We Ran A Stock Scan For Earnings Growth And MS&AD Insurance Group Holdings (TSE:8725) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MS&AD Insurance Group Holdings (TSE:8725). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for MS&AD Insurance Group Holdings

MS&AD Insurance Group Holdings' Improving Profits

MS&AD Insurance Group Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, MS&AD Insurance Group Holdings' EPS grew from JP¥89.81 to JP¥224, over the previous 12 months. Year on year growth of 149% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

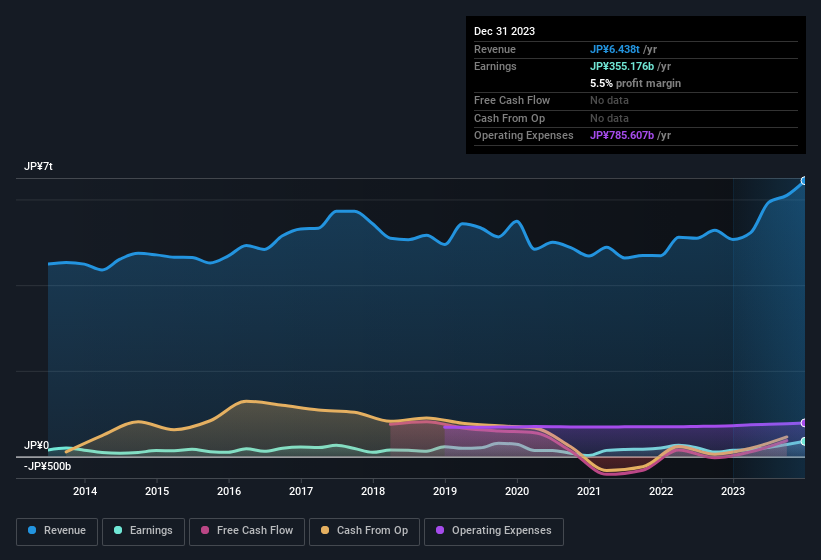

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of MS&AD Insurance Group Holdings' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that MS&AD Insurance Group Holdings is growing revenues, and EBIT margins improved by 2.8 percentage points to 9.9%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of MS&AD Insurance Group Holdings' forecast profits?

Are MS&AD Insurance Group Holdings Insiders Aligned With All Shareholders?

Since MS&AD Insurance Group Holdings has a market capitalisation of JP¥4.4t, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. To be specific, they have JP¥2.0b worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.05% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to MS&AD Insurance Group Holdings, with market caps over JP¥1.2t, is around JP¥240m.

MS&AD Insurance Group Holdings offered total compensation worth JP¥124m to its CEO in the year to March 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is MS&AD Insurance Group Holdings Worth Keeping An Eye On?

MS&AD Insurance Group Holdings' earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. MS&AD Insurance Group Holdings is certainly doing some things right and is well worth investigating. Before you take the next step you should know about the 2 warning signs for MS&AD Insurance Group Holdings that we have uncovered.

Although MS&AD Insurance Group Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8725

MS&AD Insurance Group Holdings

An insurance holding company, provides insurance and financial services worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives