- Japan

- /

- Medical Equipment

- /

- TSE:7733

Did PolyLoop Safety Fix and Stent Deal Just Shift Olympus' (TSE:7733) Medtech Investment Narrative?

Reviewed by Sasha Jovanovic

- In early December 2025, Olympus Corporation announced a voluntary corrective action for its Single-Use Ligating Device (“PolyLoop”) after reports that the loop could fail to release, potentially causing bleeding, mucosal injury, perforation, or requiring emergency or surgical intervention, although no deaths were reported.

- On the same day, Olympus, W. L. Gore & Associates, and ConMed detailed a planned handover of global distribution rights for the GORE VIABIL Biliary Endoprosthesis to Olympus from January 2026, tightening Olympus’s control over an important endoscopic stent while it manages scrutiny around PolyLoop safety.

- We’ll now examine how the PolyLoop safety corrective action may affect Olympus’s investment narrative built around medtech growth and efficiency gains.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Olympus Investment Narrative Recap

To own Olympus, you need to be comfortable with a medtech story built on endoscopy leadership, incremental earnings growth and ongoing efficiency programs like Project Elevate. The PolyLoop corrective action raises execution and regulatory questions, but based on what is known today it does not obviously change the near term focus on improving margins or the key risk around macro and policy pressure in China.

The planned transfer of global distribution rights for the GORE VIABIL Biliary Endoprosthesis to Olympus from January 2026 sits squarely within that medtech growth narrative, reinforcing its presence in high value gastrointestinal procedures while PolyLoop is under closer scrutiny. How effectively Olympus integrates VIABIL alongside OLYSENSE and its AI portfolio could matter for how investors view its ability to turn product breadth into steadier revenue and earnings.

Yet against this growth story, the emerging device safety and regulatory risk around PolyLoop is something investors should be aware of as they consider...

Read the full narrative on Olympus (it's free!)

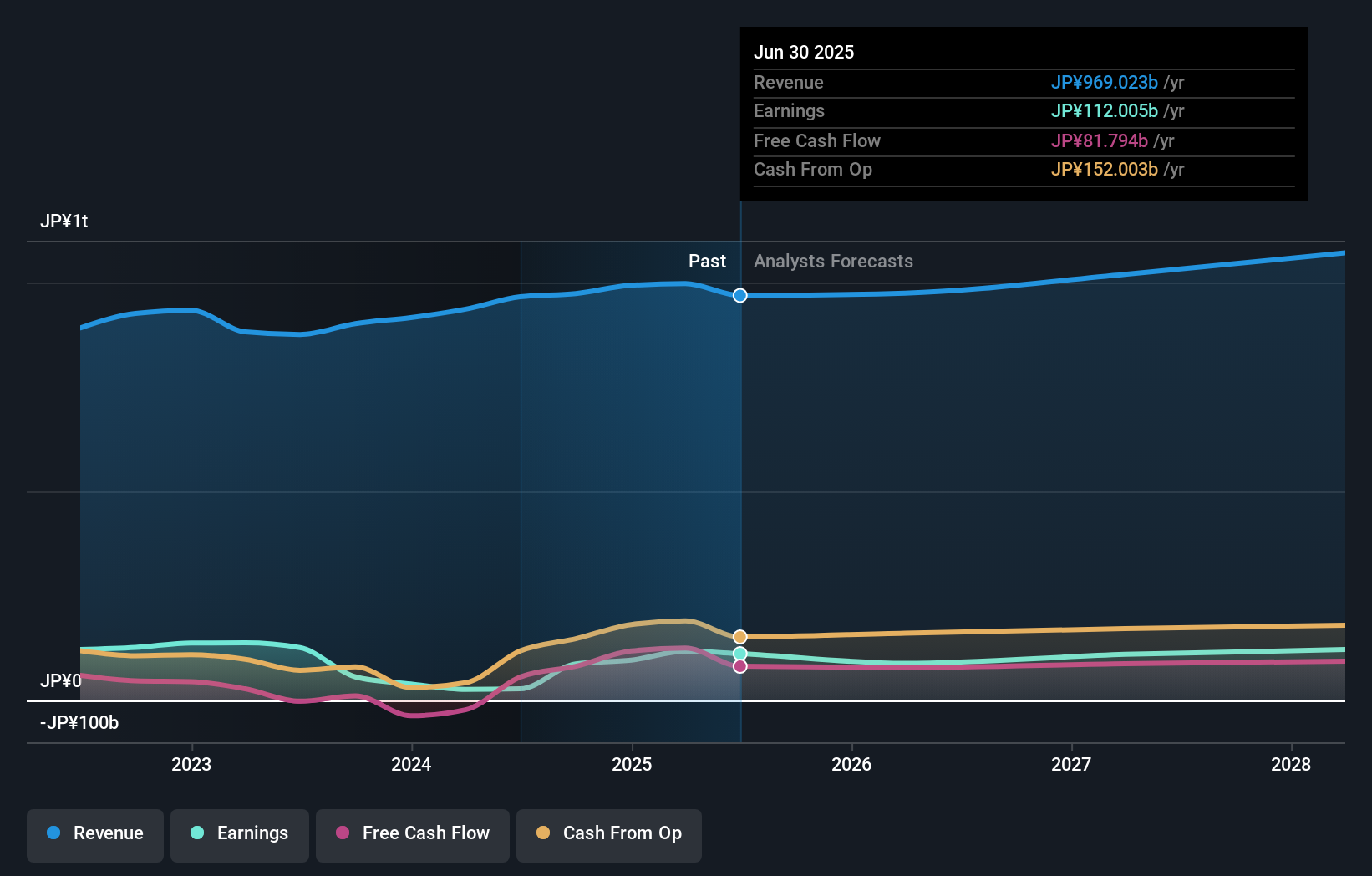

Olympus' narrative projects ¥1086.7 billion revenue and ¥125.4 billion earnings by 2028.

Uncover how Olympus' forecasts yield a ¥2078 fair value, in line with its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Olympus span a tight range from ¥1,847.80 to ¥2,077.69, underscoring how differently private investors can see the same stock. You can weigh those views against the new product safety questions around PolyLoop and what they might mean for Olympus’s efforts to improve margins and sustain earnings growth.

Explore 2 other fair value estimates on Olympus - why the stock might be worth as much as ¥2078!

Build Your Own Olympus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olympus research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Olympus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olympus' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7733

Olympus

Manufactures and sells medical equipment in Japan, America, the Middle East, Asia, and Oceania.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026