- Japan

- /

- Medical Equipment

- /

- TSE:197A

One TAUNS Laboratories,Inc. (TSE:197A) Analyst Just Cut Their EPS Forecasts

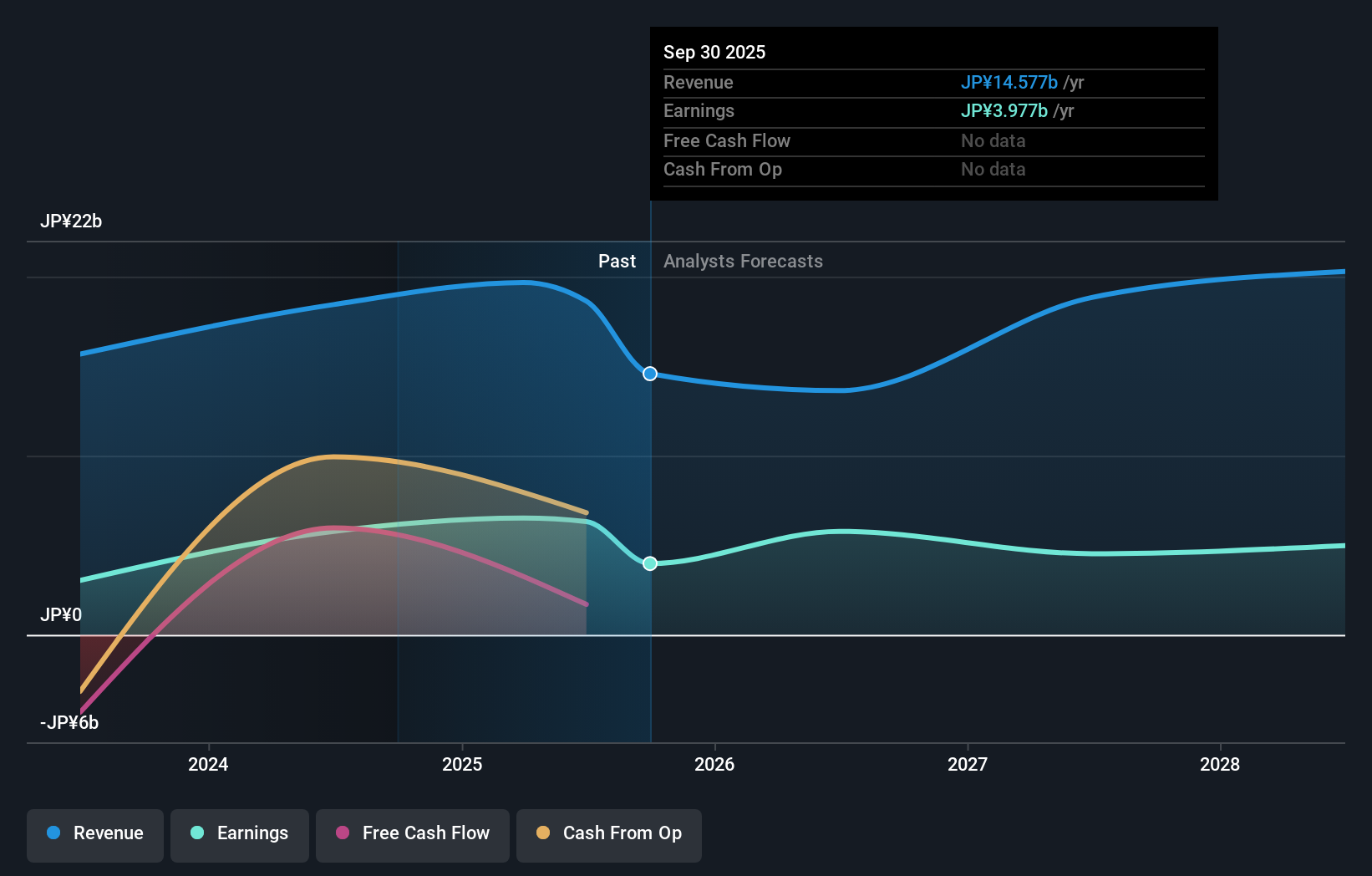

Market forces rained on the parade of TAUNS Laboratories,Inc. (TSE:197A) shareholders today, when the covering analyst downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

Following the latest downgrade, the sole analyst covering TAUNS LaboratoriesInc provided consensus estimates of JP¥14b revenue in 2026, which would reflect a small 6.5% decline on its sales over the past 12 months. Statutory earnings per share are presumed to soar 45% to JP¥55.96. Previously, the analyst had been modelling revenues of JP¥16b and earnings per share (EPS) of JP¥65.49 in 2026. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a considerable drop in earnings per share numbers as well.

View our latest analysis for TAUNS LaboratoriesInc

It'll come as no surprise then, to learn that the analyst has cut their price target 7.3% to JP¥510.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing that stands out from these estimates is that shrinking revenues are expected to moderate over the period ending 2026 compared to the historical decline of 23% per annum over the past year. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 5.9% annually. So while a broad number of companies are forecast to grow, unfortunately TAUNS LaboratoriesInc is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that TAUNS LaboratoriesInc's revenues are expected to grow slower than the wider market. After such a stark change in sentiment from the analyst, we'd understand if readers now felt a bit wary of TAUNS LaboratoriesInc.

Worse, TAUNS LaboratoriesInc is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. See why we're concerned about TAUNS LaboratoriesInc's balance sheet by visiting our risks dashboard for free on our platform here.

We also provide an overview of the TAUNS LaboratoriesInc Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Valuation is complex, but we're here to simplify it.

Discover if TAUNS LaboratoriesInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:197A

TAUNS LaboratoriesInc

Engages in the development, manufacture, export/import, and sale of in vitro diagnostics and research reagents, and its intermediates in Japan and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026