- Japan

- /

- Commercial Services

- /

- TSE:7811

Tokyo Exchange Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As Japan's stock markets navigate recent political shifts and economic policies under new leadership, investors are keenly observing the performance of indices like the Nikkei 225 and TOPIX, which have experienced fluctuations amidst these developments. In this dynamic environment, dividend stocks on the Tokyo Exchange can offer a stable income stream, making them an attractive consideration for those looking to enhance their portfolios amidst market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.13% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.95% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.21% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.50% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

Click here to see the full list of 437 stocks from our Top Japanese Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Nakamoto PacksLtd (TSE:7811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nakamoto Packs Co., Ltd. offers gravure printing services both in Japan and internationally, with a market cap of ¥15.08 billion.

Operations: Nakamoto Packs Co., Ltd. generates revenue through its gravure printing services offered domestically and abroad.

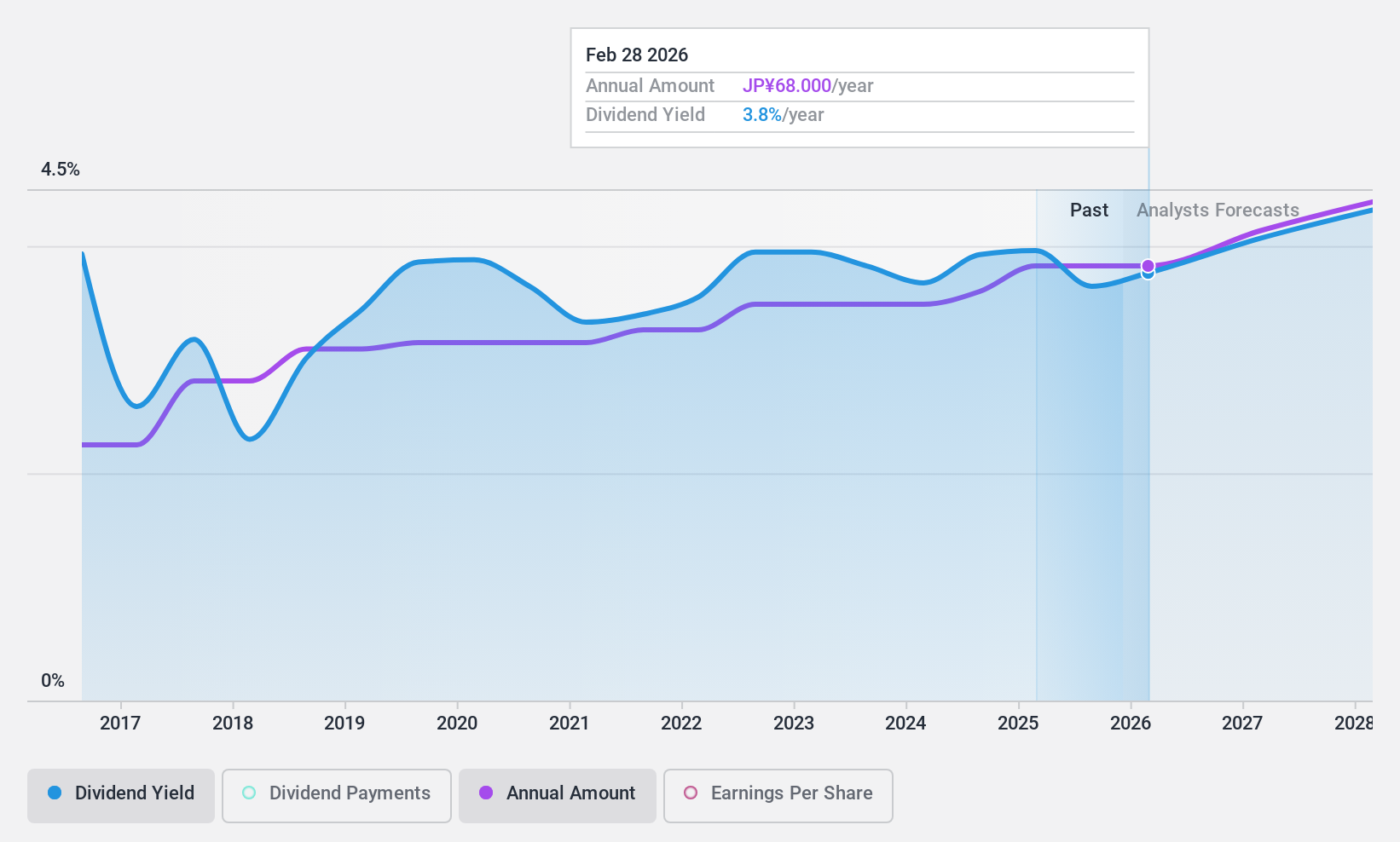

Dividend Yield: 3.8%

Nakamoto Packs Ltd. offers a compelling dividend profile with a 3.78% yield, ranking in the top 25% of Japanese dividend payers. Despite only eight years of dividend history, payments have grown steadily with minimal volatility and are well-covered by both earnings (33% payout ratio) and cash flows (24.1% cash payout ratio). However, recent exclusion from the S&P Global BMI Index may impact investor perception despite its strong relative value and robust earnings growth last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Nakamoto PacksLtd.

- Our valuation report unveils the possibility Nakamoto PacksLtd's shares may be trading at a discount.

Sanko Gosei (TSE:7888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanko Gosei Ltd. specializes in the molding and sale of plastic parts both in Japan and internationally, with a market cap of ¥18.72 billion.

Operations: Sanko Gosei Ltd.'s revenue segments comprise ¥34.14 billion from Asia, ¥32.36 billion from Japan, ¥14.34 billion from Europe, and ¥17.75 billion from North America.

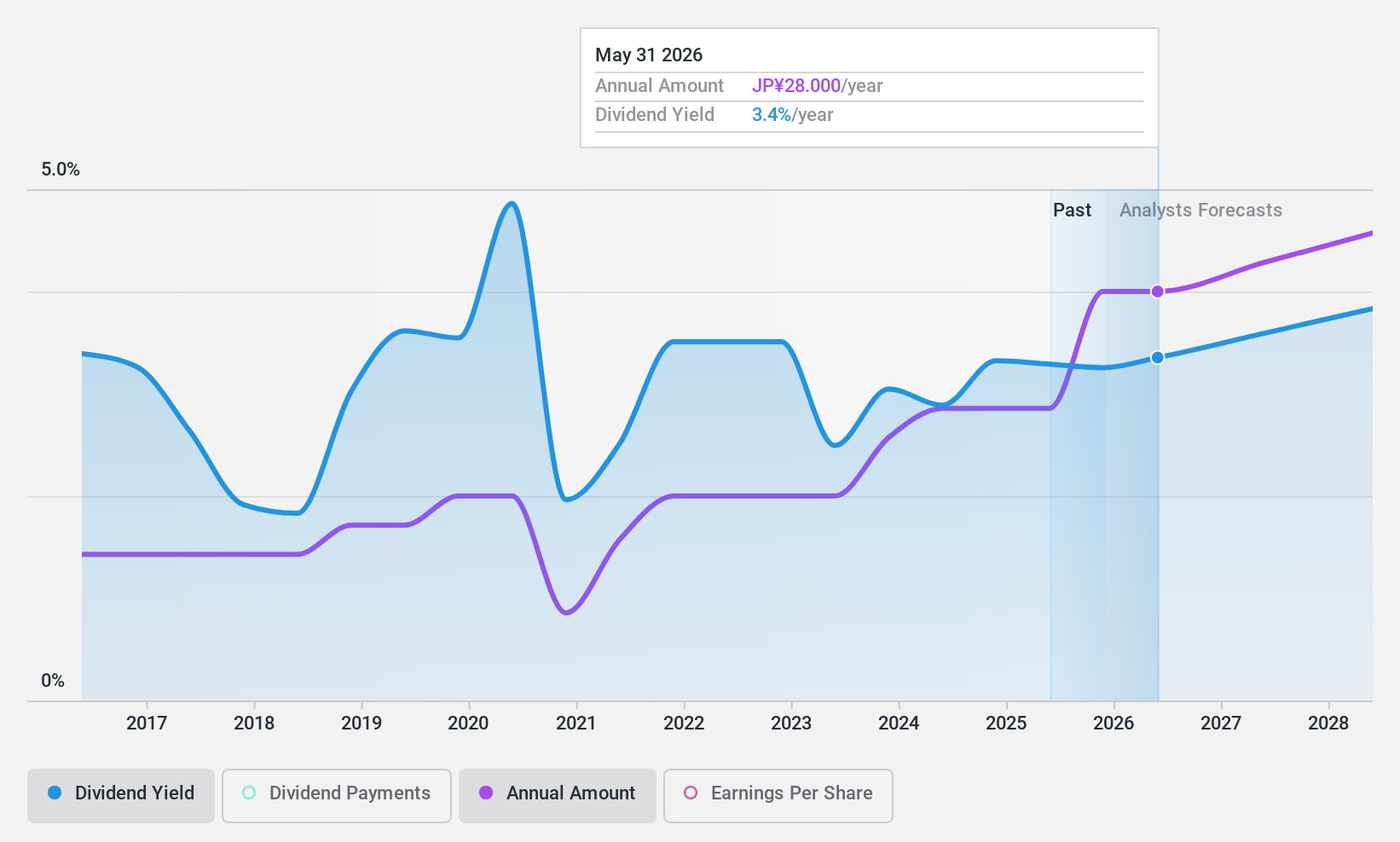

Dividend Yield: 3.3%

Sanko Gosei's dividend profile shows mixed attributes. While the company maintains a low payout ratio of 23.3%, ensuring dividends are well-covered by earnings, its cash payout ratio is higher at 78%. The dividend yield of 3.26% falls below Japan's top tier, and payments have been volatile over the past decade. Despite recent inclusion in the S&P Global BMI Index, its highly volatile share price may concern investors seeking stability in dividend stocks.

- Click to explore a detailed breakdown of our findings in Sanko Gosei's dividend report.

- In light of our recent valuation report, it seems possible that Sanko Gosei is trading behind its estimated value.

Mitsubishi UFJ Financial Group (TSE:8306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi UFJ Financial Group, Inc. is a bank holding company involved in diverse financial services across Japan, the United States, Europe, Asia/Oceania, and globally, with a market cap of ¥17.78 trillion.

Operations: Mitsubishi UFJ Financial Group generates revenue from several segments, including Global Markets Business (¥290.52 million), Global CIB Business Headquarters (¥899.32 million), Trust Property Business Headquarters (¥449.21 million), Corporate Banking Business Headquarters (¥1.05 billion), and Global Commercial Banking Business Headquarters (¥907.80 million).

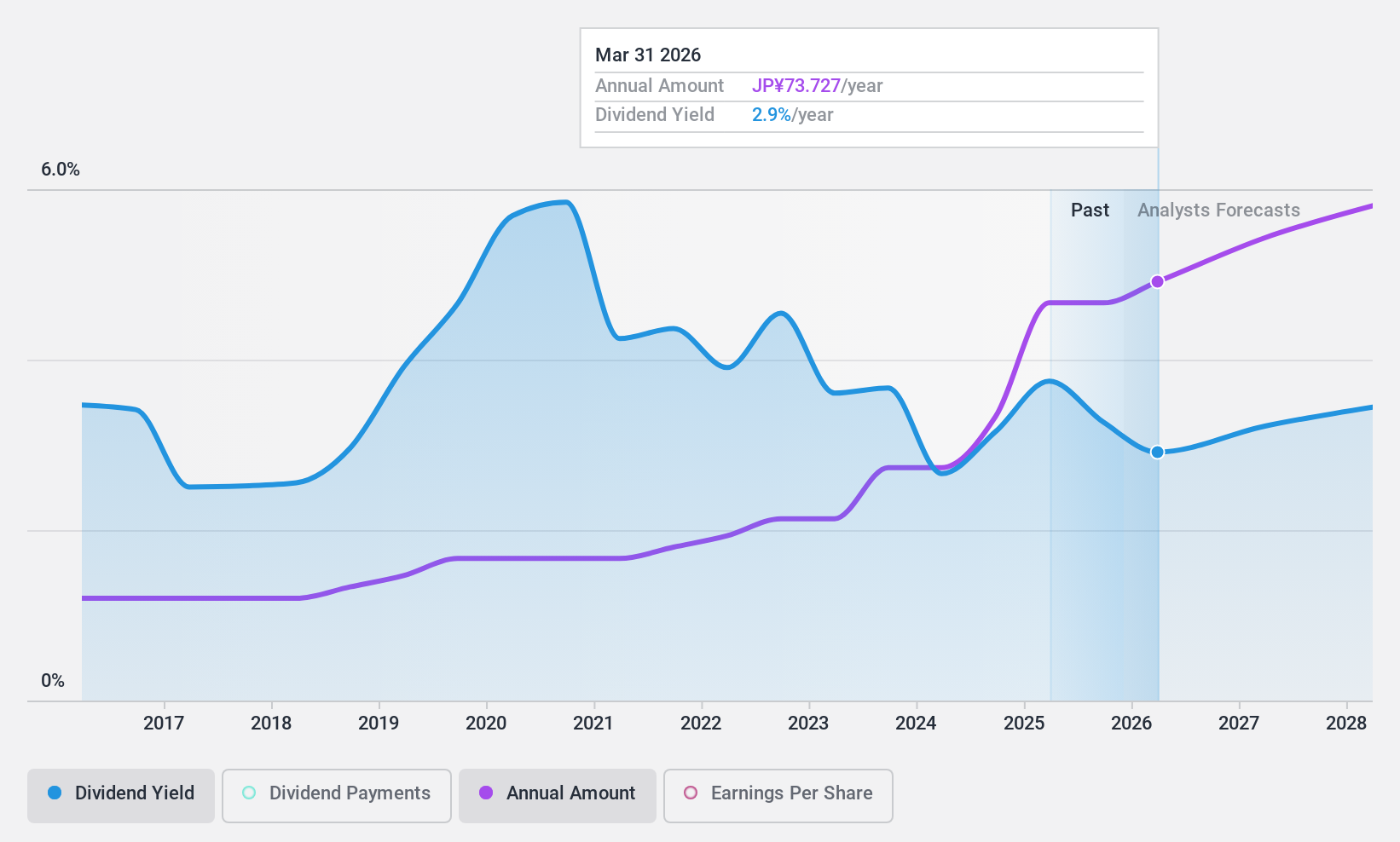

Dividend Yield: 3.3%

Mitsubishi UFJ Financial Group offers a stable dividend profile with consistent payments over the past decade and a low payout ratio of 36.8%, indicating dividends are well-covered by earnings. Despite trading significantly below fair value, its dividend yield of 3.28% is lower than Japan's top tier. Recent M&A activities, including interest in acquiring stakes in Yes Bank and DMI Finance, highlight strategic growth efforts but could impact future financial stability and dividend sustainability considerations.

- Unlock comprehensive insights into our analysis of Mitsubishi UFJ Financial Group stock in this dividend report.

- According our valuation report, there's an indication that Mitsubishi UFJ Financial Group's share price might be on the cheaper side.

Seize The Opportunity

- Gain an insight into the universe of 437 Top Japanese Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nakamoto PacksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7811

Nakamoto PacksLtd

Provides gravure printing services in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives