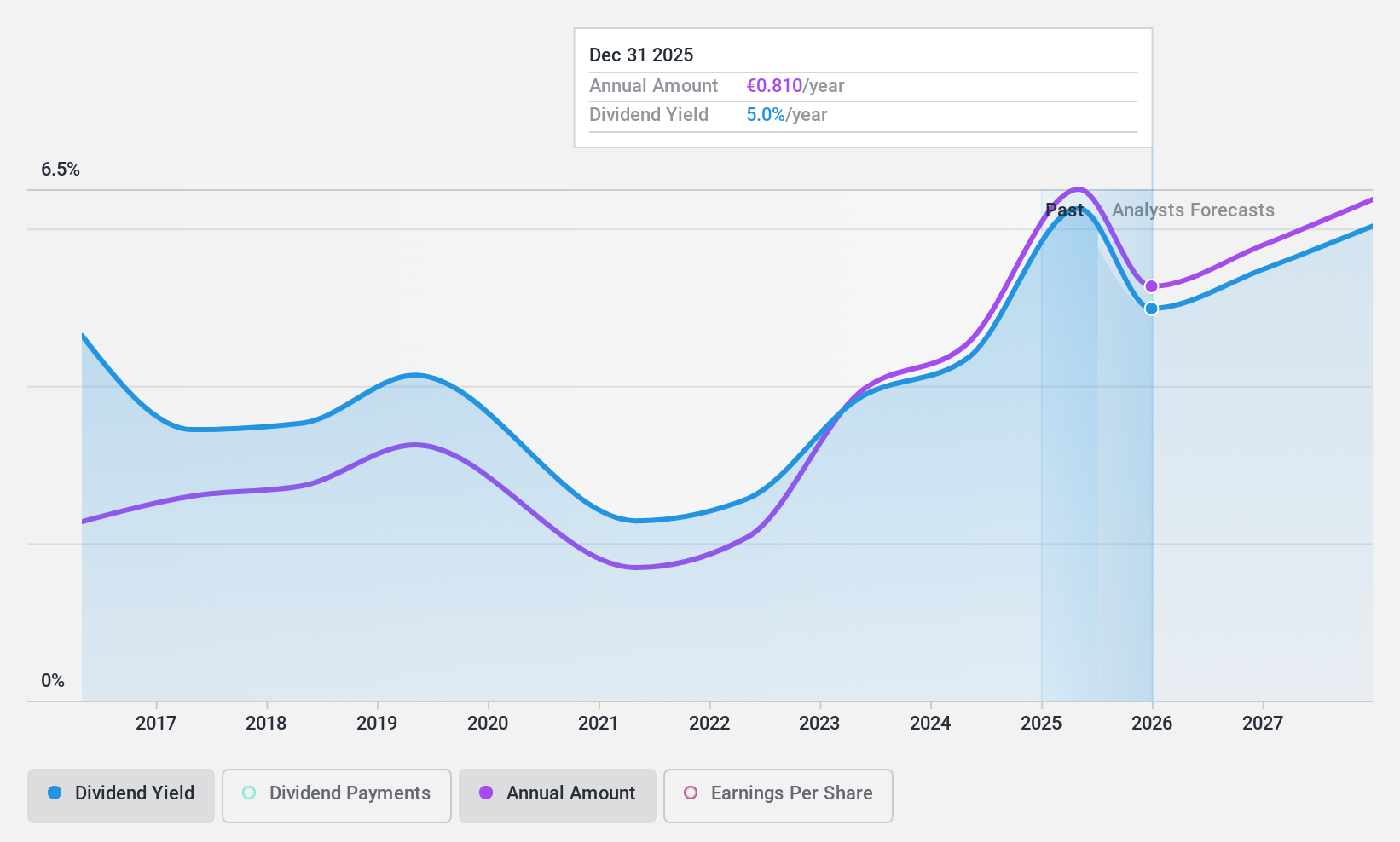

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. is an Italian company that produces and markets professional loudspeakers under the B&C brand both domestically and internationally, with a market cap of €184.51 million.

Operations: B&C Speakers S.p.A. generates revenue primarily from its Acoustic Transducers segment, which accounted for €99.40 million.

Dividend Yield: 4.2%

B&C Speakers offers a dividend with a reasonable payout ratio of 44.1%, indicating earnings and cash flows sufficiently cover the payments. However, its yield of 4.17% is below the Italian market's top tier, and dividends have been volatile over the past decade. Recent earnings growth is notable, with net income rising to €15.78 million for nine months ending September 2024, up from €11.67 million year-on-year, supporting potential dividend stability improvements.

- Get an in-depth perspective on B&C Speakers' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that B&C Speakers is priced lower than what may be justified by its financials.

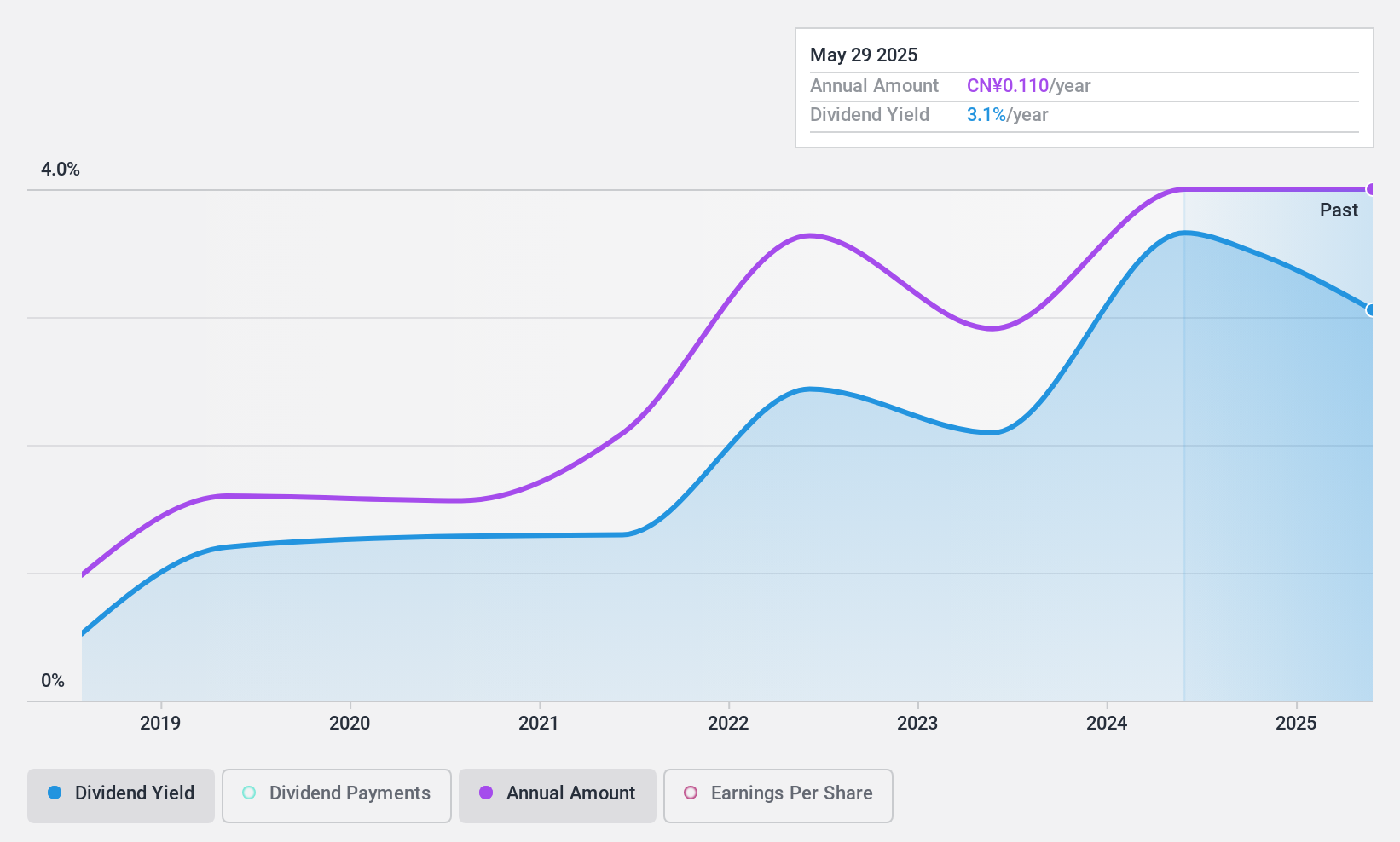

Jiaze Renewables (SHSE:601619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects and has a market capitalization of approximately CN¥8.47 billion.

Operations: Jiaze Renewables Corporation Limited generates its revenue primarily from the development, construction, sale, operation, and maintenance of new energy projects.

Dividend Yield: 3.2%

Jiaze Renewables' dividend yield of 3.16% is among the top quarter in the Chinese market, supported by a payout ratio of 41.3% and cash coverage at 57%. However, its high debt levels and volatile dividend history over six years raise sustainability concerns. The company's recent earnings report showed a decline in net income to CNY 550.76 million for the first nine months of 2024, down from CNY 649.2 million year-on-year, potentially impacting future payouts.

- Take a closer look at Jiaze Renewables' potential here in our dividend report.

- According our valuation report, there's an indication that Jiaze Renewables' share price might be on the expensive side.

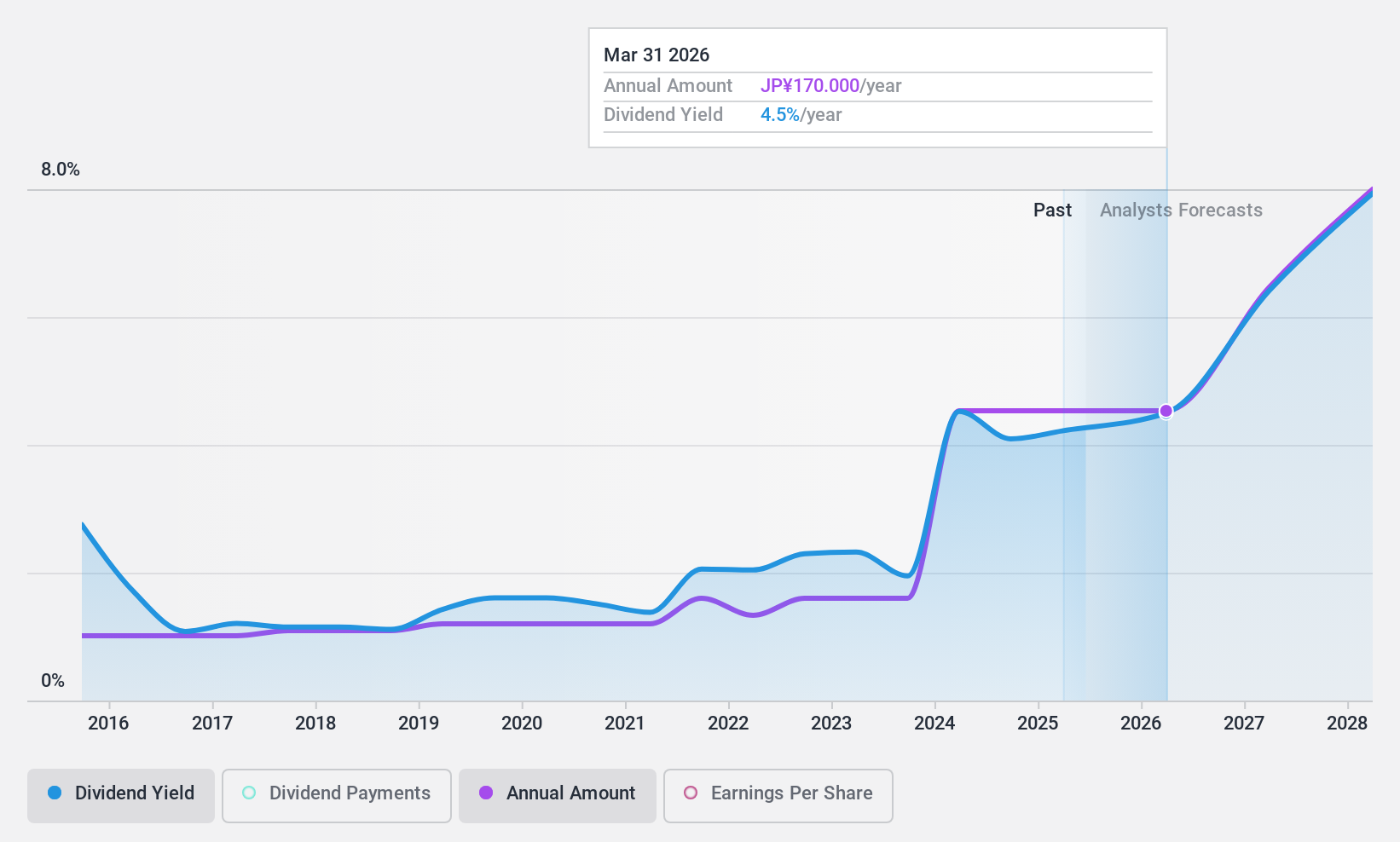

Stella Chemifa (TSE:4109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella Chemifa Corporation manufactures and sells inorganic fluorine compounds both in Japan and internationally, with a market cap of ¥53.89 billion.

Operations: Stella Chemifa's revenue primarily comes from its High-Purity Chemical segment, which generated ¥29.48 billion, followed by the Transportation segment at ¥7.86 billion.

Dividend Yield: 3.8%

Stella Chemifa's dividend yield of 3.8% ranks in the top quarter of Japanese dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 392.9%. Despite trading at a significant discount to estimated fair value, dividends have been volatile over the past decade with inadequate coverage by free cash flows. The recent share buyback program aims to enhance shareholder returns and improve capital efficiency, reflecting strategic financial management efforts.

- Click here to discover the nuances of Stella Chemifa with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Stella Chemifa shares in the market.

Taking Advantage

- Embark on your investment journey to our 1938 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4109

Stella Chemifa

Manufactures and sells inorganic fluorine compounds in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives