- Japan

- /

- Medical Equipment

- /

- TSE:6869

After Leaping 26% Sysmex Corporation (TSE:6869) Shares Are Not Flying Under The Radar

Sysmex Corporation (TSE:6869) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.8% isn't as attractive.

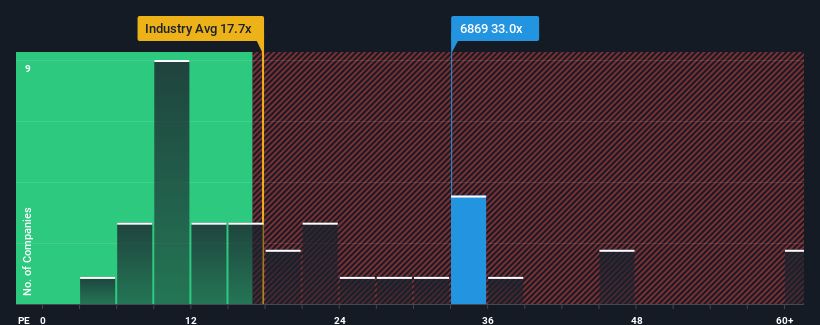

Since its price has surged higher, Sysmex may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 33x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Sysmex's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Sysmex

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sysmex's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. This was backed up an excellent period prior to see EPS up by 35% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 14% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 9.4% per year growth forecast for the broader market.

With this information, we can see why Sysmex is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Sysmex's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sysmex maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Sysmex with six simple checks.

If you're unsure about the strength of Sysmex's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives