How Domestic Analyst Downgrades at Nichirei (TSE:2871) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, leading domestic analysts downgraded Nichirei to a middle-tier rating, shifting their outlook for the company's prospects.

- This adjustment in analyst sentiment is a meaningful development, as coverage changes from major brokerages can influence broader market perception.

- We’ll explore how this change in domestic analyst sentiment shapes Nichirei’s investment narrative and outlook going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Nichirei's Investment Narrative?

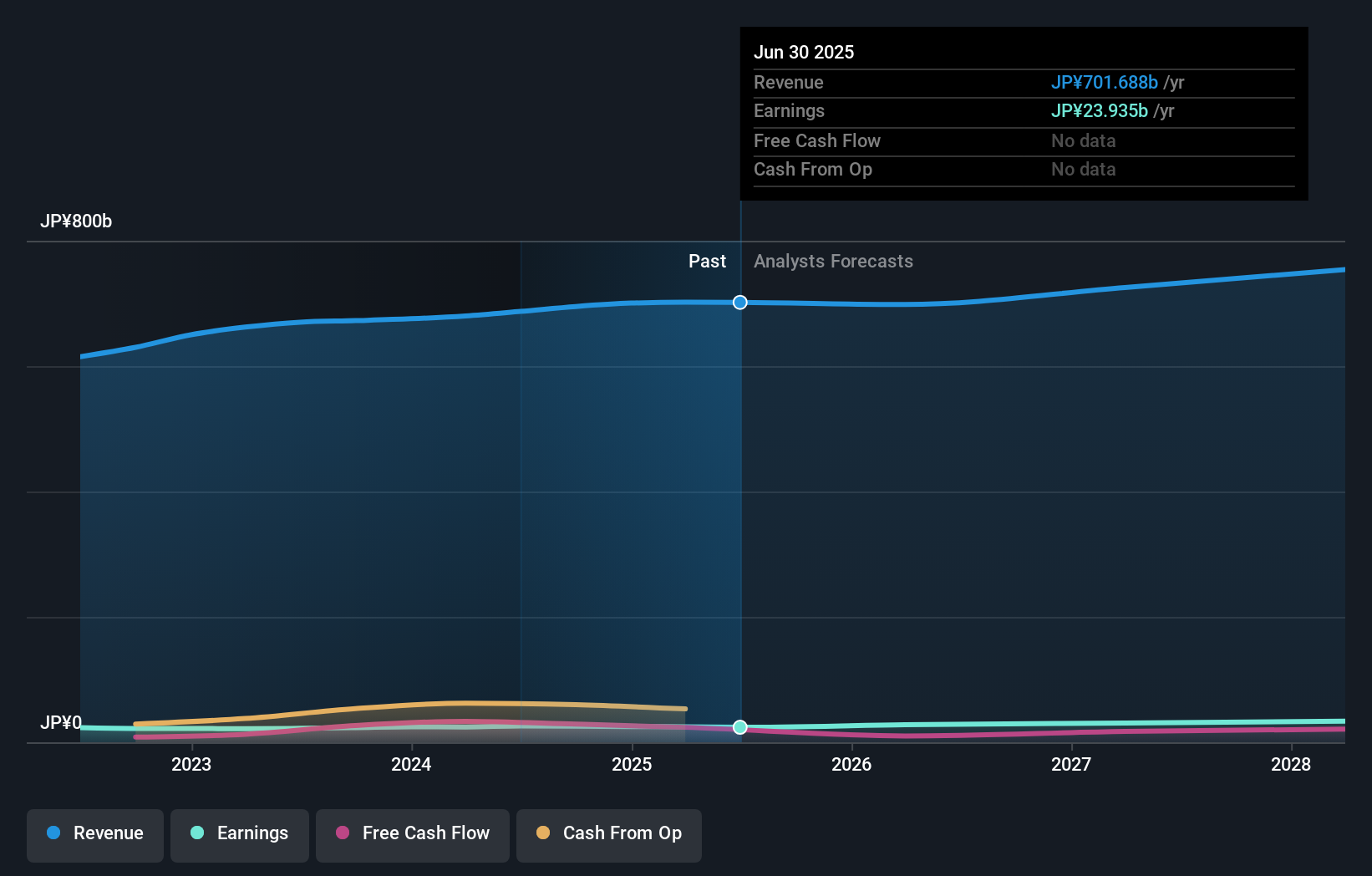

To own Nichirei stock, you need to believe in the company’s ability to maintain steady profit growth, supported by its established position in the Japanese food sector and a history of prudent management decisions, such as progressive dividend policies and periodic share buybacks. The latest analyst downgrade, which shifted Nichirei to a middle-tier rating and lowered its target price, has the potential to temper near-term optimism, though the recent muted price reaction suggests the market may have already factored in many of these developments. For now, key catalysts remain centered around the upcoming Q1 results and management’s commitment to a sustainable dividend, despite guidance for a lower payout in the next fiscal year. Still, the analyst revision does put a sharper focus on risks, particularly around sustained margin pressure and lagging returns versus peers, which could influence both sentiment and capital allocation as results come in. But watch out: retreating margins and a lower dividend may test shareholder patience more than before. Contrasting the growth narrative, declining margins could pose a real challenge to the current outlook.

Nichirei's shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Nichirei - why the stock might be worth as much as 27% more than the current price!

Build Your Own Nichirei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nichirei research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nichirei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nichirei's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichirei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2871

Nichirei

Through its subsidiaries, engages in the processed food, logistics, marine products, meat and poultry products, bioscience, and real estate businesses in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives