Ohmura Shigyo Co.,Ltd.'s (TSE:3953) 25% Share Price Plunge Could Signal Some Risk

The Ohmura Shigyo Co.,Ltd. (TSE:3953) share price has fared very poorly over the last month, falling by a substantial 25%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

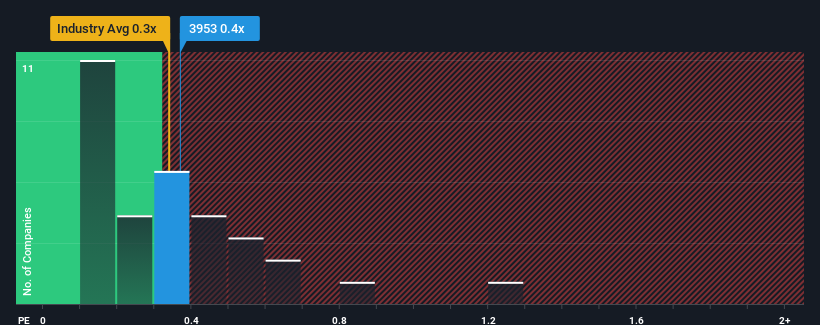

Even after such a large drop in price, there still wouldn't be many who think Ohmura ShigyoLtd's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Japan's Packaging industry is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ohmura ShigyoLtd

How Has Ohmura ShigyoLtd Performed Recently?

Revenue has risen at a steady rate over the last year for Ohmura ShigyoLtd, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Ohmura ShigyoLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ohmura ShigyoLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Ohmura ShigyoLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.8% last year. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Ohmura ShigyoLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Ohmura ShigyoLtd's P/S?

Ohmura ShigyoLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Ohmura ShigyoLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ohmura ShigyoLtd you should be aware of, and 1 of them is concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3953

Flawless balance sheet very low.

Market Insights

Community Narratives