Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Muto Seiko Co. (TYO:7927) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Muto Seiko

What Is Muto Seiko's Debt?

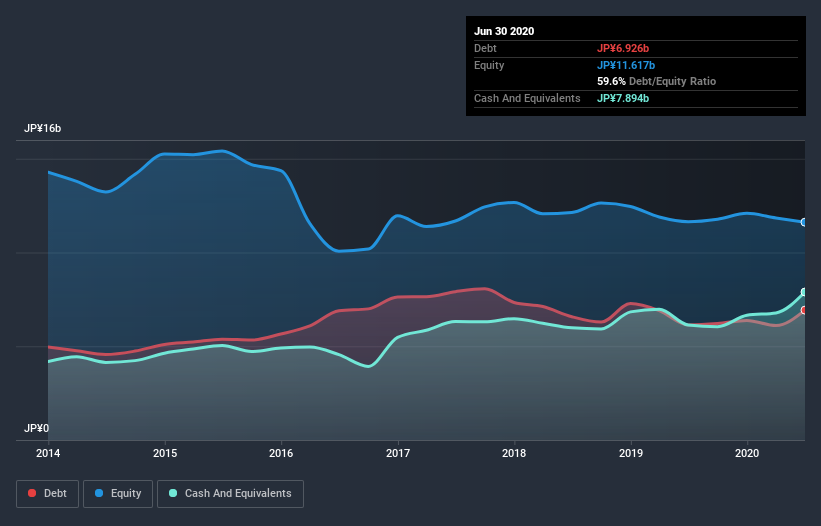

As you can see below, at the end of June 2020, Muto Seiko had JP¥6.93b of debt, up from JP¥6.14b a year ago. Click the image for more detail. However, it does have JP¥7.89b in cash offsetting this, leading to net cash of JP¥968.0m.

How Healthy Is Muto Seiko's Balance Sheet?

According to the last reported balance sheet, Muto Seiko had liabilities of JP¥6.40b due within 12 months, and liabilities of JP¥3.44b due beyond 12 months. On the other hand, it had cash of JP¥7.89b and JP¥3.14b worth of receivables due within a year. So it can boast JP¥1.19b more liquid assets than total liabilities.

This excess liquidity is a great indication that Muto Seiko's balance sheet is just as strong as racists are weak. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Simply put, the fact that Muto Seiko has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that Muto Seiko's load is not too heavy, because its EBIT was down 40% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But it is Muto Seiko's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Muto Seiko has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Muto Seiko actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While it is always sensible to investigate a company's debt, in this case Muto Seiko has JP¥968.0m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 102% of that EBIT to free cash flow, bringing in JP¥1.0b. So is Muto Seiko's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Muto Seiko has 3 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Muto Seiko, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:7927

Muto Seiko

Manufactures and sells plastic parts in Japan, Vietnam, China, Taiwan, rest of Asia, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026