- Japan

- /

- Medical Equipment

- /

- TSE:7741

We Ran A Stock Scan For Earnings Growth And HOYA (TSE:7741) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like HOYA (TSE:7741), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide HOYA with the means to add long-term value to shareholders.

See our latest analysis for HOYA

HOYA's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. HOYA managed to grow EPS by 11% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

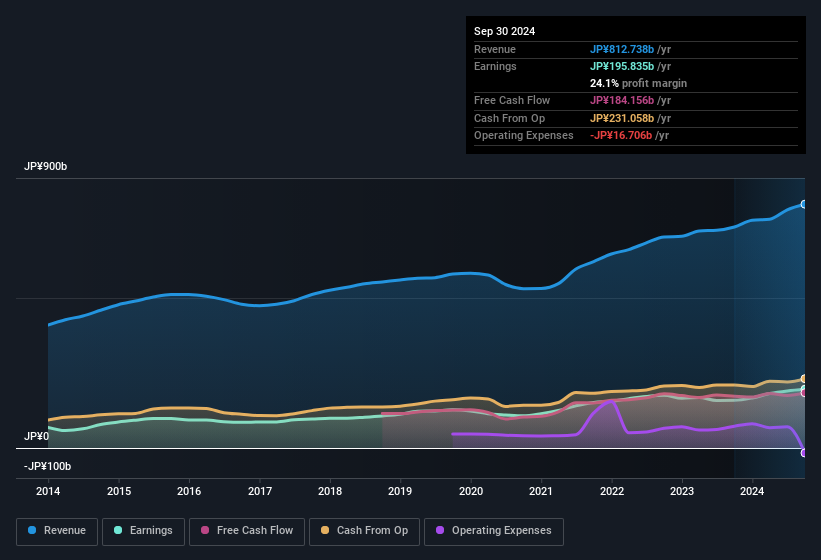

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note HOYA achieved similar EBIT margins to last year, revenue grew by a solid 10% to JP¥813b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for HOYA's future profits.

Are HOYA Insiders Aligned With All Shareholders?

Owing to the size of HOYA, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at JP¥83b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does HOYA Deserve A Spot On Your Watchlist?

One important encouraging feature of HOYA is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. If you think HOYA might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Although HOYA certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7741

HOYA

A med-tech company, provides high-tech and medical products worldwide.

Outstanding track record with excellent balance sheet.