Paul Hartmann And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, major stock indices have shown varied performances, with large-cap stocks generally outperforming their smaller-cap counterparts. This trend is evident as the Russell 2000 Index continues to lag behind larger indices like the S&P 500, highlighting a challenging environment for small-cap companies amid economic uncertainties and shifting monetary policies. In such conditions, identifying promising stocks involves looking for those with strong fundamentals and potential growth drivers that can withstand broader market pressures. Paul Hartmann and two other lesser-known companies stand out as intriguing opportunities within this context.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of €795.59 million.

Operations: The company's revenue streams are primarily derived from Incontinence Management (€769.70 million), Wound Care (€597.39 million), and Infection Management (€516.66 million), along with contributions from its complementary divisions (€499.70 million).

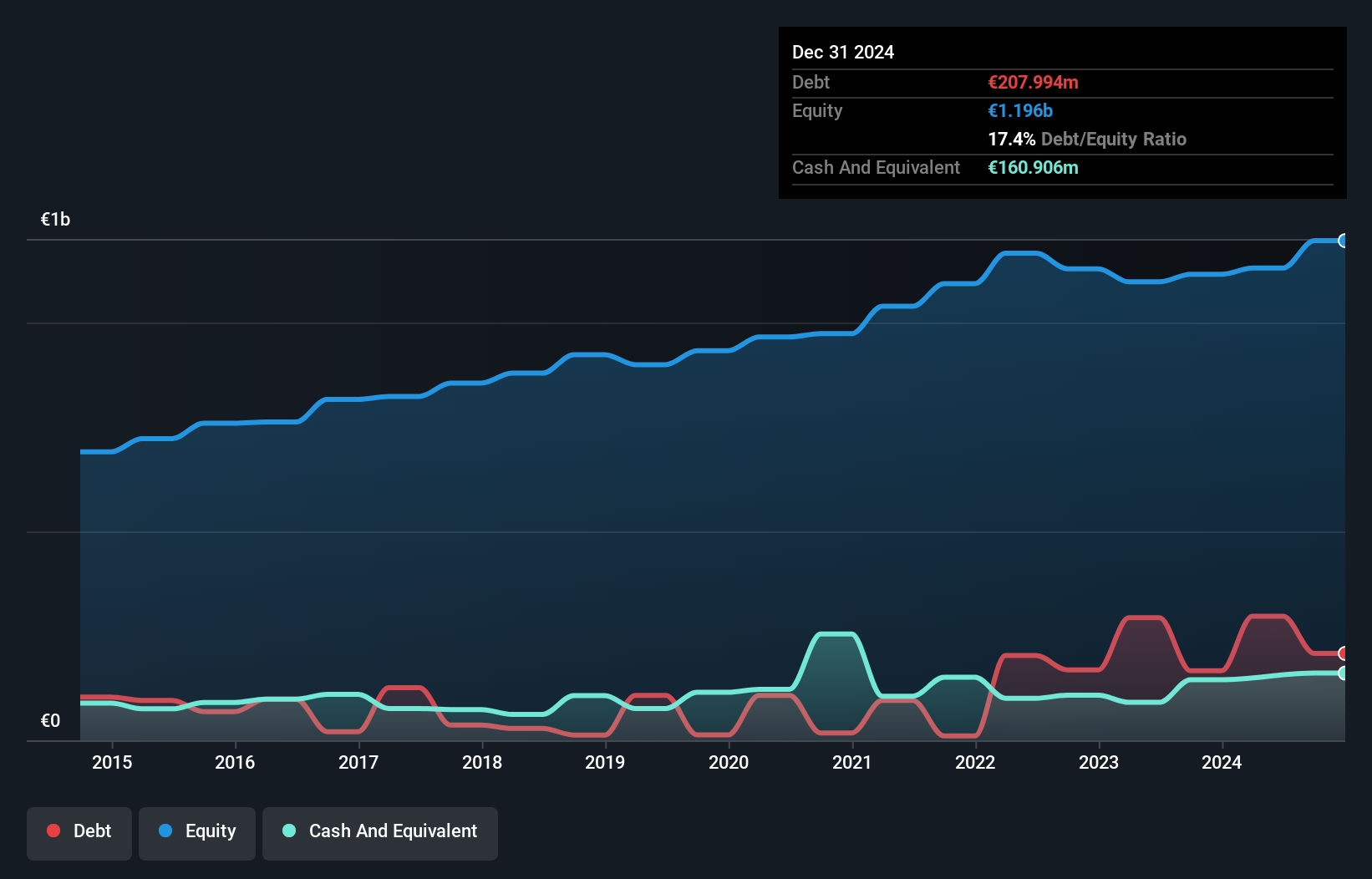

Hartmann, a notable player in the medical equipment sector, has shown impressive earnings growth of 156.1% over the past year, outpacing the industry average of 10.1%. This growth seems to be supported by its high-quality earnings and robust interest coverage ratio of 6.2 times EBIT, indicating that debt obligations are well-managed. Despite an increase in its debt-to-equity ratio from 12% to 26.3% over five years, it remains at a satisfactory level with net debt to equity at 13.4%. Trading significantly below its estimated fair value by about 96%, Hartmann presents an intriguing investment opportunity within this niche market space.

- Click to explore a detailed breakdown of our findings in Paul Hartmann's health report.

Explore historical data to track Paul Hartmann's performance over time in our Past section.

Edarat Communication and Information Technology (SASE:9557)

Simply Wall St Value Rating: ★★★★★☆

Overview: Edarat Communication and Information Technology Co. operates in the technology sector, focusing on providing cloud services and data center engineering solutions, with a market cap of SAR1.71 billion.

Operations: Edarat Communication and Information Technology Co. generates revenue primarily from cloud services and data center engineering solutions, with SAR38.44 million and SAR47.55 million respectively in these segments.

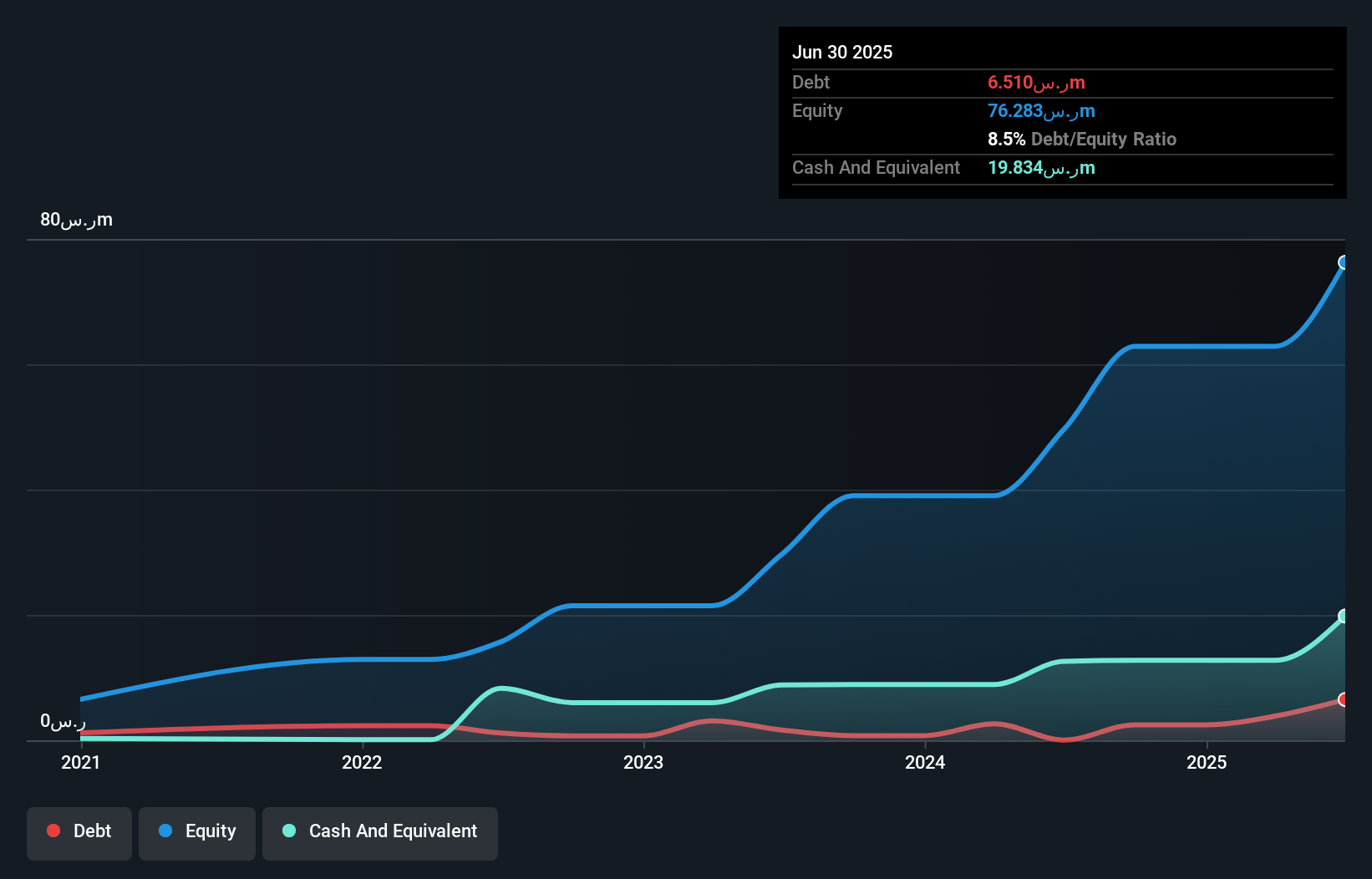

Edarat Communication and Information Technology, a promising player in the IT sector, has shown significant growth with earnings surging by 41.7% over the past year, outpacing the industry average of 18.9%. The company's strong financial position is evident as it holds more cash than its total debt, ensuring interest payments are well-covered at 59.9 times EBIT. Despite recent share price volatility over three months, Edarat's profitability and high level of non-cash earnings suggest resilience. A special shareholders meeting scheduled for November indicates proactive governance amidst these financial dynamics, potentially shaping future strategies in Riyadh's competitive market landscape.

Nippon Soda (TSE:4041)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nippon Soda Co., Ltd. engages in the development, production, processing, importation, marketing, sale, and export of chemicals and agrochemicals both in Japan and globally with a market capitalization of approximately ¥156.65 billion.

Operations: Nippon Soda generates revenue primarily from its Chemicals Business and Trading Company Business, contributing ¥50.26 billion and ¥51.54 billion respectively. The Agriculture Chemicals Business also plays a significant role with revenues of ¥49.86 billion.

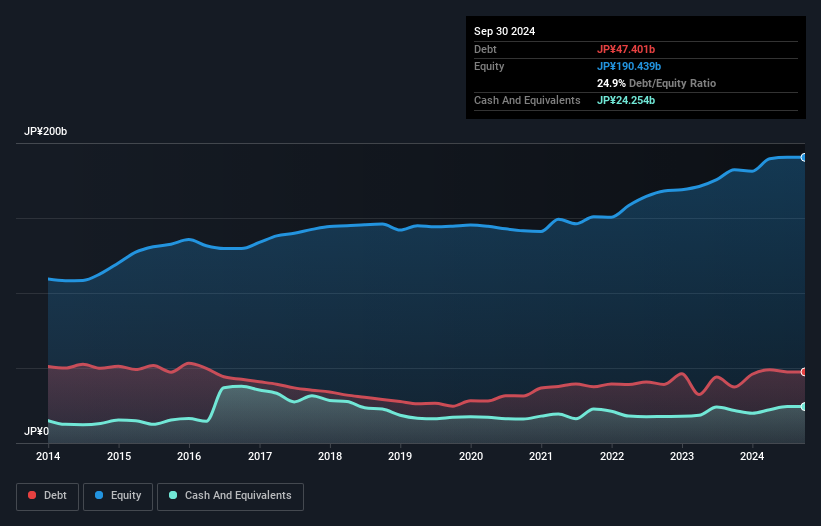

Nippon Soda, a compact player in the chemicals sector, is catching attention with its strategic moves and financial metrics. The company's recent alliance with Kyulux to mass-produce TADF materials for OLED displays marks a significant step into new markets, leveraging their Brill Through Chemistry vision. Financially, Nippon Soda's earnings have grown 22.8% annually over five years despite a debt-to-equity increase from 17% to 24.9%. With a P/E ratio of 10.2x below the JP market average of 13.4x and high-quality earnings, it remains an attractive option for those eyeing potential growth avenues in advanced materials technology.

- Take a closer look at Nippon Soda's potential here in our health report.

Understand Nippon Soda's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 4621 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Soda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4041

Nippon Soda

Develops, produces, processes, imports, markets, sells, and exports chemicals, agrochemicals, and other products in Japan and internationally.

Excellent balance sheet average dividend payer.