- Japan

- /

- Specialty Stores

- /

- TSE:8219

Top Dividend Stocks Featuring Three Noteworthy Picks

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policy changes, U.S. stocks have seen a notable rally, with major indices reaching record highs. In this dynamic environment, dividend stocks offer investors the potential for steady income streams, making them an attractive option amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 4.95% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

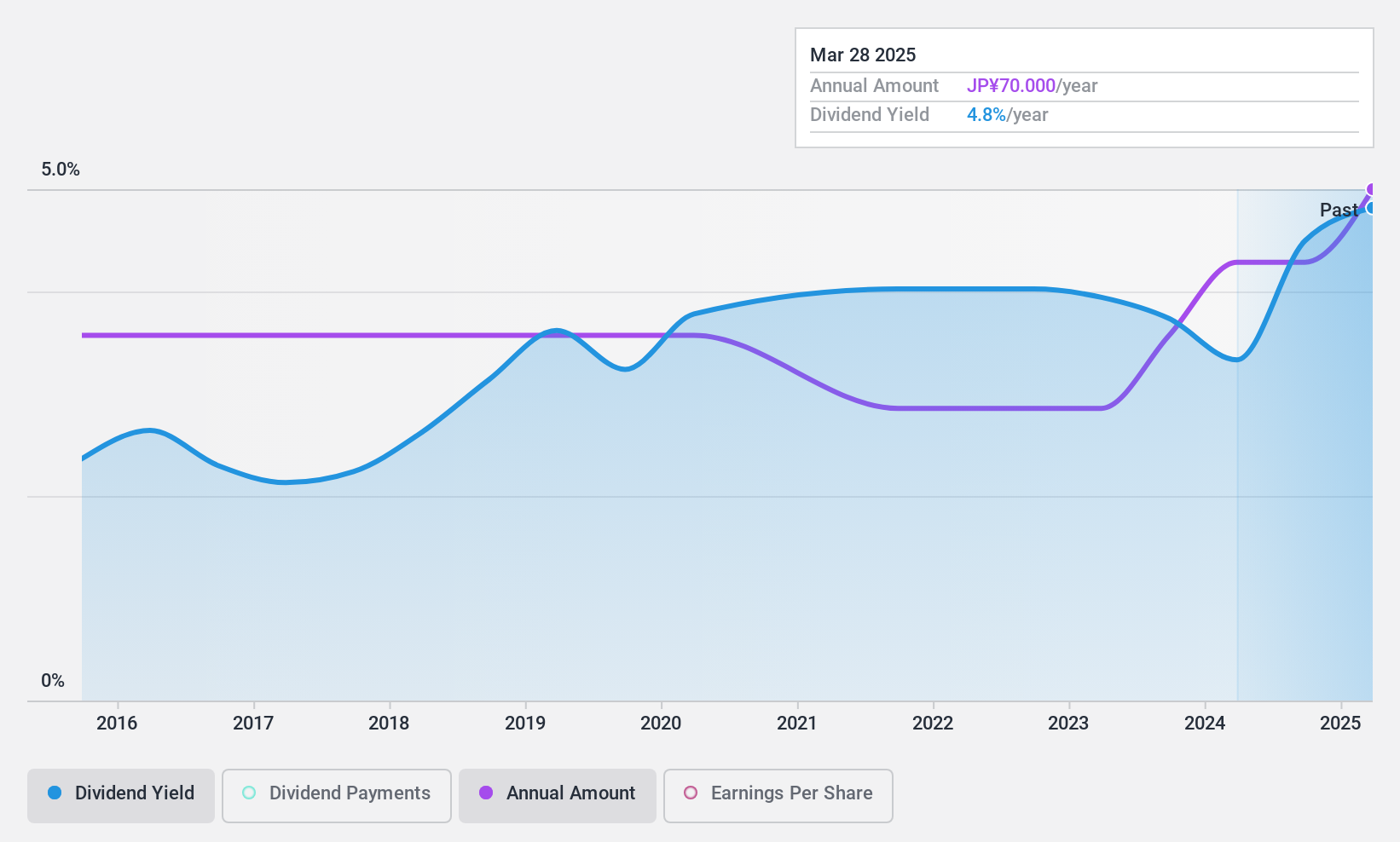

Chuetsu Pulp & Paper (TSE:3877)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chuetsu Pulp & Paper Co., Ltd. is involved in the production, processing, and sales of paper, pulp, and related by-products both in Japan and internationally with a market cap of ¥15.67 billion.

Operations: Chuetsu Pulp & Paper Co., Ltd.'s revenue is primarily derived from its Paper and Pulp Manufacture Business, which generated ¥97.59 billion, and its Power Generation Business, contributing ¥6.57 billion.

Dividend Yield: 4.3%

Chuetsu Pulp & Paper's dividend payments have been volatile over the past decade, despite recent increases. The dividends are well covered by both earnings and cash flows, with payout ratios of 24.5% and 14.1%, respectively, suggesting sustainability from a cash perspective. However, the company carries a high level of debt that could impact future payouts. Trading at 75.9% below its estimated fair value, it offers a competitive dividend yield in Japan's market but with some risks attached due to its unstable track record.

- Click here to discover the nuances of Chuetsu Pulp & Paper with our detailed analytical dividend report.

- According our valuation report, there's an indication that Chuetsu Pulp & Paper's share price might be on the cheaper side.

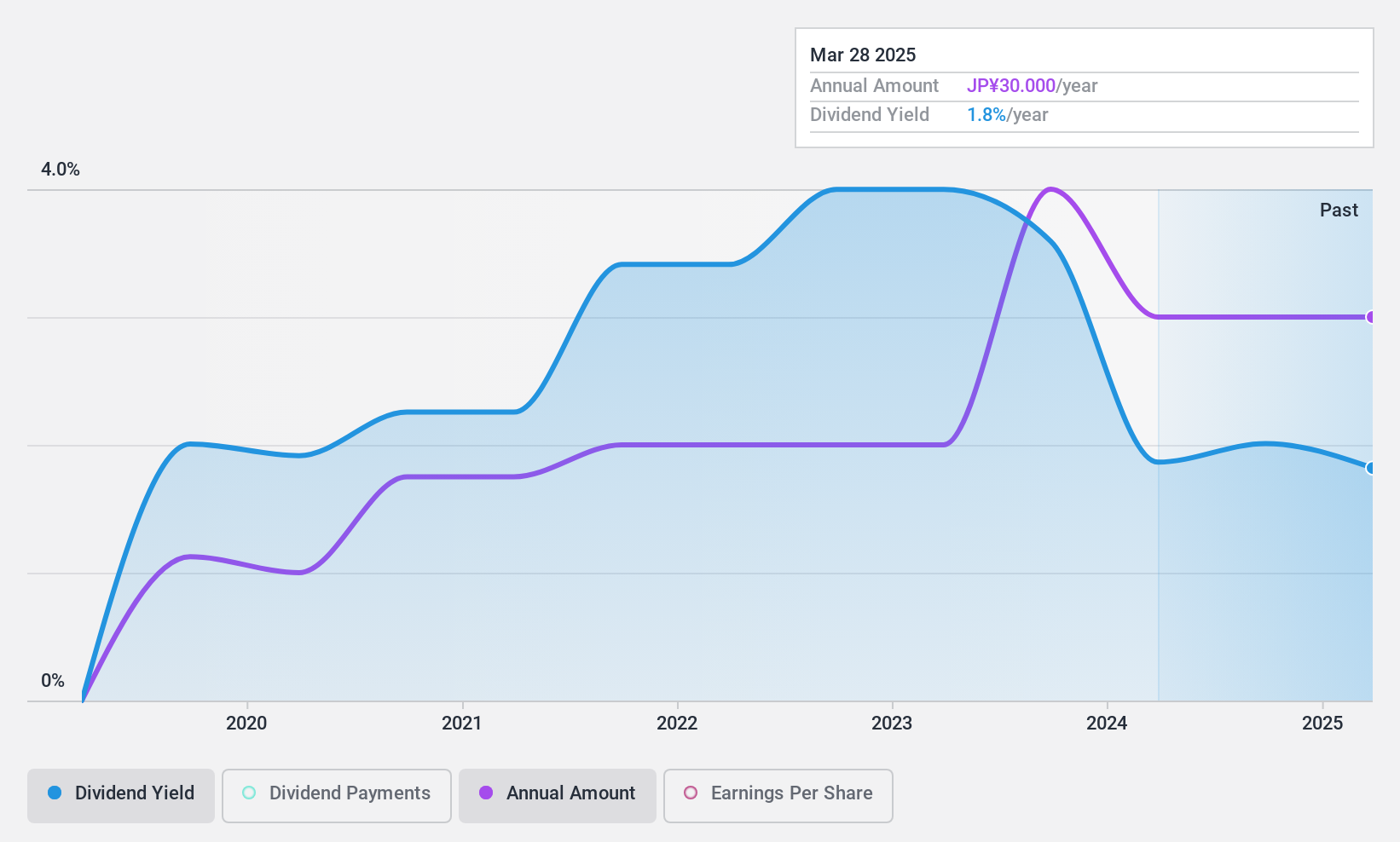

COPRO-HOLDINGS (TSE:7059)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: COPRO-HOLDINGS Co., Ltd. operates in the temporary staffing industry both in Japan and internationally, with a market cap of ¥27.06 billion.

Operations: COPRO-HOLDINGS Co., Ltd. generates revenue through its operations in the temporary staffing sector, serving clients both domestically in Japan and internationally.

Dividend Yield: 3.8%

COPRO-HOLDINGS has been paying dividends for five years, with recent increases. Dividends are covered by earnings and cash flows, with payout ratios of 55.6% and 59.5%, respectively, indicating sustainability. However, the dividend history is unstable with significant annual drops over 20%. Trading at 39.7% below estimated fair value, it offers a competitive yield in Japan's market but carries risks due to its volatile payment history.

- Unlock comprehensive insights into our analysis of COPRO-HOLDINGS stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of COPRO-HOLDINGS shares in the market.

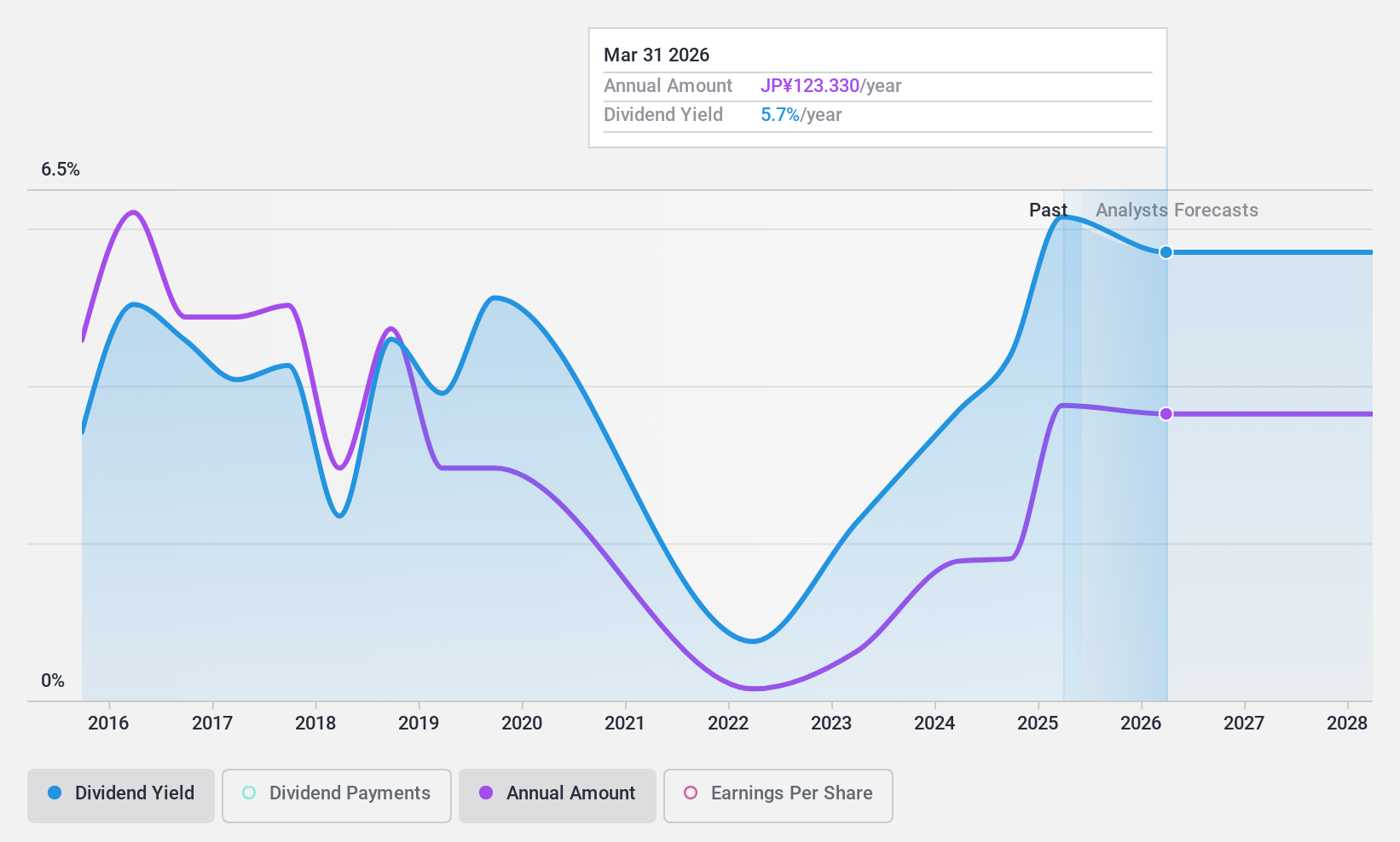

Aoyama Trading (TSE:8219)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Aoyama Trading Co., Ltd. operates in business wear, credit card services, printing and media, sundry sales, repair services, and franchises in Japan with a market cap of ¥66.52 billion.

Operations: Aoyama Trading Co., Ltd.'s revenue segments include Business Wear Business at ¥133.22 billion, Franchisee Business at ¥15.40 billion, Miscellaneous Goods Sales Business at ¥15.20 billion, Comprehensive Repair Service Business at ¥13.81 billion, Printing / Media Business at ¥11.45 billion, Real Estate Business at ¥3.05 billion, and Card Business at ¥5.01 billion.

Dividend Yield: 3.7%

Aoyama Trading's dividend payments are well-covered by earnings and cash flows, with payout ratios of 31% and 34.7%, respectively. Despite trading at a significant discount to estimated fair value, the dividend history has been volatile over the past decade, showing declines. Recent sales data indicates a year-to-date decline in net sales compared to last year, which may impact future payouts. The current yield is slightly below top-tier levels in Japan's market.

- Click to explore a detailed breakdown of our findings in Aoyama Trading's dividend report.

- Our comprehensive valuation report raises the possibility that Aoyama Trading is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 1941 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8219

Aoyama Trading

Engages in the business wear, credit card, printing and media, sundry sales, repair service, franchisee, and other businesses in Japan.

Proven track record with adequate balance sheet and pays a dividend.