- South Korea

- /

- Industrials

- /

- KOSE:A000150

Asian Market Highlights 3 Stocks Possibly Trading Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the Asian markets navigate through a complex landscape of economic shifts and policy changes, investors are keenly observing opportunities that may arise from undervalued stocks. In this environment, identifying stocks trading below their intrinsic value can offer potential for growth, especially when market conditions present unique challenges and opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wellness Communications (TSE:366A) | ¥2565.00 | ¥5107.83 | 49.8% |

| Tibet Tianlu (SHSE:600326) | CN¥12.30 | CN¥24.33 | 49.4% |

| Seegene (KOSDAQ:A096530) | ₩26350.00 | ₩52046.97 | 49.4% |

| Nippon Thompson (TSE:6480) | ¥710.00 | ¥1405.56 | 49.5% |

| Nichicon (TSE:6996) | ¥1309.00 | ¥2587.20 | 49.4% |

| Mobvista (SEHK:1860) | HK$18.95 | HK$37.73 | 49.8% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.09 | CN¥20.13 | 49.9% |

| JINS HOLDINGS (TSE:3046) | ¥6220.00 | ¥12222.55 | 49.1% |

| EVE Energy (SZSE:300014) | CN¥83.45 | CN¥165.96 | 49.7% |

| EMRO (KOSDAQ:A058970) | ₩40150.00 | ₩79493.22 | 49.5% |

Let's review some notable picks from our screened stocks.

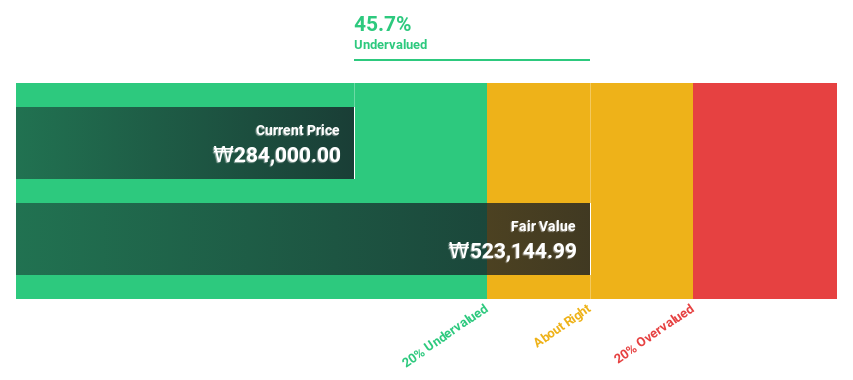

Doosan (KOSE:A000150)

Overview: Doosan Corporation, with a market cap of ₩15.86 trillion, operates in power generation facilities, industrial facilities, construction machinery, engines, and construction sectors across Korea and globally.

Operations: The company's revenue segments include Doosan Bobcat with ₩8.22 billion, Doosan Energy with ₩8.07 billion, Electronic BG with ₩1.46 billion, Doosan Fuel Cell with ₩521.82 million, and Digital Innovation BU with ₩292.74 million.

Estimated Discount To Fair Value: 10.1%

Doosan Corporation is trading at ₩975,000, below its estimated fair value of ₩1,084,535.38. Despite high share price volatility recently and slower revenue growth forecasts compared to the Korean market, Doosan's earnings are projected to grow significantly at 66.37% annually over the next three years. The stock was added to the FTSE All-World Index in September 2025 and is expected to achieve profitability within three years with a strong future return on equity forecasted at 20.9%.

- The analysis detailed in our Doosan growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Doosan.

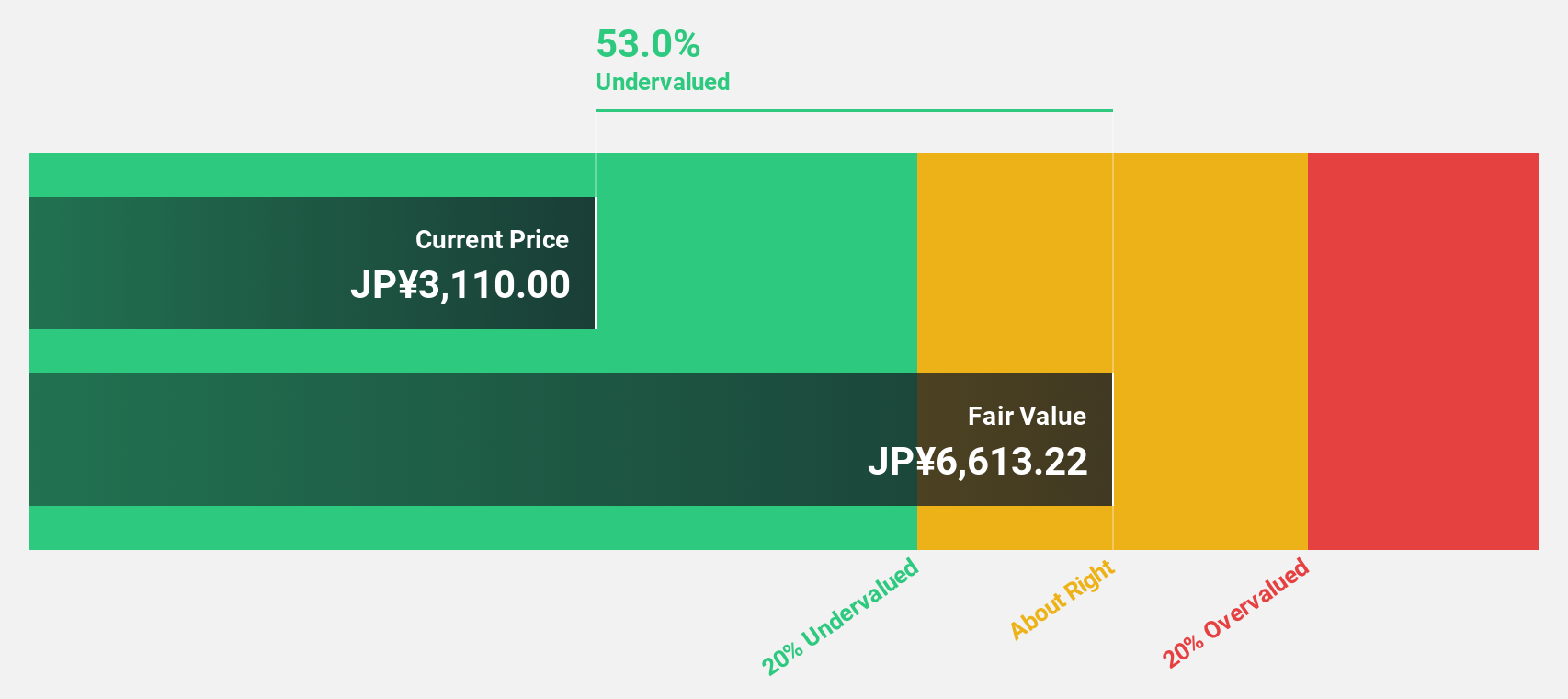

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥80.13 billion.

Operations: The company's revenue is primarily derived from its Human Resource Platform Business at ¥23.65 billion and its Medical Platform Business at ¥8.31 billion, with additional contributions from New Services amounting to ¥1.11 billion.

Estimated Discount To Fair Value: 27.3%

Medley, Inc. is trading at ¥2,555, significantly below its estimated fair value of ¥3,512.26. Despite recent share price volatility and a decline in profit margins from 11% to 4.3%, Medley's earnings are forecast to grow substantially at 25.74% annually over the next three years, outpacing the Japanese market's growth rate of 7.9%. The company has announced a share repurchase program worth ¥3 billion to enhance shareholder value amidst these dynamics.

- According our earnings growth report, there's an indication that Medley might be ready to expand.

- Get an in-depth perspective on Medley's balance sheet by reading our health report here.

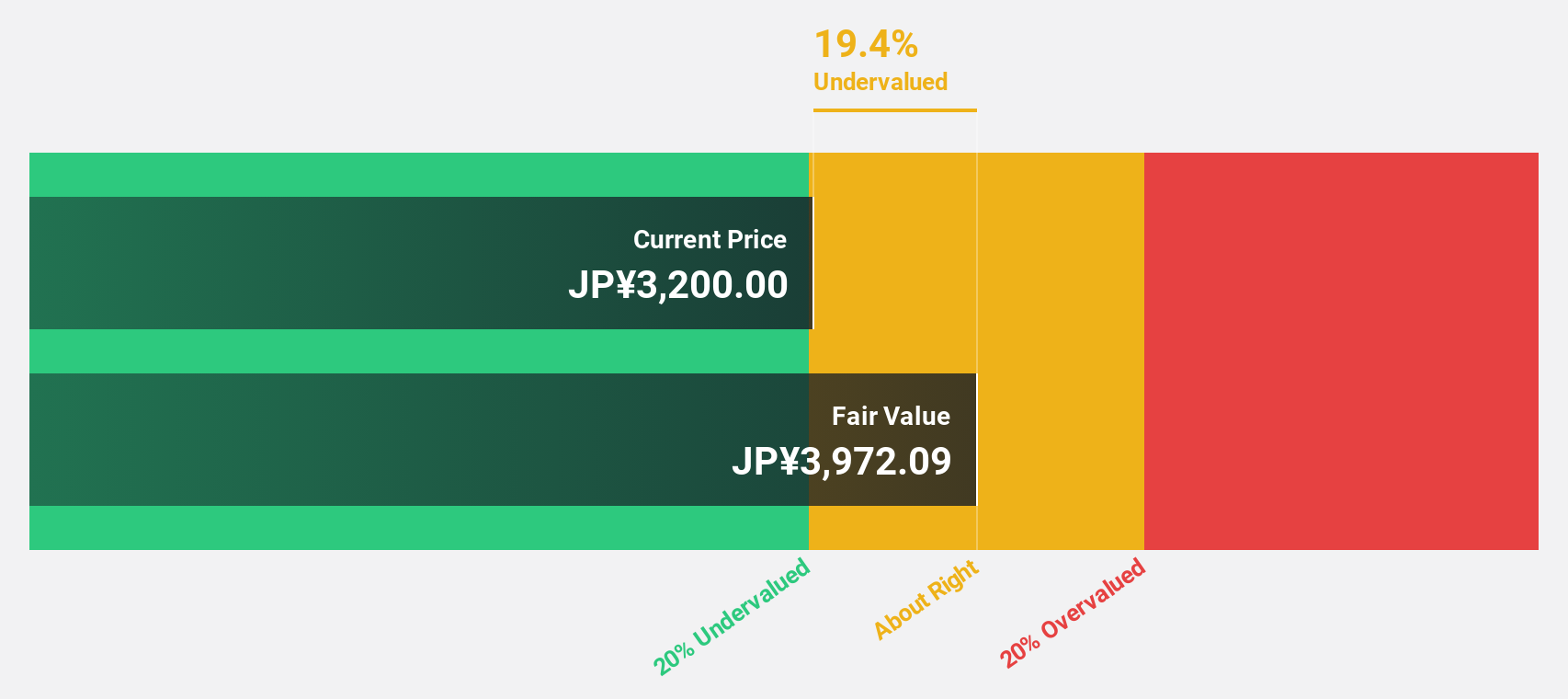

Cybozu (TSE:4776)

Overview: Cybozu, Inc. develops, sells, and operates groupware solutions in Japan with a market cap of ¥147.98 billion.

Operations: The company generates revenue from its development, sales, and operation of groupware solutions in Japan.

Estimated Discount To Fair Value: 19.4%

Cybozu, Inc. is currently trading at ¥3,200, below its estimated fair value of ¥3,972.09. The company has demonstrated strong sales growth with recent monthly sales figures showing significant year-over-year increases. Earnings are expected to grow at 17.5% annually, surpassing the Japanese market's average of 7.9%. However, revenue growth is projected to be moderate at 11.9% per year and slower than the desired high-growth threshold of 20%.

- Insights from our recent growth report point to a promising forecast for Cybozu's business outlook.

- Navigate through the intricacies of Cybozu with our comprehensive financial health report here.

Seize The Opportunity

- Get an in-depth perspective on all 287 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000150

Doosan

Engages in the power generation facilities, industrial facilities, construction machinery, engines, and construction businesses in Korea, the United States, Asia, the Middle East, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives