Investors Appear Satisfied With Coca-Cola Bottlers Japan Holdings Inc.'s (TSE:2579) Prospects As Shares Rocket 27%

Coca-Cola Bottlers Japan Holdings Inc. (TSE:2579) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

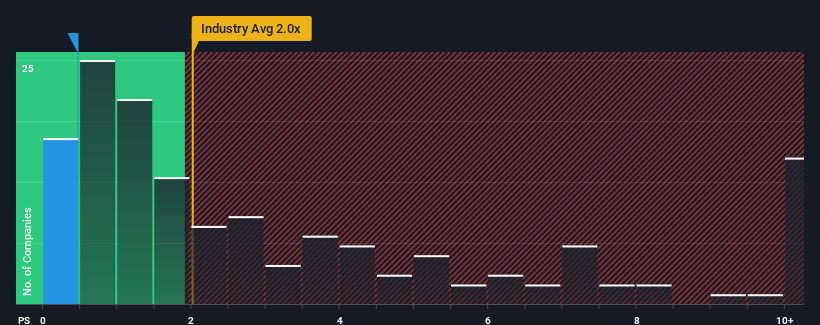

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Coca-Cola Bottlers Japan Holdings' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Beverage industry in Japan is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Coca-Cola Bottlers Japan Holdings

What Does Coca-Cola Bottlers Japan Holdings' P/S Mean For Shareholders?

Coca-Cola Bottlers Japan Holdings' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Coca-Cola Bottlers Japan Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Coca-Cola Bottlers Japan Holdings will help you uncover what's on the horizon.How Is Coca-Cola Bottlers Japan Holdings' Revenue Growth Trending?

Coca-Cola Bottlers Japan Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 7.6% gain to the company's revenues. The latest three year period has also seen a 9.7% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 1.5% per annum over the next three years. With the industry predicted to deliver 2.9% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why Coca-Cola Bottlers Japan Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Coca-Cola Bottlers Japan Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Coca-Cola Bottlers Japan Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Coca-Cola Bottlers Japan Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Coca-Cola Bottlers Japan Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2579

Coca-Cola Bottlers Japan Holdings

Engages in the purchase, bottling, packaging, distribution, marketing, and sale of carbonated, coffee, tea-based, mineral water, alcohol, and other soft drinks in Japan.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives