Does Ishihara Sangyo KaishaLtd (TSE:4028) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Ishihara Sangyo Kaisha,Ltd. (TSE:4028) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ishihara Sangyo KaishaLtd

What Is Ishihara Sangyo KaishaLtd's Net Debt?

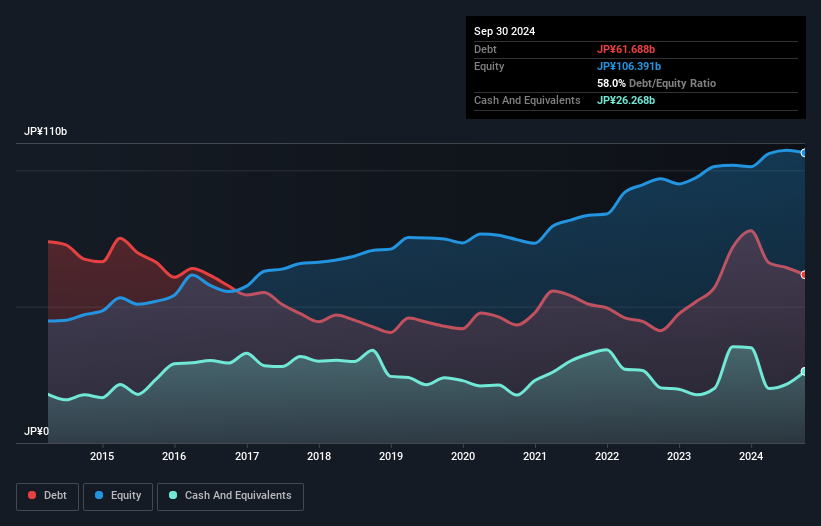

The image below, which you can click on for greater detail, shows that Ishihara Sangyo KaishaLtd had debt of JP¥61.7b at the end of September 2024, a reduction from JP¥71.8b over a year. On the flip side, it has JP¥26.3b in cash leading to net debt of about JP¥35.4b.

A Look At Ishihara Sangyo KaishaLtd's Liabilities

We can see from the most recent balance sheet that Ishihara Sangyo KaishaLtd had liabilities of JP¥53.5b falling due within a year, and liabilities of JP¥60.8b due beyond that. Offsetting this, it had JP¥26.3b in cash and JP¥38.4b in receivables that were due within 12 months. So it has liabilities totalling JP¥49.7b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of JP¥66.5b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Ishihara Sangyo KaishaLtd's net debt to EBITDA ratio of about 2.1 suggests only moderate use of debt. And its strong interest cover of 48.1 times, makes us even more comfortable. Importantly, Ishihara Sangyo KaishaLtd grew its EBIT by 57% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Ishihara Sangyo KaishaLtd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Ishihara Sangyo KaishaLtd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We feel some trepidation about Ishihara Sangyo KaishaLtd's difficulty conversion of EBIT to free cash flow, but we've got positives to focus on, too. For example, its interest cover and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Ishihara Sangyo KaishaLtd is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Ishihara Sangyo KaishaLtd , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4028

Ishihara Sangyo KaishaLtd

Manufactures and sells organic and inorganic chemicals in Japan, Asia, the United States, Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026