- Japan

- /

- Healthcare Services

- /

- TSE:7362

What Terminalcare Support Institute Inc.'s (TSE:7362) 28% Share Price Gain Is Not Telling You

Terminalcare Support Institute Inc. (TSE:7362) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

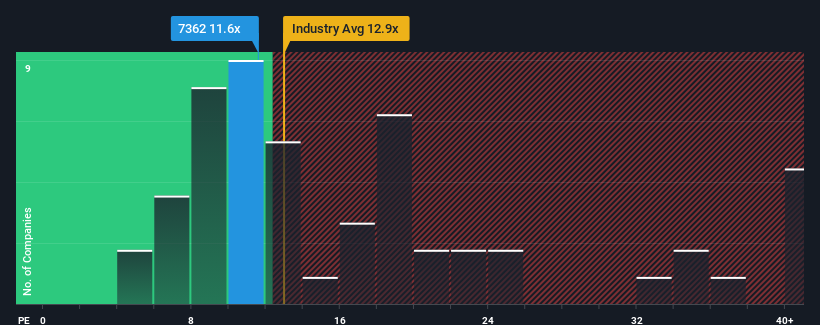

Although its price has surged higher, you could still be forgiven for feeling indifferent about Terminalcare Support Institute's P/E ratio of 11.6x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 4 warning signs investors should be aware of before investing in Terminalcare Support Institute. Read for free now.As an illustration, earnings have deteriorated at Terminalcare Support Institute over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Terminalcare Support Institute

Does Growth Match The P/E?

In order to justify its P/E ratio, Terminalcare Support Institute would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.4%. As a result, earnings from three years ago have also fallen 21% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 9.7% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Terminalcare Support Institute is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Terminalcare Support Institute's P/E

Terminalcare Support Institute appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Terminalcare Support Institute revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Terminalcare Support Institute that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Terminalcare Support Institute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7362

Terminalcare Support Institute

Provides home-visit care, preventive care, home-care support, and home-visit nursing services in Japan.

Slight risk with poor track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026