Japan's stock markets have recently experienced volatility due to political changes and evolving monetary policy stances, with the Nikkei 225 and TOPIX indices showing notable declines. Despite these fluctuations, opportunities may arise for investors seeking undiscovered gems in Japan's market, particularly among small-cap stocks that can offer unique growth potential amidst current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa and has a market cap of ¥179.23 billion.

Operations: SAN-A CO., LTD. generates revenue primarily from its supermarket operations in Okinawa. The company has a market capitalization of approximately ¥179.23 billion, reflecting its position within the retail sector.

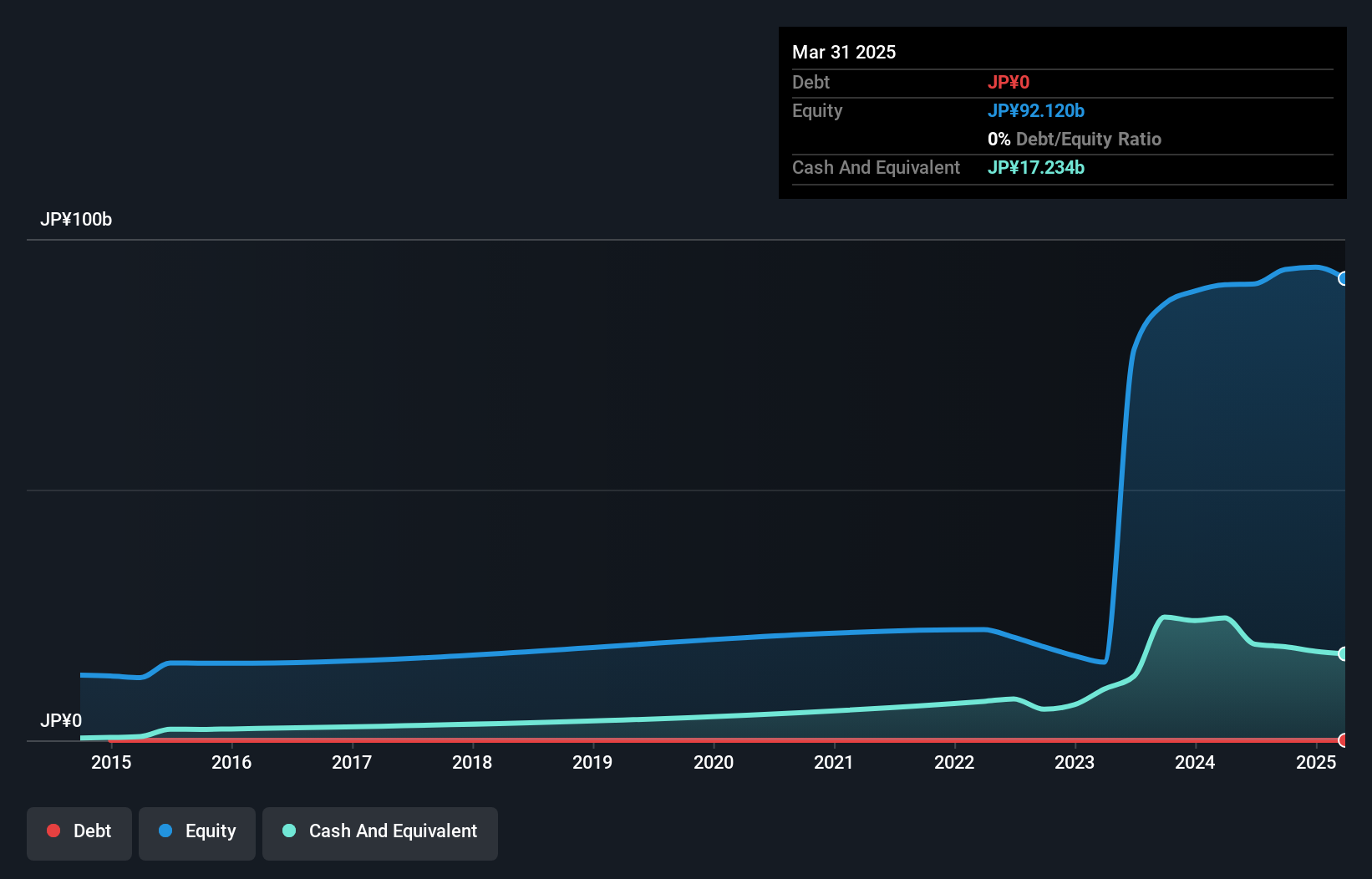

SAN-ALTD, a promising name in Japan's market landscape, showcases solid financial health with earnings growing at 8.7% annually over the past five years. It's trading at a compelling 40.9% below its estimated fair value, suggesting potential upside for investors. The company operates debt-free, eliminating concerns about interest payments and enhancing its financial stability. Despite not outpacing the industry’s recent growth rate of 22%, SAN-ALTD remains on track with high-quality earnings and positive free cash flow.

- Unlock comprehensive insights into our analysis of SAN-ALTD stock in this health report.

Explore historical data to track SAN-ALTD's performance over time in our Past section.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lifenet Insurance Company offers life insurance products and services in Japan, North America, and internationally, with a market cap of approximately ¥140.48 billion.

Operations: Lifenet Insurance generates revenue primarily through its life insurance products and services. The company's cost structure includes expenses related to policyholder benefits, which significantly impact its financial performance. Net profit margin trends can provide insights into the company's profitability over time.

Lifenet Insurance, a nimble player in the Japanese market, recently turned profitable, setting it apart from industry norms. With no debt for five years and high-quality past earnings, it's on solid financial ground. The company reported levered free cash flow of ¥5.23 billion as of March 2024. Lifenet is launching new term medical products with flexible insurance periods and lower premiums starting October 2024, enhancing its product lineup while maintaining customer-friendly options.

77 Bank (TSE:8341)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd. operates as a financial institution offering a range of banking products and services to both corporate and individual clients in Japan, with a market capitalization of ¥291.37 billion.

Operations: 77 Bank generates revenue primarily through its banking products and services offered to corporate and individual clients in Japan. The company has a market capitalization of ¥291.37 billion.

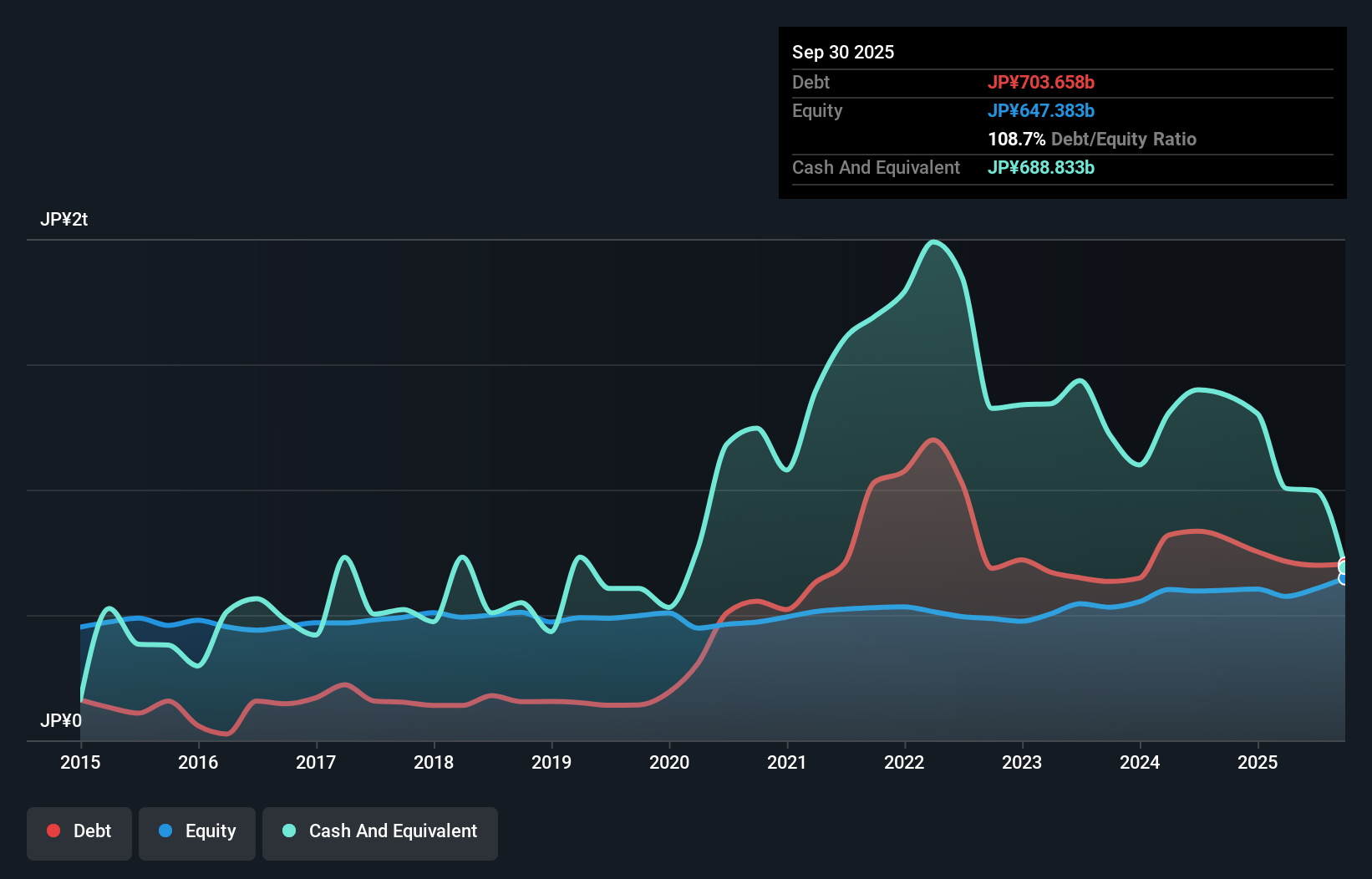

77 Bank, with total assets of ¥10.58 billion and equity of ¥595.7 million, is navigating the financial landscape with a high bad loans ratio of 1010.4%, indicating potential risk areas despite its primarily low-risk funding sources, which account for 90% of liabilities. The bank's earnings grew by 27% over the past year, outpacing the industry average growth rate of 19%. Additionally, it's trading at a significant discount to estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in Japan's financial sector.

Turning Ideas Into Actions

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 727 more companies for you to explore.Click here to unveil our expertly curated list of 730 Japanese Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7157

Lifenet Insurance

Provides life insurance products and services in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success