- Japan

- /

- Personal Products

- /

- TSE:4928

Undiscovered Gems On None Exchange To Watch In January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets are reflecting a mixed bag of economic indicators with U.S. consumer confidence dipping and manufacturing orders declining, while major stock indexes like the S&P 500 and Nasdaq Composite have shown moderate gains despite recent volatility. Amidst this backdrop, small-cap stocks in particular may present unique opportunities for investors seeking potential growth in sectors that are often overlooked by larger market players. In such a dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals that can weather economic fluctuations and capitalize on niche market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| AuMas Resources Berhad | NA | 14.09% | 57.21% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vietnam Container Shipping | 47.45% | 7.52% | -7.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Tomoe (TSE:1921)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomoe Corporation engages in general construction, steel structures construction, and real estate businesses in Japan with a market cap of ¥40.21 billion.

Operations: The company generates revenue primarily through its general construction and steel structures construction segments. The net profit margin has shown variability, indicating fluctuations in operational efficiency or cost management over time.

Tomoe, a lesser-known player in its industry, has shown impressive earnings growth of 331.5% over the past year, outpacing the construction industry's 20.7%. Trading at 71.6% below its estimated fair value suggests potential undervaluation. However, a significant one-off gain of ¥12 billion has impacted financial results, indicating some volatility in earnings quality. The debt to equity ratio increased from 16.8% to 18.7% over five years but remains satisfactory with net debt at just 2%. Despite shareholder dilution last year, Tomoe's free cash flow is positive and interest coverage is not an issue for this company.

- Dive into the specifics of Tomoe here with our thorough health report.

Gain insights into Tomoe's historical performance by reviewing our past performance report.

Noevir Holdings (TSE:4928)

Simply Wall St Value Rating: ★★★★★★

Overview: Noevir Holdings Co., Ltd. is engaged in the development, production, and sale of cosmetics, pharmaceuticals, and health food products across various countries including Japan and North America, with a market cap of ¥167.19 billion.

Operations: Noevir Holdings generates revenue through the sale of cosmetics, pharmaceuticals, and health food products across multiple countries. The company's net profit margin reflects its ability to manage costs relative to its sales revenue.

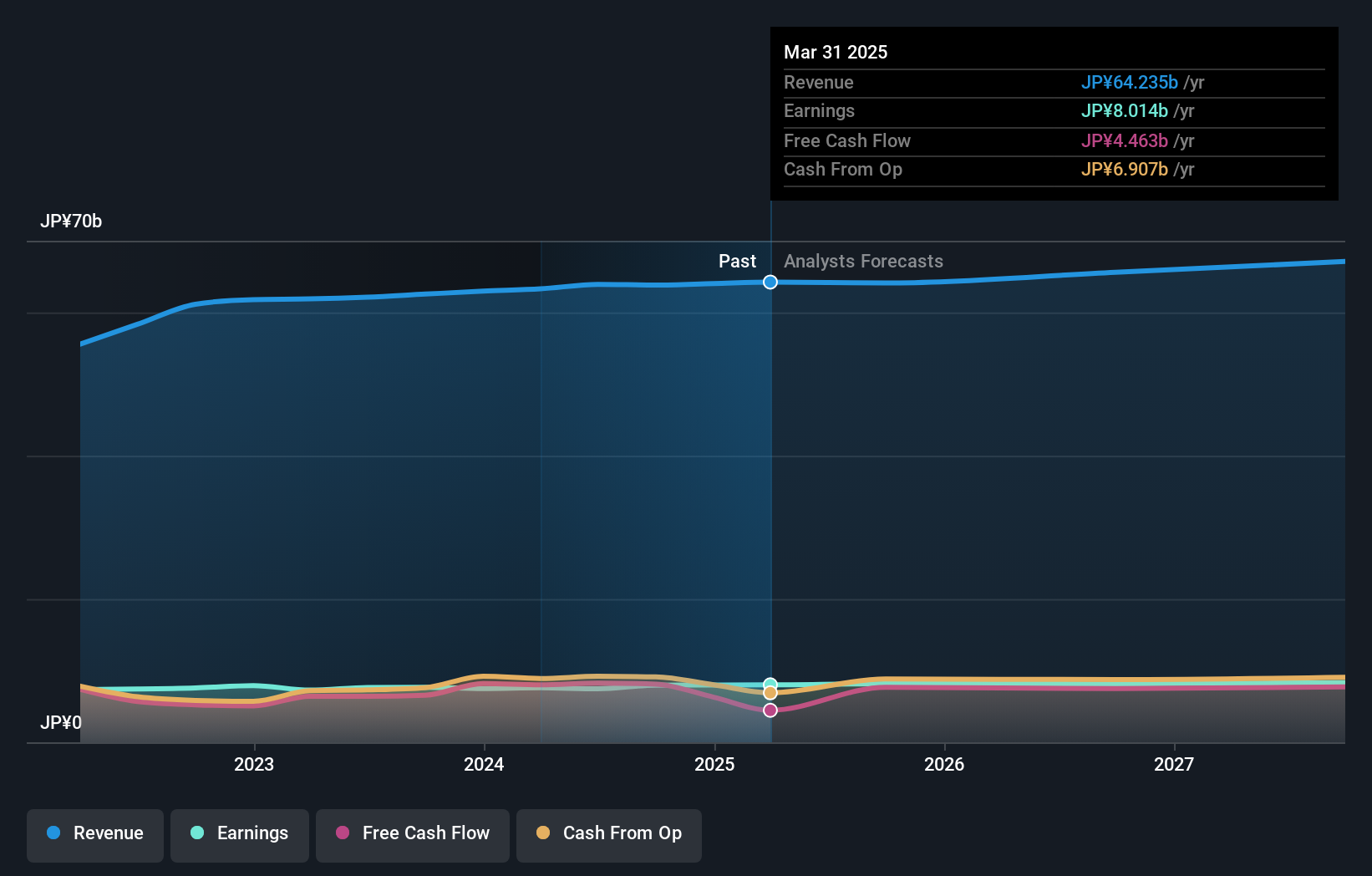

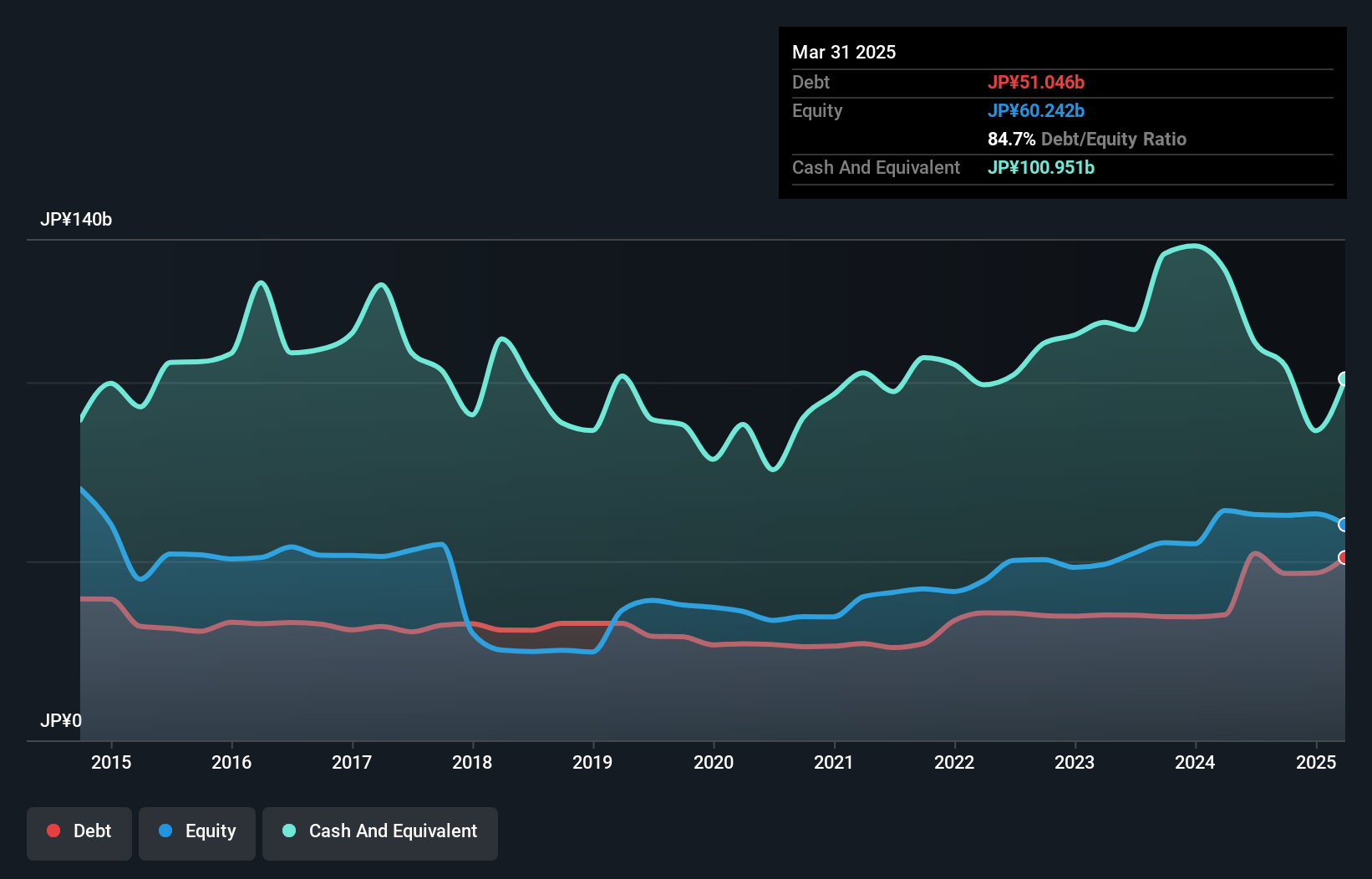

Noevir Holdings, a noteworthy player in the personal products sector, showcases a strong financial footing with earnings growth of 5.4% annually over the past five years. The company operates debt-free, enhancing its financial stability and flexibility. Trading at a price-to-earnings ratio of 21x, it offers good value compared to peers in its industry average of 24.1x. Recent developments include an increased dividend payout to ¥225 per share for fiscal year-end September 2024 from ¥220 previously, reflecting confidence in cash flow health. Looking ahead, Noevir projects net sales of ¥64 billion and operating profit at ¥11.5 billion for FY2025.

- Click here to discover the nuances of Noevir Holdings with our detailed analytical health report.

Gain insights into Noevir Holdings' past trends and performance with our Past report.

Toyo Engineering (TSE:6330)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toyo Engineering Corporation specializes in the engineering and construction of industrial facilities, with a market cap of ¥42.66 billion.

Operations: Toyo Engineering generates revenue primarily from its engineering and construction services for industrial facilities. The company's financial performance is characterized by a net profit margin that has fluctuated over recent periods.

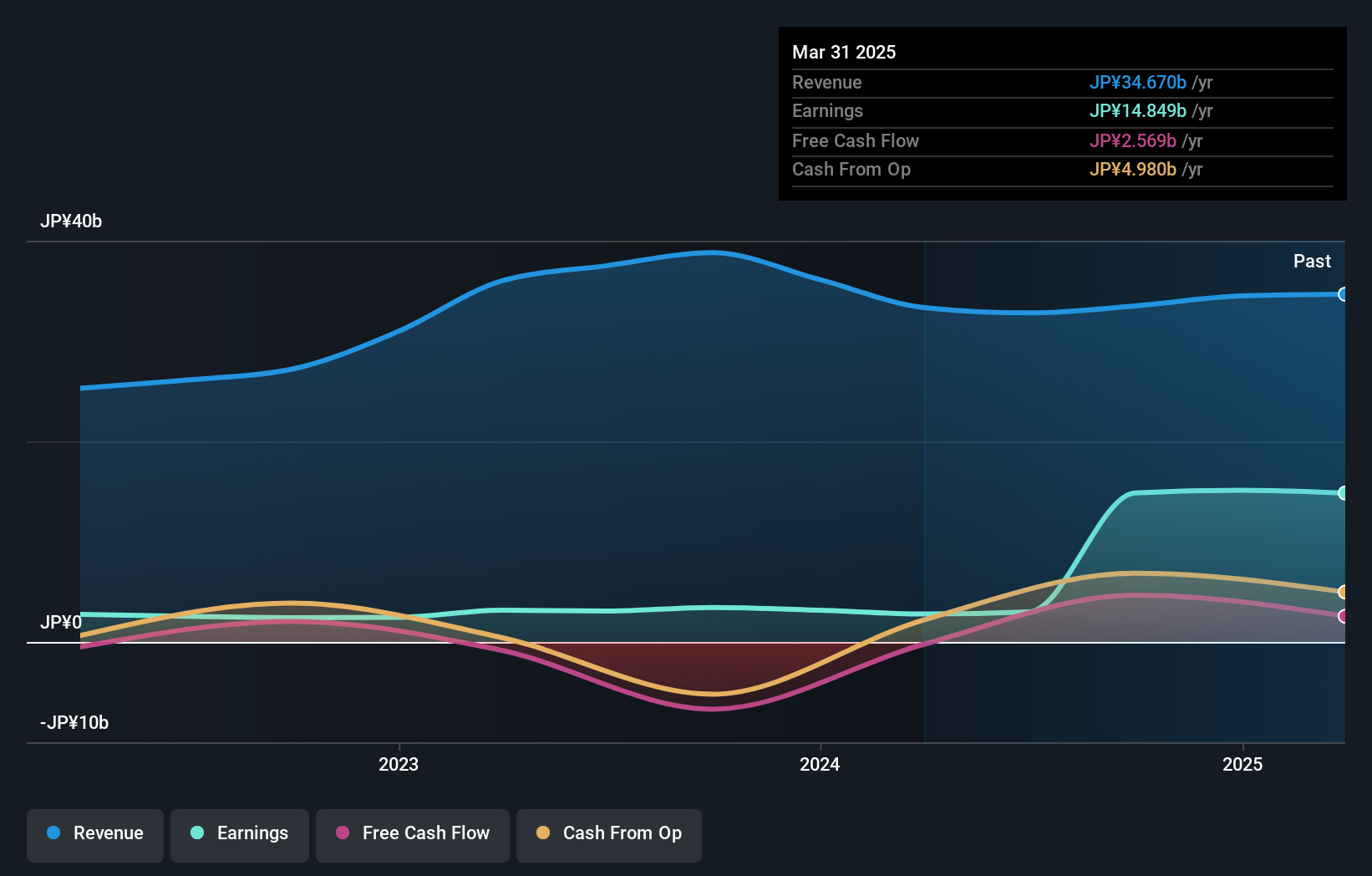

Toyo Engineering, a smaller player in the construction sector, has shown remarkable earnings growth of 232% over the past year, outpacing its industry. Despite this impressive uptick, a ¥5.1 billion one-off gain significantly influenced these results. The company is trading at nearly 29% below its estimated fair value, suggesting potential undervaluation compared to peers. Over five years, Toyo's debt-to-equity ratio improved from 76% to 74%, indicating prudent financial management. While future earnings are expected to decline by an average of 19% annually over the next three years, recent strategic briefings may offer insights into navigating upcoming challenges.

- Unlock comprehensive insights into our analysis of Toyo Engineering stock in this health report.

Evaluate Toyo Engineering's historical performance by accessing our past performance report.

Seize The Opportunity

- Navigate through the entire inventory of 4638 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noevir Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4928

Noevir Holdings

Develops, produces, and sells cosmetics, pharmaceuticals, and health food products in Japan, China, Taiwan, South Korea, Hong Kong, Singapore, Thailand, the United States, and Canada.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives