- Japan

- /

- Medical Equipment

- /

- TSE:6823

It's Down 33% But Rion Co., Ltd. (TSE:6823) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Rion Co., Ltd. (TSE:6823) share price has dived 33% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 13% share price drop.

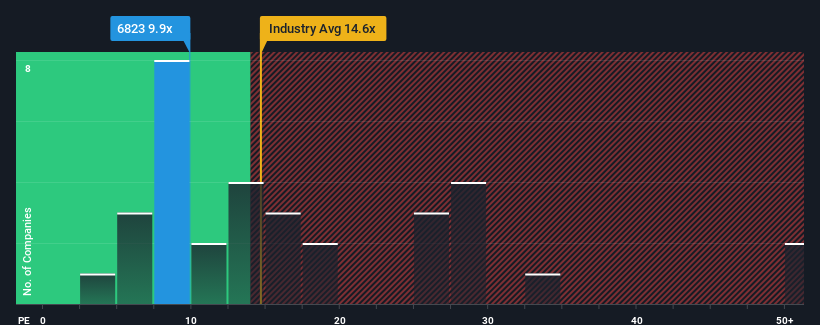

Since its price has dipped substantially, Rion's price-to-earnings (or "P/E") ratio of 9.9x might make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, Rion has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Rion

Is There Any Growth For Rion?

There's an inherent assumption that a company should underperform the market for P/E ratios like Rion's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.1%. The latest three year period has also seen an excellent 39% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 17% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 9.6% each year, which is noticeably less attractive.

With this information, we find it odd that Rion is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Rion's P/E

Rion's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Rion currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Rion, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Rion, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6823

Rion

Manufactures, sells, and maintains hearing instruments, medical equipment, sound and vibration measuring instruments, particle counters, and related parts and equipment in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives