As global markets navigate a landscape marked by fluctuating interest rates and geopolitical tensions, the technology sector has faced particular volatility, with the Nasdaq Composite experiencing notable declines due to competitive pressures in artificial intelligence. Amidst this backdrop, identifying high-growth tech stocks requires careful consideration of their innovation potential and resilience to market shifts, especially as companies adapt to emerging technological advancements and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Vaisala Oyj (HLSE:VAIAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vaisala Oyj operates in the weather and environmental, as well as industrial measurement sectors, catering to weather-related and industrial markets, with a market cap of €1.94 billion.

Operations: The company generates revenue primarily from two segments: Industrial Measurements (€219.40 million) and Weather and Environment (€325 million).

Vaisala Oyj's strategic appointment of Lorenzo Gulli as EVP, focusing on M&A to accelerate strategy execution, underscores its commitment to leveraging high-level expertise for growth. With an annual revenue growth forecast at 7.3%, slightly above the Finnish market's 2.2%, and earnings expected to rise by 16.4% annually, Vaisala is positioning itself advantageously against market norms. Particularly noteworthy is its past year’s earnings surge of 22.9%, outpacing the electronic industry’s decline by a significant margin. This performance highlights Vaisala's capability to not only navigate but also capitalize on industry dynamics effectively, suggesting robust future prospects in a competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of Vaisala Oyj.

Examine Vaisala Oyj's past performance report to understand how it has performed in the past.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

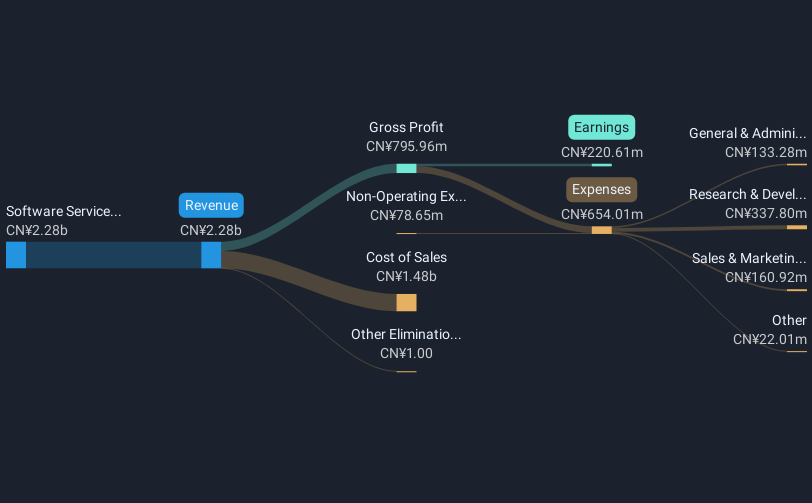

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥8.19 billion.

Operations: The company generates revenue primarily from software services, amounting to CN¥2.28 billion.

Guangzhou Sie Consulting, with its notable 27.5% projected annual earnings growth and a robust revenue increase of 13.9%, is carving a niche in the tech sector. This performance is particularly impressive given the broader Chinese market's average revenue growth of 13.3%. The company has also strategically repurchased shares, spending CNY 39.97 million to buy back 0.62% of its stock since August last year, signaling confidence in its financial health and future prospects. These moves underscore Guangzhou Sie’s commitment to harnessing its innovative capabilities to stay ahead in a competitive landscape, even as it outpaces many local counterparts in both earnings and revenue growth trajectories.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

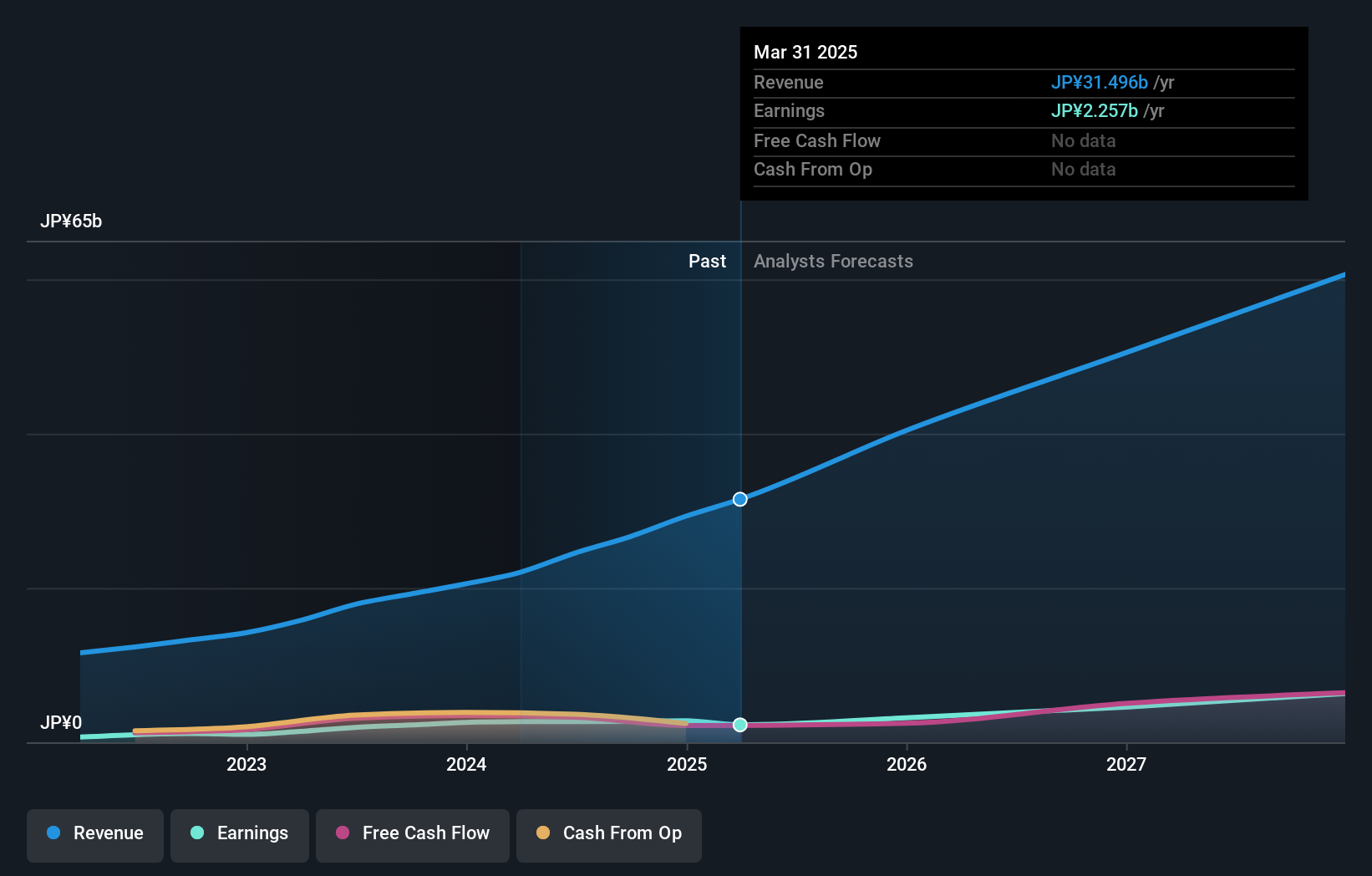

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market capitalization of ¥132.54 billion.

Operations: Medley, Inc. generates revenue primarily through its Human Resource Platform Business, contributing ¥19.45 billion, and its Medical Platform Business, which adds ¥6.52 billion. The company focuses on leveraging technology to enhance recruitment and medical services across Japan and the United States.

Medley's strategic maneuvers, including its recent acquisition of AxisRoot Holdings and the private placement involving Alfresa Corporation, underscore its aggressive expansion and partnership strategy in the healthcare tech sector. Notably, Medley has shown a robust annual revenue growth rate of 20.9% and an even more impressive earnings growth forecast at 27.3% per year, outpacing the broader Japanese market significantly. These financial indicators, coupled with a high forecasted return on equity of 22.3%, highlight Medley's strong market position and innovative edge in integrating technology with healthcare services. The company’s recent activities not only expand its operational scope but also solidify its foothold as a formidable entity in high-growth tech sectors, promising continued upward trajectories in both market influence and financial performance.

- Take a closer look at Medley's potential here in our health report.

Gain insights into Medley's past trends and performance with our Past report.

Make It Happen

- Explore the 1230 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300687

Guangzhou Sie Consulting

Operates as solution provider in the fields of industrial Internet and intelligent manufacturing, core ERP, and business operation center in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives