- Japan

- /

- Medical Equipment

- /

- TSE:7733

Olympus Launches VISERA S Platform Could Be a Game Changer for Olympus (TSE:7733)

Reviewed by Simply Wall St

- Earlier this month, Olympus Corporation announced the U.S. launch of the VISERA S OTV-S500 imaging platform, which delivers advanced diagnostic capabilities for ear, nose, and throat as well as urology applications, while offering integration with the company's medical content management systems.

- This new system highlights Olympus's commitment to innovation in patient-centered diagnostics, with design enhancements aimed at office and outpatient flexibility, improved image quality, and expanded endoscope compatibility.

- We'll now examine how the VISERA S platform launch strengthens Olympus's investment narrative by expanding its innovative medical device portfolio.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Olympus Investment Narrative Recap

To be optimistic about Olympus, investors need confidence in the company’s ability to grow its medical device portfolio and translate product innovation into sustained earnings, despite current regional headwinds. The launch of the VISERA S video system is a clear demonstration of ongoing innovation, but it does not change the immediate importance of successfully commercializing these high-investment products or minimize the challenges in China and other international markets. Near-term profitability remains tightly linked to how efficiently Olympus can deploy new technology without major delays or cost overruns.

Among recent announcements, the June 2025 unveiling of the SeleCT AI-driven screening program stands out. Like the new VISERA S platform, SeleCT represents Olympus’ push into advanced, office-based diagnostics, reinforcing a strategic theme: broadening advanced offerings to drive recurring use and offset external market pressures. While there is clear momentum in product launches, execution risk can affect the scale and timing of revenue impact.

By contrast, investors should be aware of the pace at which healthcare budget constraints in key regions could...

Read the full narrative on Olympus (it's free!)

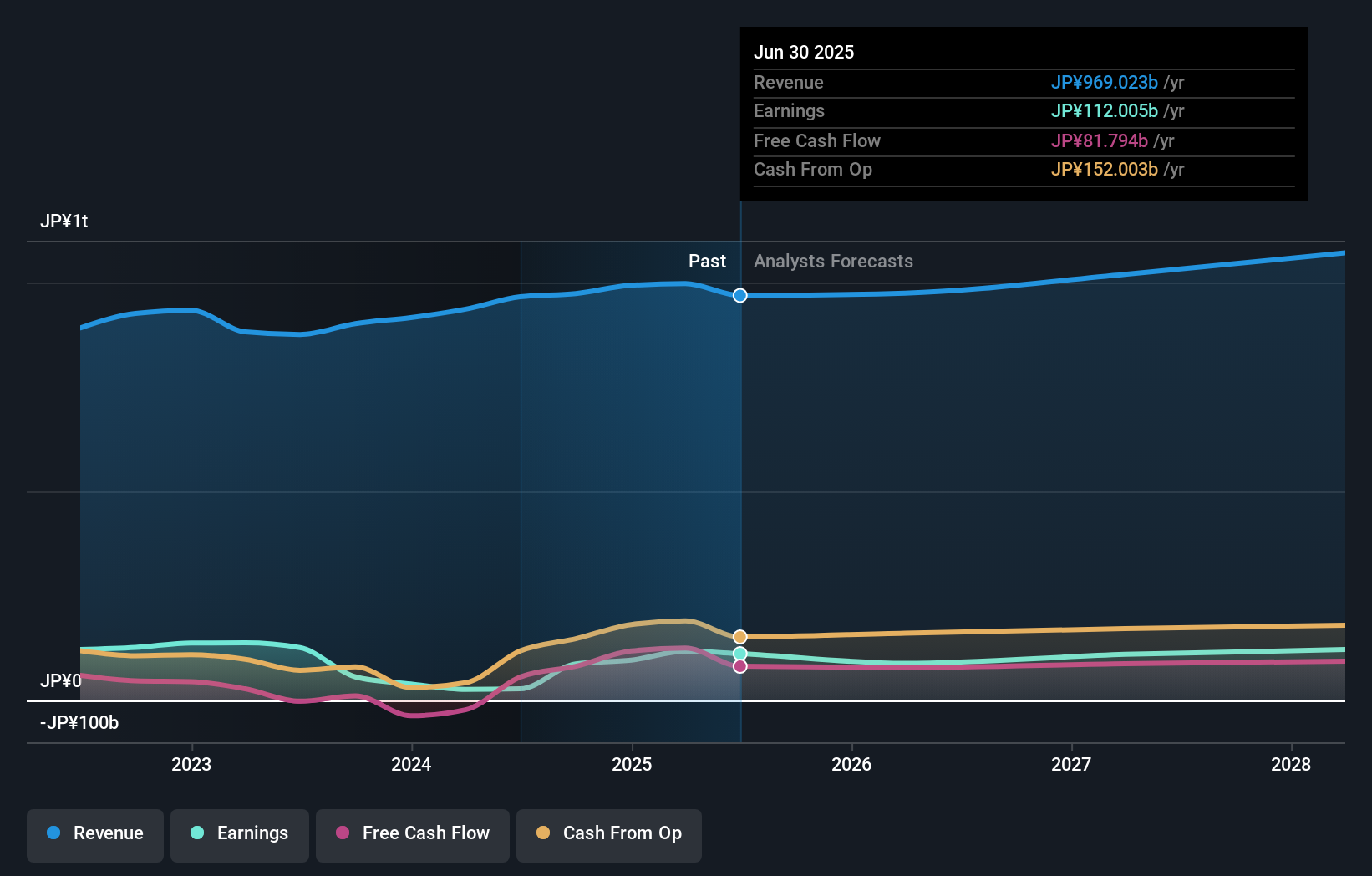

Olympus' narrative projects ¥1,086.7 billion revenue and ¥125.4 billion earnings by 2028. This requires 3.9% yearly revenue growth and a ¥13.4 billion earnings increase from ¥112.0 billion.

Uncover how Olympus' forecasts yield a ¥2119 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community set Olympus’ fair value between ¥1,637 and ¥2,119 per share. These views contrast with ongoing concerns that high R&D spending may hamper near-term profit momentum, so it is worth exploring different opinions before forming your own assessment.

Explore 2 other fair value estimates on Olympus - why the stock might be worth as much as 17% more than the current price!

Build Your Own Olympus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olympus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Olympus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olympus' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7733

Olympus

Manufactures and sells precision machineries and instruments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives