As global markets navigate a landscape marked by rising inflation and volatile treasury yields, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing their value counterparts. In this environment of economic uncertainty and shifting monetary policies, dividend stocks can offer investors a measure of stability and income, making them an appealing consideration for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1977 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

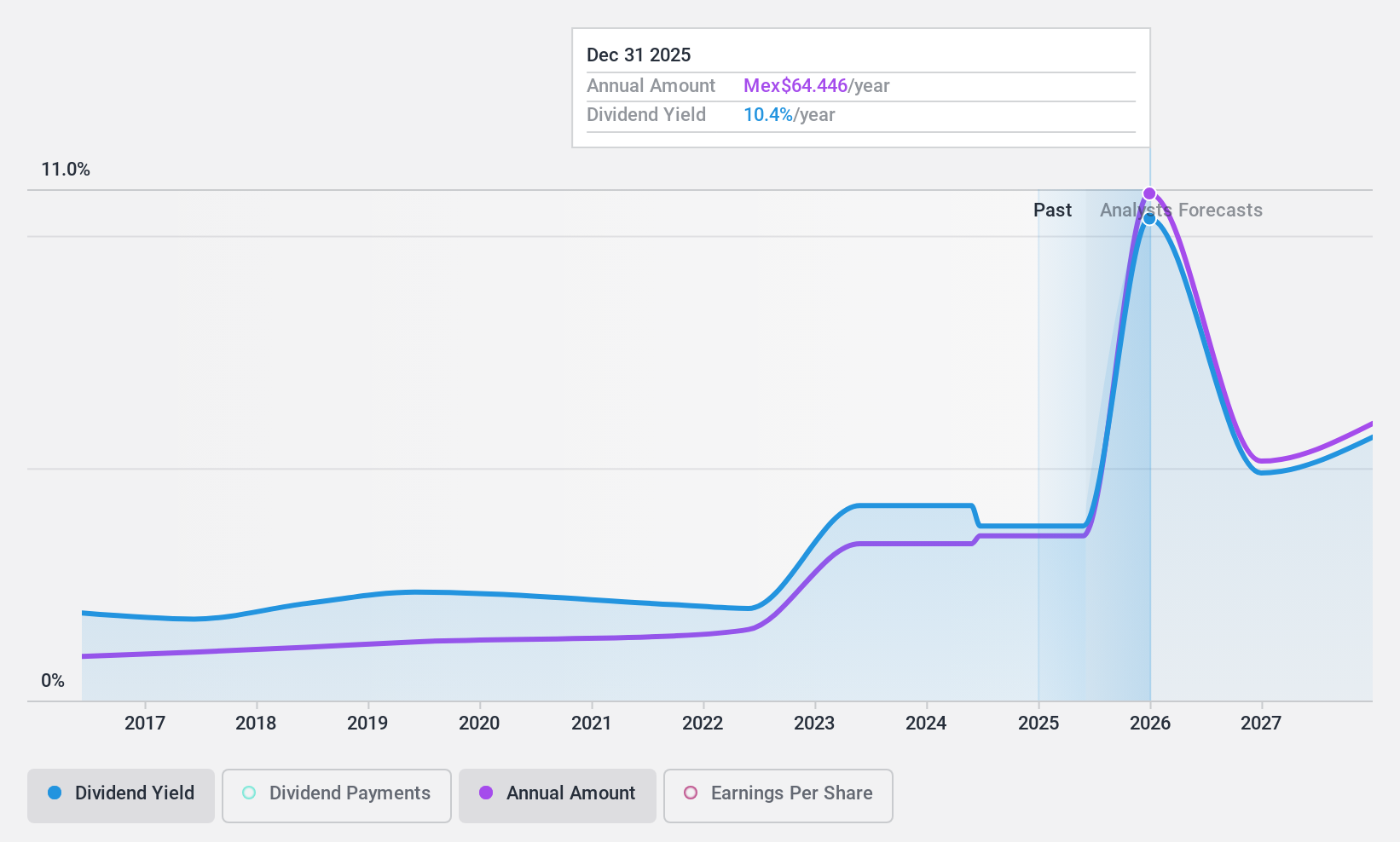

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates airports primarily in Mexico and has a market cap of MX$173 billion.

Operations: Grupo Aeroportuario del Sureste, S. A. B. de C. V's revenue primarily comes from its operations in Cancun (MX$17.17 billion), San Juan, Puerto Rico (MX$4.50 billion), Colombia (MX$3.12 billion), Merida (MX$1.41 billion), and Villahermosa (MX$599 million).

Dividend Yield: 3.6%

Grupo Aeroportuario del Sureste S.A.B. de C.V. offers a mixed dividend profile. Despite a reasonable cash payout ratio of 54.9%, its dividend yield of 3.63% falls short compared to the top Mexican market payers at 6.17%. While dividends are covered by earnings and cash flows, their reliability is questionable due to volatility over the past decade. Recent announcements show steady passenger traffic growth, which might support future stability in payouts amidst an improving earnings landscape.

- Click here to discover the nuances of Grupo Aeroportuario del Sureste S. A. B. de C. V with our detailed analytical dividend report.

- According our valuation report, there's an indication that Grupo Aeroportuario del Sureste S. A. B. de C. V's share price might be on the cheaper side.

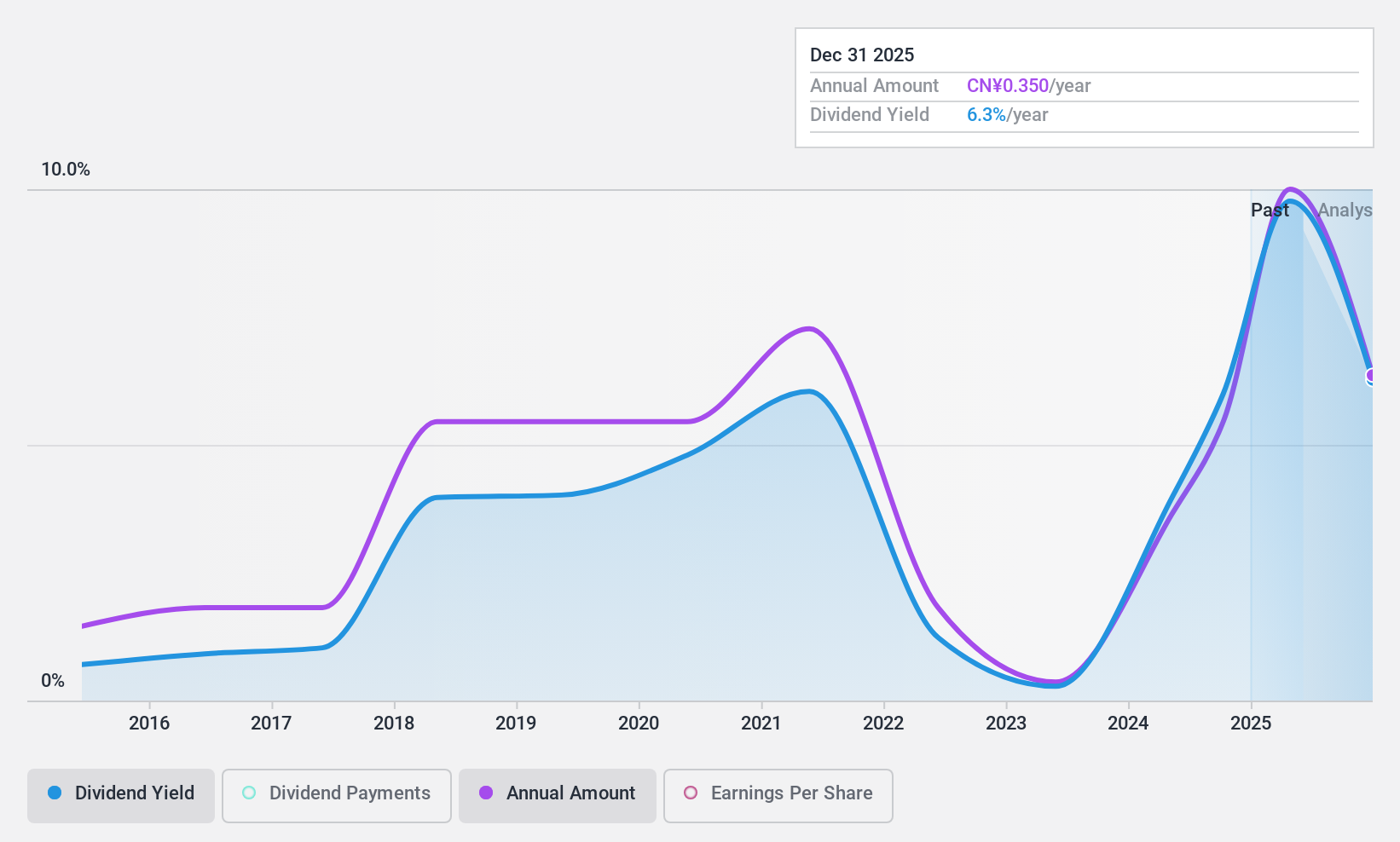

Jangho Group (SHSE:601886)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jangho Group Co., Ltd. operates in the architectural decoration sector across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of CN¥6.33 billion.

Operations: Jangho Group Co., Ltd. generates revenue through its architectural decoration operations across Mainland China, Hong Kong, Macau, Taiwan, and various international markets.

Dividend Yield: 5.4%

Jangho Group's dividend profile is characterized by a high yield of 5.37%, placing it among the top 25% in China's market. Despite this, dividends have been volatile over the past decade, though they have increased overall. The company's low cash payout ratio of 23.9% indicates strong coverage by cash flows, while a payout ratio of 56.4% suggests earnings also support dividends well. Currently trading at good value relative to peers and industry benchmarks, Jangho presents potential for income-focused investors seeking exposure in China.

- Take a closer look at Jangho Group's potential here in our dividend report.

- Our expertly prepared valuation report Jangho Group implies its share price may be lower than expected.

Dai-ichi Life Holdings (TSE:8750)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dai-ichi Life Holdings, Inc. operates through its subsidiaries to provide insurance products in Japan, the United States, and internationally, with a market cap of ¥4 trillion.

Operations: Dai-ichi Life Holdings, Inc. generates revenue primarily from its Domestic Insurance Business at ¥8.41 billion and Overseas Insurance Business at ¥3.57 billion.

Dividend Yield: 3.1%

Dai-ichi Life Holdings offers a stable dividend profile, with payments reliably increasing over the past decade. The company's dividends are well covered by earnings and cash flows, reflected in a payout ratio of 35.6% and a cash payout ratio of 17.8%. Recent guidance revisions indicate improved financial performance, supporting an increased year-end dividend to ¥72 per share from ¥61. Trading below estimated fair value, Dai-ichi provides reasonable relative value amidst consistent dividend growth.

- Get an in-depth perspective on Dai-ichi Life Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Dai-ichi Life Holdings may be undervalued.

Next Steps

- Gain an insight into the universe of 1977 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives