Lifenet Insurance (TSE:7157) shareholders are still up 183% over 3 years despite pulling back 11% in the past week

Lifenet Insurance Company (TSE:7157) shareholders might be concerned after seeing the share price drop 13% in the last quarter. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 183% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. The thing to consider is whether the underlying business is doing well enough to support the current price.

Although Lifenet Insurance has shed JP¥16b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

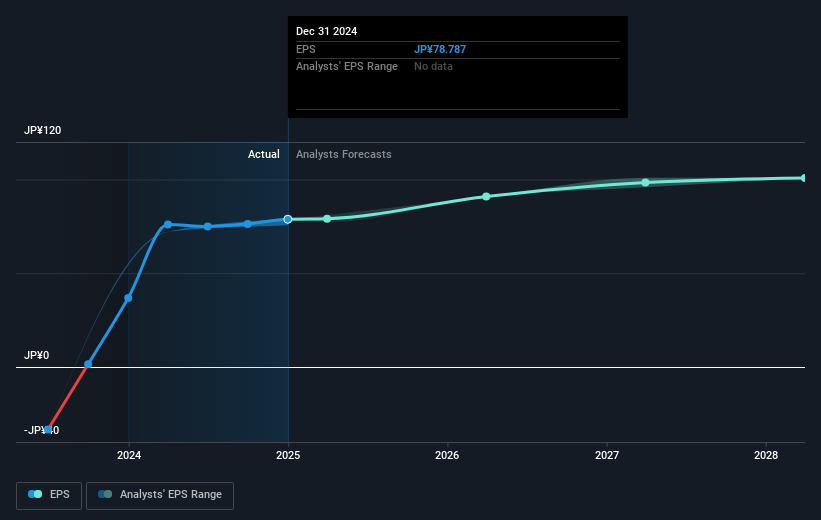

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

A Different Perspective

We're pleased to report that Lifenet Insurance shareholders have received a total shareholder return of 10% over one year. Having said that, the five-year TSR of 19% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before forming an opinion on Lifenet Insurance you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7157

Lifenet Insurance

Provides life insurance products and services in Japan, North America, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives