Sompo Holdings (TSE:8630) Valuation in Focus Following Completion of Share Buyback Program

Reviewed by Kshitija Bhandaru

Sompo Holdings (TSE:8630) has finalized its share repurchase program, buying back around 1.8% of its outstanding shares as planned. This move marks the company’s follow-through on a key shareholder return initiative.

See our latest analysis for Sompo Holdings.

Sompo Holdings’ latest buyback wraps up during a period of steady progress for shareholders, with the stock’s recent momentum mostly holding firm. Over the past year, the company delivered a total shareholder return of 0.45%, reflecting stability amid sector shifts and reinforcing a longer-term positive trajectory.

If Sompo’s disciplined approach to shareholder value has you thinking bigger, now is the perfect chance to discover fast growing stocks with high insider ownership.

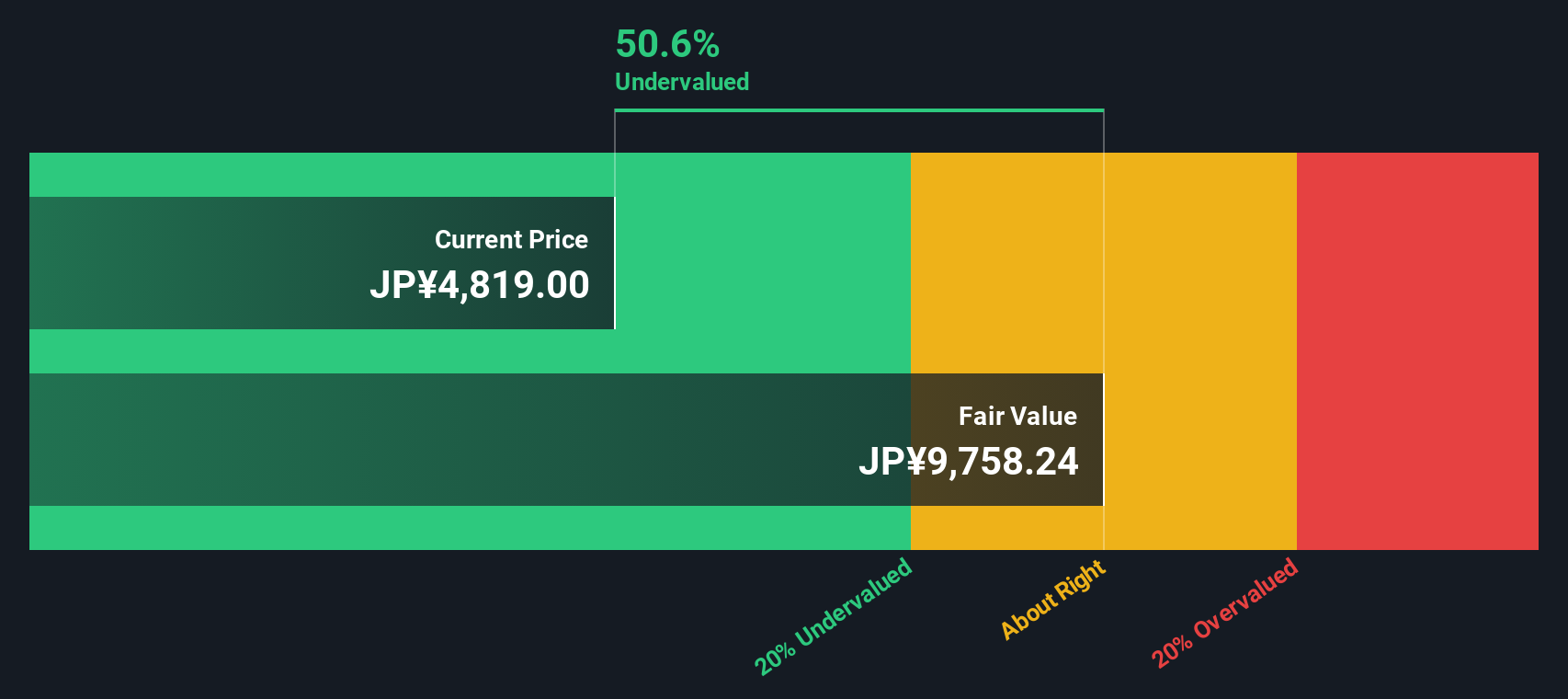

With the buyback now in the rearview, the question becomes clear: Is Sompo Holdings trading below its true value, or is the market already factoring in the company’s future growth prospects, leaving little room for upside?

Price-to-Earnings of 10.6x: Is it justified?

Sompo Holdings is trading on a price-to-earnings (P/E) ratio of 10.6x, placing it above the peer average of 9.9x and signaling a valuation premium in the local insurance sector.

The price-to-earnings ratio is a key yardstick investors use to compare current share price with per-share earnings. It sheds light on how the market values the company’s profit outlook. For Sompo, the current P/E suggests expectations are running higher than the average for Japanese insurance peers, potentially reflecting confidence in the company’s ability to sustain or grow earnings.

Despite this, when compared to the broader Asian insurance industry, Sompo’s P/E actually appears attractive, coming in lower than the industry average of 11.8x. Additionally, it trades below its fair P/E ratio of 14x, which could indicate room for upward market adjustment should fundamentals stay strong.

Explore the SWS fair ratio for Sompo Holdings

Result: Price-to-Earnings of 10.6x (ABOUT RIGHT)

However, a slowdown in revenue growth or an unexpected dip in net income could quickly reverse recent optimism for Sompo Holdings’ valuation.

Find out about the key risks to this Sompo Holdings narrative.

Another View: Discounted Cash Flow Perspective

Taking a different approach, our DCF model suggests Sompo Holdings may be trading well below its intrinsic value. The current share price reflects a 52% discount according to this method, which hints at possible undervaluation that simple multiples might overlook. Could the market be missing something fundamental?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sompo Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sompo Holdings Narrative

If you see things differently or want to dig into the numbers your own way, it only takes a few minutes to shape your own perspective. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sompo Holdings.

Looking for more investment ideas?

Don’t wait for the perfect stock to come along. Energize your portfolio by exploring handpicked opportunities you might not have considered yet.

- Unlock growth potential by checking out these 25 AI penny stocks that are transforming industries with artificial intelligence and state-of-the-art automation.

- Pursue passive income streams by starting your search with these 19 dividend stocks with yields > 3% that offer compelling yields above 3% along with strong fundamentals.

- Jump ahead of the crowd by uncovering value opportunities among these 894 undervalued stocks based on cash flows where future cash flows point to attractive share prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8630

Sompo Holdings

Provides property and casualty insurance services in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives