- Japan

- /

- Healthcare Services

- /

- TSE:4544

Assessing H.U. Group Holdings (TSE:4544) Valuation After UBS Upgrade and Surging Alzheimer’s Blood Test Sales

Reviewed by Kshitija Bhandaru

UBS upgraded H.U. Group Holdings (TSE:4544) to Buy after strong demand for its Alzheimer’s disease blood test in the US. Regulatory approval led to a doubling of year-over-year sales in the latest quarter.

See our latest analysis for H.U. Group Holdings.

H.U. Group Holdings has enjoyed strong momentum lately, with a 45.6% year-to-date share price return and a 47.1% total shareholder return for the past 12 months. The recent surge has been fueled by the successful US launch of its Alzheimer’s blood test, which helped shift investor sentiment and highlighted the company’s growth potential.

If healthcare breakthroughs like this one have you interested in what else is happening in the space, take the next step and browse See the full list for free.

The impressive rally and earnings upgrades naturally raise the question: Is H.U. Group Holdings now trading above its true worth, or could market excitement be missing further upside for investors willing to look ahead?

Price-to-Sales Ratio of 0.9x: Is it justified?

H.U. Group Holdings is currently priced at a price-to-sales (P/S) ratio of 0.9x, which sets it above both its peer average and the Japanese healthcare sector.

The price-to-sales ratio measures the value investors place on each unit of revenue for a company. For H.U. Group Holdings, the P/S of 0.9x means that investors are paying ¥0.90 for every ¥1 of sales generated. This is higher than the peer average of 0.7x and well above the industry average of 0.6x. This suggests the market may be valuing the company’s sales at a premium due to growth expectations or recent positive momentum.

This premium pricing invites scrutiny because it suggests the market has priced in significant optimism. However, compared to the estimated fair price-to-sales ratio of 1x, the current level could still be justified if the company continues to execute on its growth initiatives and maintain profitability. The market could move closer to the fair ratio if management delivers on expected financial improvements.

Explore the SWS fair ratio for H.U. Group Holdings

Result: Price-to-Sales Ratio of 0.9x (OVERVALUED)

However, downside risks remain if revenue growth slows or profit margins weaken in a competitive market. This could pressure the company's premium valuation.

Find out about the key risks to this H.U. Group Holdings narrative.

Another View: Discounted Cash Flow Signals Opportunity

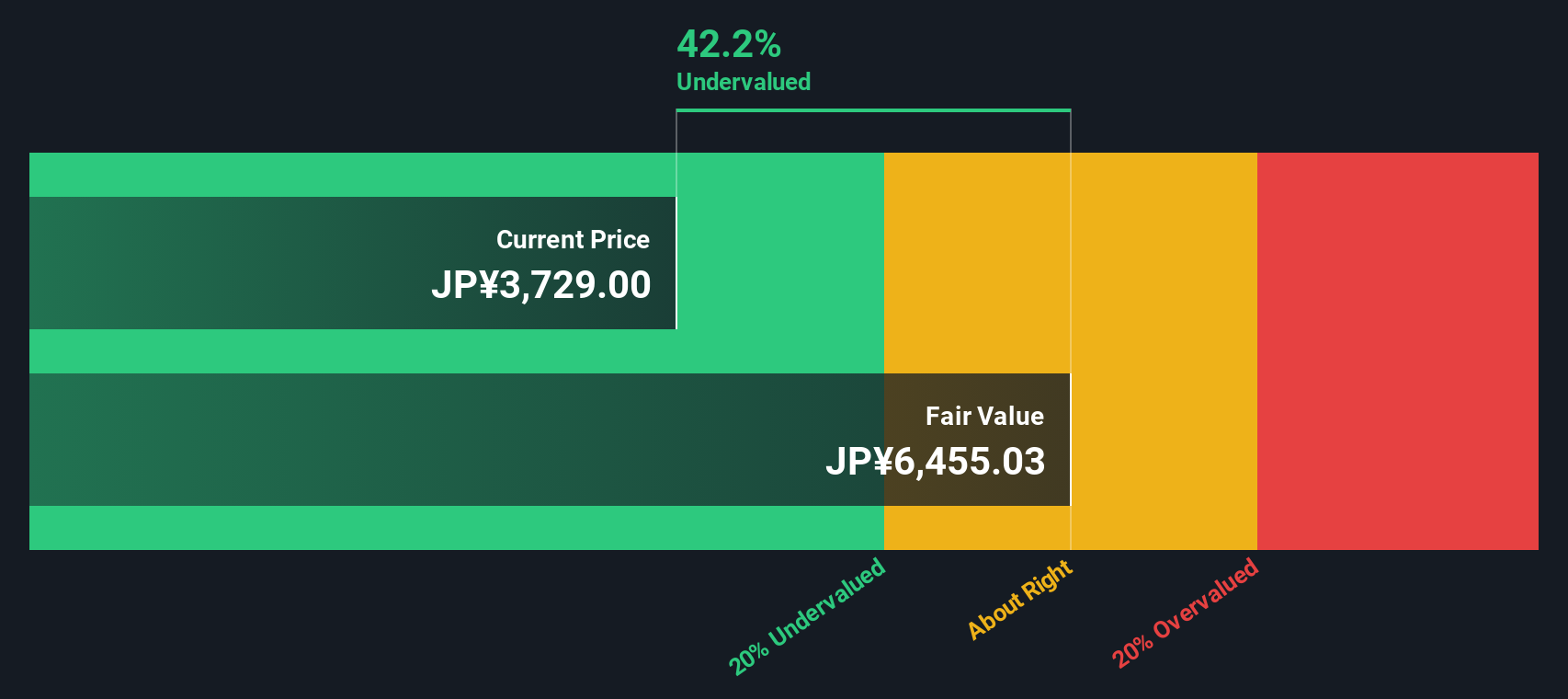

While the market’s current pricing looks expensive using sales multiples, our DCF model takes a broader perspective and indicates a different story. By estimating future cash flows, the SWS DCF model suggests H.U. Group Holdings is actually undervalued by around 42%, trading below its intrinsic value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H.U. Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H.U. Group Holdings Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your personal view quickly and easily with Do it your way

A great starting point for your H.U. Group Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep an eye on opportunities before everyone else. Don’t wait. Get ahead now and find stocks with hidden value, exceptional growth, or reliable income potential.

- Grow your wealth by targeting long-term winners among these 868 undervalued stocks based on cash flows that look set to reward forward-thinking investors.

- Catch the next wave of innovation and assess these 26 quantum computing stocks pioneering breakthroughs in cutting-edge computation and technology.

- Supercharge your portfolio with steady payouts by searching these 20 dividend stocks with yields > 3% offering consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H.U. Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4544

H.U. Group Holdings

Operates healthcare business in Japan, the United States, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives