As global markets react to the Federal Reserve's interest rate cuts and mixed signals from economic indicators, concerns about technology stock valuations have resurfaced, particularly impacting indices like the tech-heavy Nasdaq Composite. In this environment, identifying high growth tech stocks in Asia involves considering factors such as innovation potential and resilience amidst fluctuating market sentiments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

CARsgen Therapeutics Holdings (SEHK:2171)

Simply Wall St Growth Rating: ★★★★★☆

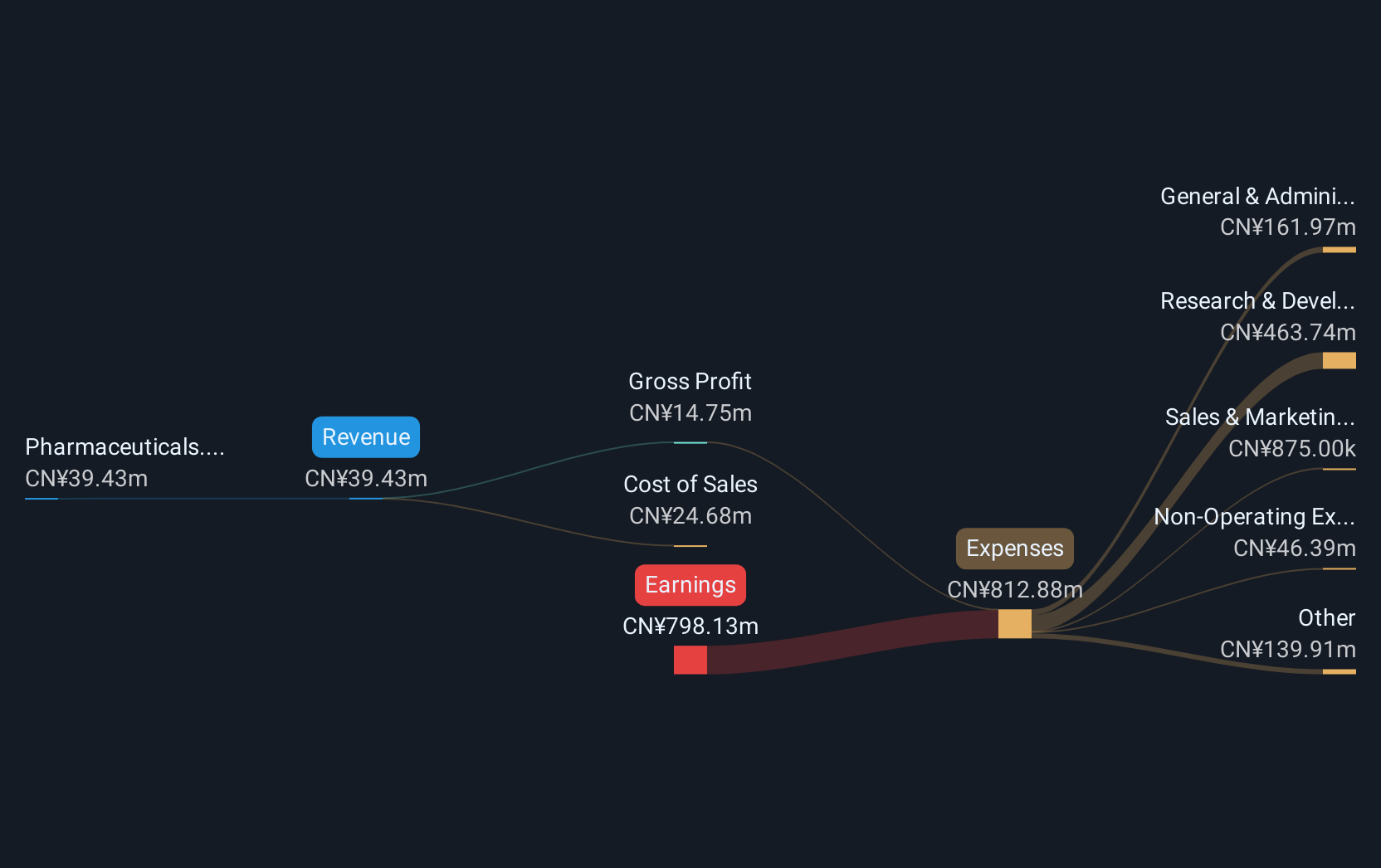

Overview: CARsgen Therapeutics Holdings Limited is an investment holding company focused on discovering, developing, and commercializing CAR-T cell therapies for hematological malignancies, solid tumors, and autoimmune diseases in China with a market cap of HK$8.08 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥84.05 million. It focuses on CAR-T cell therapies targeting hematological malignancies, solid tumors, and autoimmune diseases within the Chinese market.

CARsgen Therapeutics Holdings recently showcased its innovative strides in CAR-T therapy at the ASH Annual Congress, presenting promising preliminary results for CT0596, a BCMA-targeting allogeneic product. This development underscores CARsgen's commitment to expanding treatment options in plasma cell malignancies and autoimmune diseases. Additionally, the inclusion of zevor-cel in China's Innovative Drug Catalogue marks a significant milestone, enhancing patient access and supporting revenue growth, which has been robust at an annual rate of 98.8%. With earnings also on an upward trajectory by 95.1% annually and substantial investments in R&D shaping future capabilities, CARsgen is positioning itself as a pivotal player in biotechnological innovations for challenging medical conditions.

- Click here to discover the nuances of CARsgen Therapeutics Holdings with our detailed analytical health report.

Understand CARsgen Therapeutics Holdings' track record by examining our Past report.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. specializes in the production and distribution of electronic components and parts, with a market capitalization of CN¥18.29 billion.

Operations: Fenghua Advanced Technology generates revenue primarily from its electronic components and parts segment, totaling CN¥5.48 billion.

Guangdong Fenghua Advanced Technology has been actively refining its governance structure, as evidenced by recent amendments to its bylaws, potentially enhancing operational flexibility and strategic execution. Despite a dip in net income to CNY 228.47 million from CNY 265.5 million in the last nine months, the company's sales grew to CNY 4.1 billion, up from CNY 3.57 billion year-over-year, indicating resilience in revenue generation capabilities. With earnings expected to surge by approximately 35.9% annually and revenue forecasted to grow at a steady rate of 16% per year, Fenghua is aligning itself with robust growth trajectories within China's tech sector despite some challenges in earnings consistency due to one-off losses impacting financial outcomes.

Medical Data Vision (TSE:3902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medical Data Vision Co., Ltd. develops, produces, maintains, and sells medical information integration systems across Japan and various international markets including Europe, North America, Asia, and Oceania with a market cap of ¥39.45 billion.

Operations: The company primarily generates revenue through its Medical Data Network Business, which reported ¥6.43 billion in sales.

Amidst a transformative acquisition by Nippon Life Insurance, Medical Data Vision (MDV) is poised for significant structural changes with the deal valued at ¥40.4 billion, promising complete ownership and strategic realignment. Despite a challenging fiscal year where MDV revised its earnings forecast downward—expecting net sales of JPY 6.86 billion compared to an earlier projection of JPY 9 billion—its commitment to growth is evident in its investment in sales personnel and the enhancement of its ALPHASALUS cloud-based medical system. This strategic pivot towards improving service delivery and operational scalability could potentially stabilize MDV's performance in the competitive healthcare tech sector, aligning with an anticipated profit growth forecast of 48.17% annually and revenue growth at a steady 11.8% per year.

- Click here and access our complete health analysis report to understand the dynamics of Medical Data Vision.

Evaluate Medical Data Vision's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 190 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2171

CARsgen Therapeutics Holdings

An investment holding company, engages in discovering, developing, and commercializing chimeric antigen receptor T (CAR-T) cell therapies for the treatment of hematological malignancies, solid tumors, and autoimmune diseases in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)