As global markets experience a boost from easing inflation and strong bank earnings, investors are increasingly optimistic about potential rate cuts later in the year. With major U.S. stock indexes rebounding and value stocks outpacing growth shares, dividend stocks present an attractive option for those seeking steady income streams in a dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €183.75 million.

Operations: Toyota Caetano Portugal, S.A.'s revenue segments include Domestic Motor Vehicles Commercialization (€764.41 million), External Motor Vehicles Industry (€61.96 million), External Motor Vehicles Commercialization (€28.15 million), Domestic Motor Vehicles Services (€24.70 million), Domestic Industrial Equipment Machines (€12.25 million), and other smaller segments such as Domestic Industrial Equipment Services and Rental, and Foreign Industrial Equipment Services and Rental contributing to the total revenue in millions of euros.

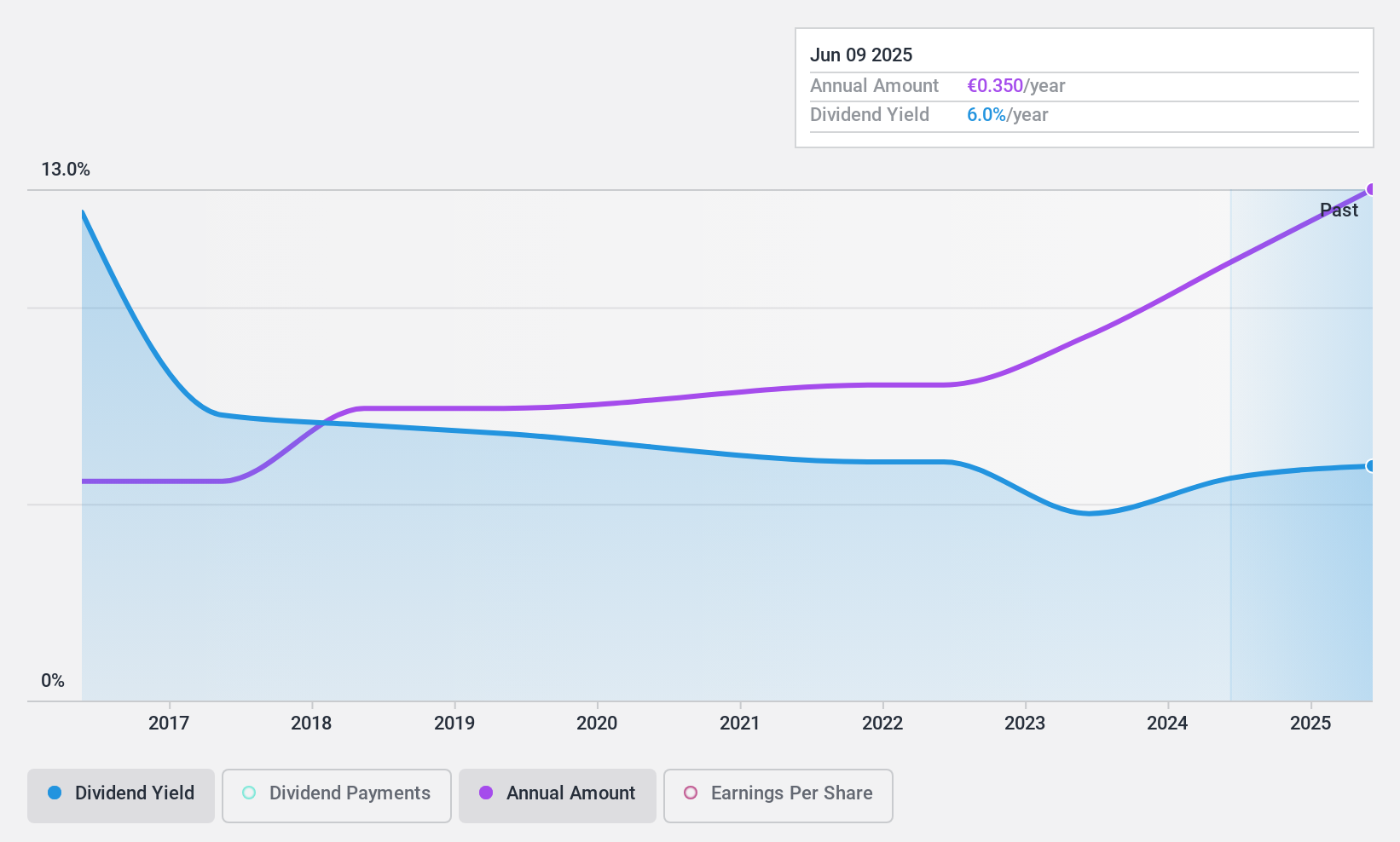

Dividend Yield: 5.7%

Toyota Caetano Portugal offers a mixed dividend profile. Despite its low price-to-earnings ratio of 8.3x, which is below the Portuguese market average, and a reasonable payout ratio of 47.2% covered by earnings, its dividends have been unreliable and volatile over the past decade. While earnings grew significantly by 40.2% last year, the dividend yield remains lower than top-tier payers in Portugal at 5.71%.

- Delve into the full analysis dividend report here for a deeper understanding of Toyota Caetano Portugal.

- In light of our recent valuation report, it seems possible that Toyota Caetano Portugal is trading beyond its estimated value.

Kyowa Leather Cloth (TSE:3553)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyowa Leather Cloth Co., Ltd. manufactures and sells synthetic leather cover materials in Japan, with a market cap of ¥16.49 billion.

Operations: Kyowa Leather Cloth Co., Ltd. generates revenue from its core business of producing and distributing synthetic leather materials in Japan.

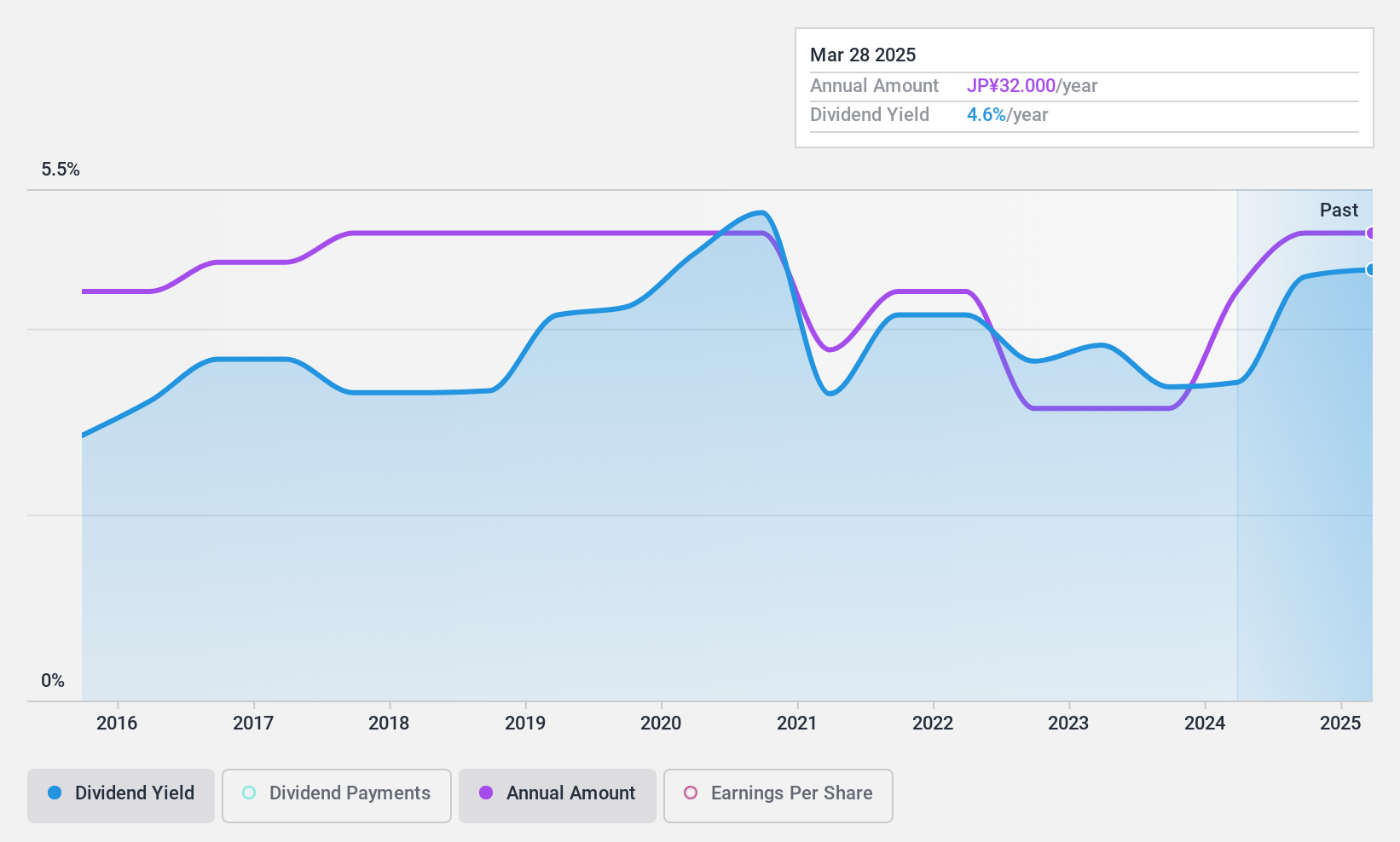

Dividend Yield: 4.6%

Kyowa Leather Cloth's dividend profile shows both strengths and weaknesses. The company's dividend yield of 4.62% ranks in the top 25% of Japanese market payers, supported by a reasonable payout ratio of 62.6%. However, dividends have been volatile over the past decade and are not well covered by free cash flows, as the company lacks free cash flows altogether. Despite this, earnings saw significant growth of 103.5% last year, enhancing potential dividend sustainability if trends continue.

- Take a closer look at Kyowa Leather Cloth's potential here in our dividend report.

- Our valuation report here indicates Kyowa Leather Cloth may be overvalued.

Roland (TSE:7944)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Roland Corporation develops, manufactures, and sells electronic musical instruments, equipment, and software both in Japan and internationally with a market cap of ¥102.02 billion.

Operations: Roland Corporation's revenue primarily comes from its electronic musical instruments segment, which generated ¥100.65 billion.

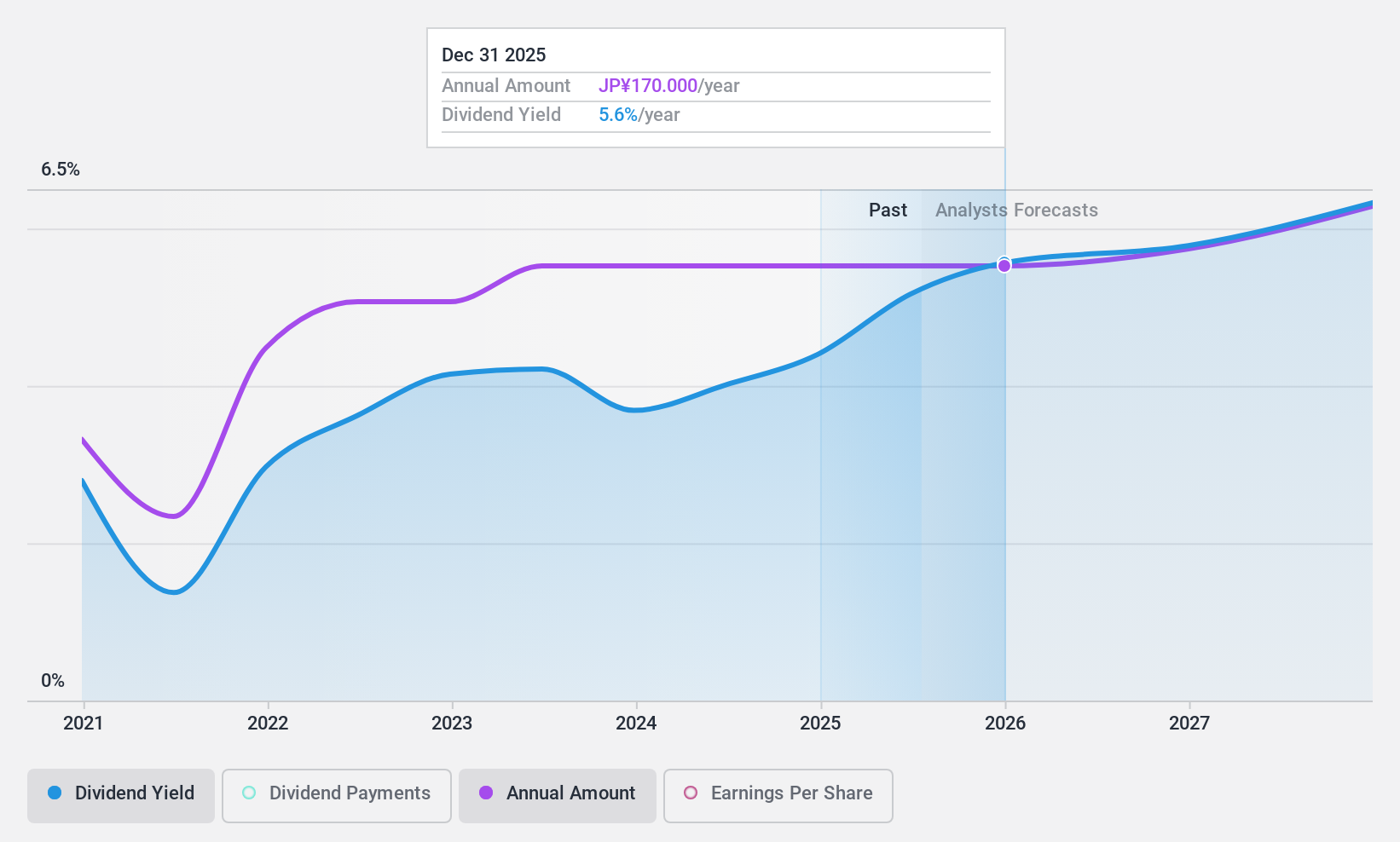

Dividend Yield: 4.6%

Roland Corporation's dividend yield of 4.61% is among the top 25% in Japan, with dividends covered by earnings and cash flows, evidenced by a payout ratio of 70.1% and a cash payout ratio of 70.6%. However, its dividend history has been volatile over the past decade. Recent business expansions in India could potentially bolster future earnings, though current corporate guidance indicates lowered profit expectations due to market adjustments and pricing pressures.

- Navigate through the intricacies of Roland with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Roland's current price could be quite moderate.

Key Takeaways

- Dive into all 1978 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7944

Roland

Engages in the development, manufacture, and sale of electronic musical instruments, equipment, and software in Japan and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives