It's A Story Of Risk Vs Reward With Coca-Cola Bottlers Japan Holdings Inc. (TSE:2579)

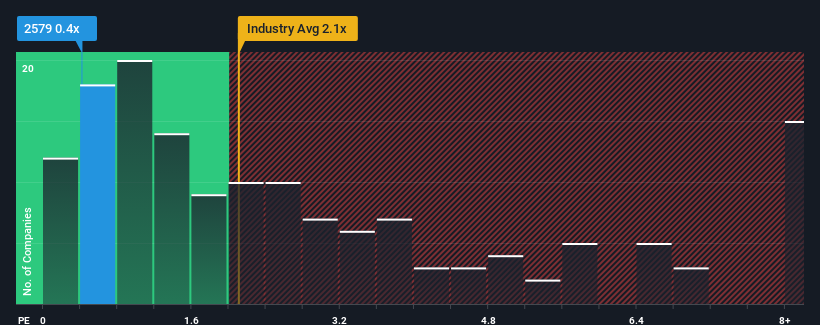

When close to half the companies operating in the Beverage industry in Japan have price-to-sales ratios (or "P/S") above 1x, you may consider Coca-Cola Bottlers Japan Holdings Inc. (TSE:2579) as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Coca-Cola Bottlers Japan Holdings

How Coca-Cola Bottlers Japan Holdings Has Been Performing

Coca-Cola Bottlers Japan Holdings could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coca-Cola Bottlers Japan Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

Coca-Cola Bottlers Japan Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.8% last year. Revenue has also lifted 12% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 0.8% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 2.0% per annum, which is not materially different.

In light of this, it's peculiar that Coca-Cola Bottlers Japan Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Coca-Cola Bottlers Japan Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Coca-Cola Bottlers Japan Holdings you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2579

Coca-Cola Bottlers Japan Holdings

Engages in the purchases, sales, bottling, packaging, distribution and marketing of carbonated beverages, coffee beverages, tea-based beverages, mineral water, and other soft drinks in Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives