Despite posting strong earnings, S.T. Corporation's (TSE:4951) stock didn't move much over the last week. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

See our latest analysis for S.T

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, S.T issued 19% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of S.T's EPS by clicking here.

How Is Dilution Impacting S.T's Earnings Per Share (EPS)?

Unfortunately, S.T's profit is down 12% per year over three years. On the bright side, in the last twelve months it grew profit by 16%. But EPS was less impressive, up only 18% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So S.T shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of S.T.

The Impact Of Unusual Items On Profit

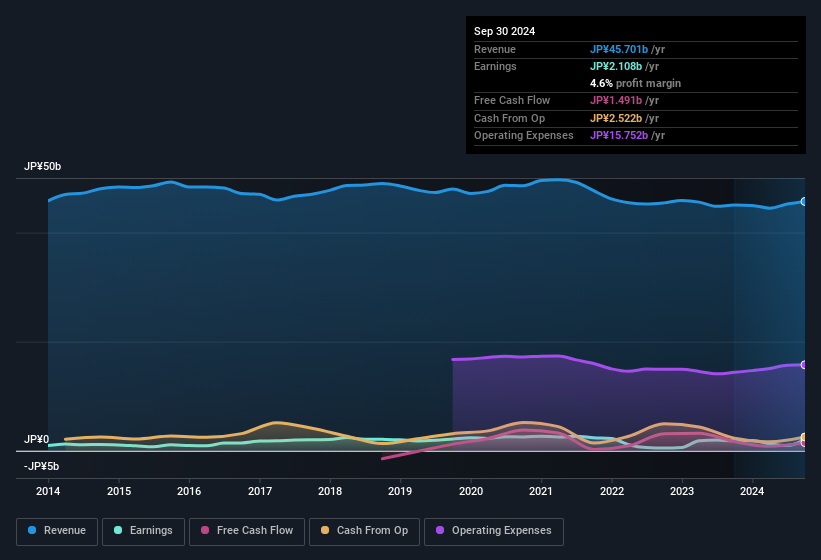

Finally, we should also consider the fact that unusual items boosted S.T's net profit by JP¥1.1b over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. S.T had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On S.T's Profit Performance

To sum it all up, S.T got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue S.T's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 3 warning signs we've spotted with S.T (including 1 which is a bit unpleasant).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4951

S.T

Manufactures and sells deodorizers and air fresheners, mothproofing agents, gloves, dehumidifiers, and other products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives