- Japan

- /

- Personal Products

- /

- TSE:4452

Kao (TSE:4452): Exploring Valuation as Shares Show Modest Movement and Earnings Trend Higher

Reviewed by Simply Wall St

Kao (TSE:4452) shares have seen mild movement this week, and investors may be weighing recent results alongside the company’s longer-term trends. Over the past month, the stock has retreated slightly, even as revenue and net income have been growing year over year.

See our latest analysis for Kao.

While Kao’s 1-year total shareholder return is slightly in the red, the stock has gained ground this year with a recent pick-up in share price momentum. Investors seem to be responding to positive earnings growth, but the longer-term picture remains a mix of steady operating results and a share price that has lagged wider market gains over the last five years.

If you’re curious where other leaders are outperforming, it’s worth exploring fast growing stocks with high insider ownership as your next discovery.

With earnings headed higher and the current share price still at a discount to analyst targets, is Kao a value play waiting to be realized, or has the market already factored in its next round of growth?

Most Popular Narrative: 15.4% Undervalued

With Kao’s latest close trailing the narrative’s fair value by a notable margin, the stage is set for a deeper dive into the assumptions that underpin this valuation gap.

Kao's consistent investment in developing high value-added and premium products, particularly in fabric care and hair care, responds to increasing consumer demand in Asia's growing urban middle class. This supports sustained revenue growth and improved net margin through pricing power. The company's accelerated expansion into emerging markets, including strong rollouts of core brands in ASEAN and China, as well as continued growth in Thailand, leverages demographic tailwinds and urbanization. These trends will expand Kao's addressable market and drive topline revenue.

Want to know which growth assumptions power this optimistic view? One key factor is a remarkable jump in earnings, rooted in ambitious financial projections that redefine Kao’s future trajectory. Curious what sets this narrative apart? Unpack the bold estimates and see what makes the consensus valuation so compelling.

Result: Fair Value of ¥7,630 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on Japan and persistent raw material cost pressures could threaten Kao’s growth outlook and put pressure on its ambitious margin targets going forward.

Find out about the key risks to this Kao narrative.

Another View: Are Multiples Telling a Different Story?

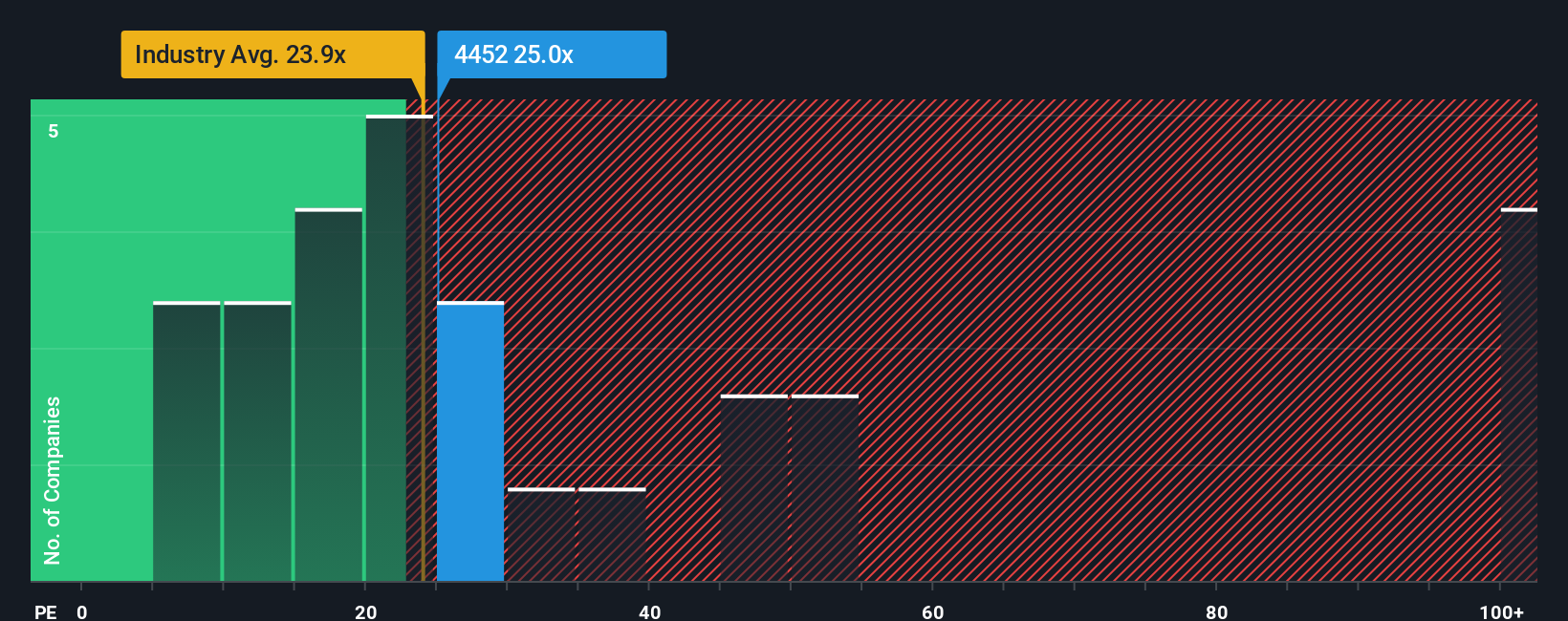

Taking a look at price-to-earnings ratios, Kao trades at 26 times earnings. That is higher than the industry average of 23.5 times, but well below the peer average of 52.9 times. Interestingly, our fair ratio suggests 29.3 times might be justified. Does this signal hidden value, or added risk if the market’s outlook dims?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kao Narrative

If you have a different perspective or want to dive into the figures yourself, it’s quick and easy to shape your own Kao outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kao.

Looking for More Investment Ideas?

Why limit yourself? Sharpen your portfolio by targeting fast-moving opportunities and emerging trends before the rest of the market catches on. Keep your investing edge with these three ways to get started:

- Tap into AI breakthroughs by analyzing the market’s top performers through these 26 AI penny stocks, and see which companies are pushing cutting-edge innovation.

- Secure reliable income streams by focusing on these 17 dividend stocks with yields > 3%, where strong yields and proven financial stability set the foundation for lasting returns.

- Ride the momentum in future finance by evaluating leaders among these 80 cryptocurrency and blockchain stocks, positioning yourself for the next wave in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4452

Kao

Develops and sells hygiene living care, health beauty care, life care, cosmetics, and chemical products.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives