- Japan

- /

- Healthcare Services

- /

- TSE:7091

The Price Is Right For Living Platform,Ltd. (TSE:7091) Even After Diving 29%

Living Platform,Ltd. (TSE:7091) shares have had a horrible month, losing 29% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

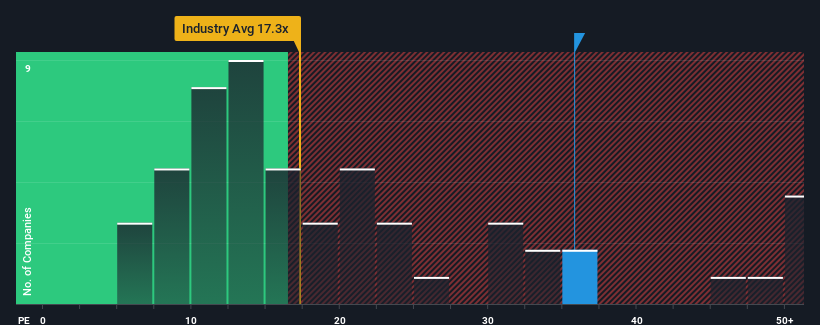

In spite of the heavy fall in price, Living PlatformLtd may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 35.8x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Living PlatformLtd as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Living PlatformLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Living PlatformLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. The strong recent performance means it was also able to grow EPS by 365% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 75% over the next year. With the market only predicted to deliver 11%, the company is positioned for a stronger earnings result.

With this information, we can see why Living PlatformLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Living PlatformLtd's P/E?

Living PlatformLtd's shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Living PlatformLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with Living PlatformLtd (including 2 which are a bit concerning).

If you're unsure about the strength of Living PlatformLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7091

Living PlatformLtd

Engages in nursing care, childcare, and disability support businesses.

Slight with acceptable track record.

Market Insights

Community Narratives