As global markets navigate a landscape marked by mixed performances and evolving trade dynamics, small- and mid-cap indexes have notably emerged as leaders, posting gains for the fifth consecutive week. This environment of cautious optimism, underscored by ongoing trade negotiations and steady interest rates from key central banks, presents a unique opportunity to explore stocks that may not yet be on every investor's radar. In such conditions, finding promising stocks often involves identifying companies with solid fundamentals that can thrive amid economic uncertainties and capitalize on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥8.37 billion.

Operations: Guangzhou Ruoyuchen Technology Co., Ltd. generates revenue through its brand integrated marketing solutions in China. The company's financial performance is highlighted by a market capitalization of CN¥8.37 billion, reflecting its standing in the industry.

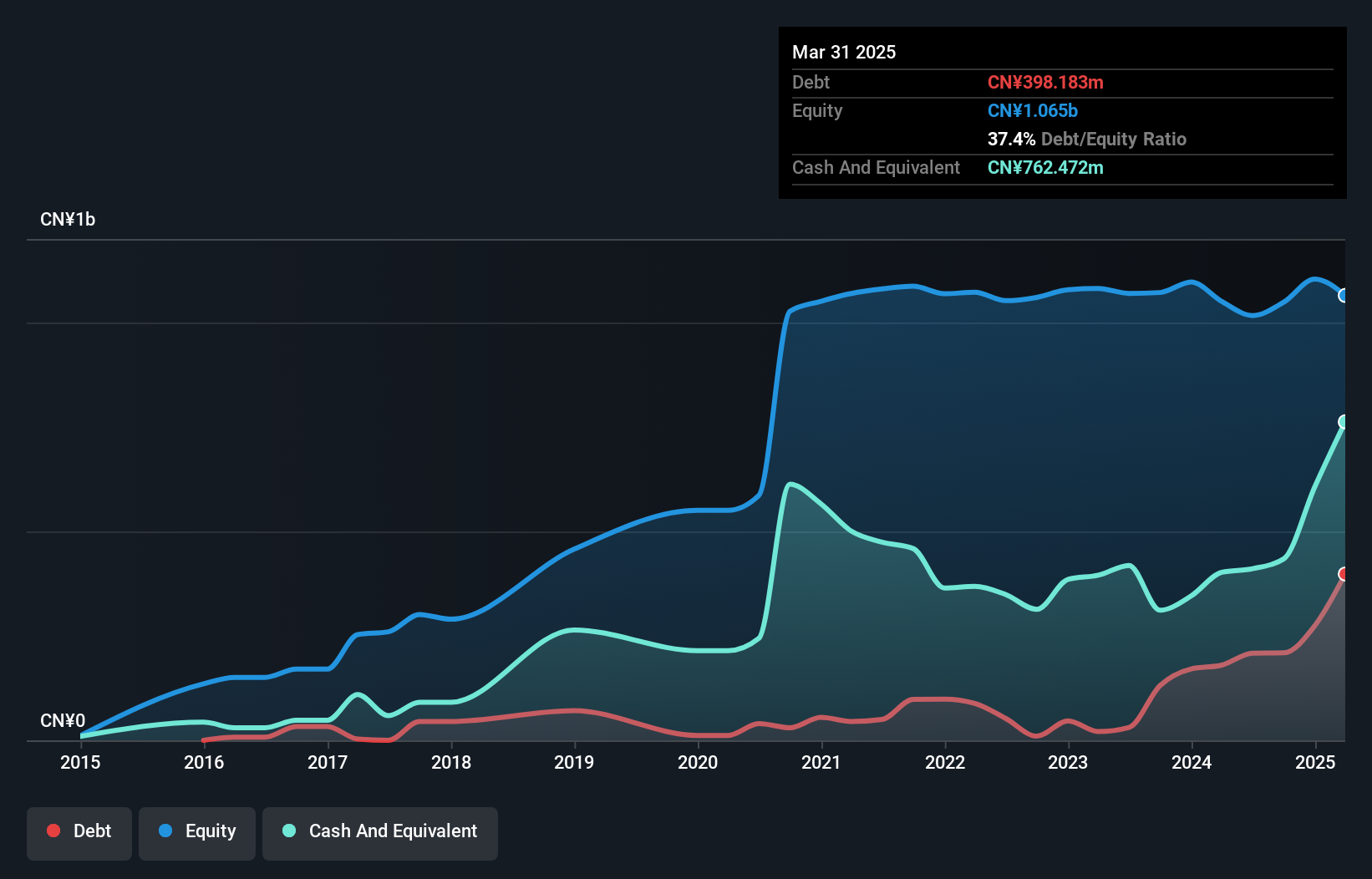

Guangzhou Ruoyuchen Technology, a smaller player in the tech scene, has shown impressive earnings growth of 94.6% over the past year, far outpacing its industry peers at 5.5%. The company trades at a value that's 12.3% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Despite an increase in debt-to-equity from 2.1 to 25.7 over five years, it maintains more cash than total debt and covers interest payments comfortably. Recent developments include a share buyback program worth CNY 200 million and a notable first-quarter revenue jump to CNY 573.81 million from CNY 372.23 million last year.

Takara Holdings (TSE:2531)

Simply Wall St Value Rating: ★★★★★★

Overview: Takara Holdings Inc. is a global company that, along with its subsidiaries, focuses on the production and sale of alcoholic beverages, seasonings, and raw alcohol, with a market capitalization of ¥243.19 billion.

Operations: Takara Holdings generates revenue primarily from the sale of alcoholic beverages, seasonings, and raw alcohol. The company's market capitalization stands at ¥243.19 billion.

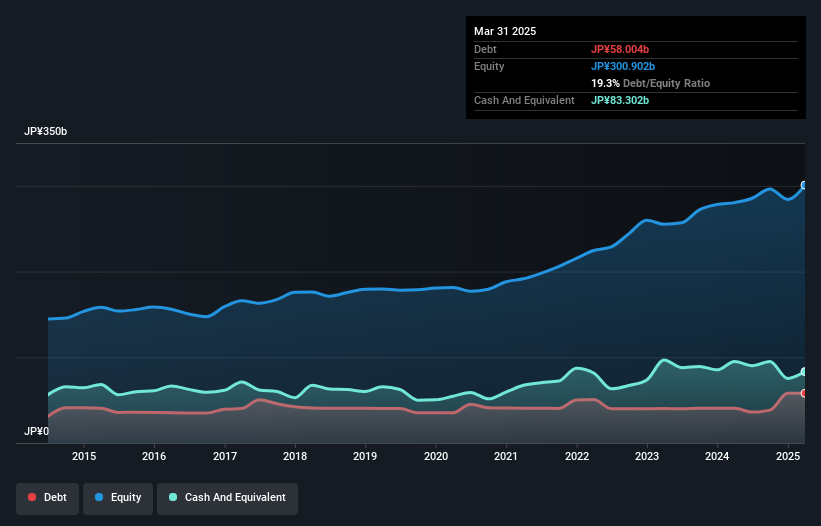

Takara Holdings, a modestly-sized player in the beverage industry, has shown resilience with its earnings growth of 0.2% over the past year, surpassing the industry's -6.7%. The company boasts a favorable price-to-earnings ratio of 15.2x, notably undercutting the industry average of 28.2x, suggesting potential value for investors. Takara's financial health is underscored by its reduced debt-to-equity ratio from 19.4% to 19.3% over five years and a solid cash position exceeding total debt levels. Recently announced share buyback plans aim to enhance shareholder returns and adapt to market conditions with ¥3 billion allocated for repurchasing up to three million shares by June's end.

- Click here and access our complete health analysis report to understand the dynamics of Takara Holdings.

Explore historical data to track Takara Holdings' performance over time in our Past section.

Elite Advanced Laser (TWSE:3450)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elite Advanced Laser Corporation offers electronic manufacturing services in Taiwan with a market capitalization of NT$31.25 billion.

Operations: The company generates revenue through its electronic manufacturing services in Taiwan. With a market capitalization of NT$31.25 billion, it operates within the electronics sector, focusing on providing specialized manufacturing solutions.

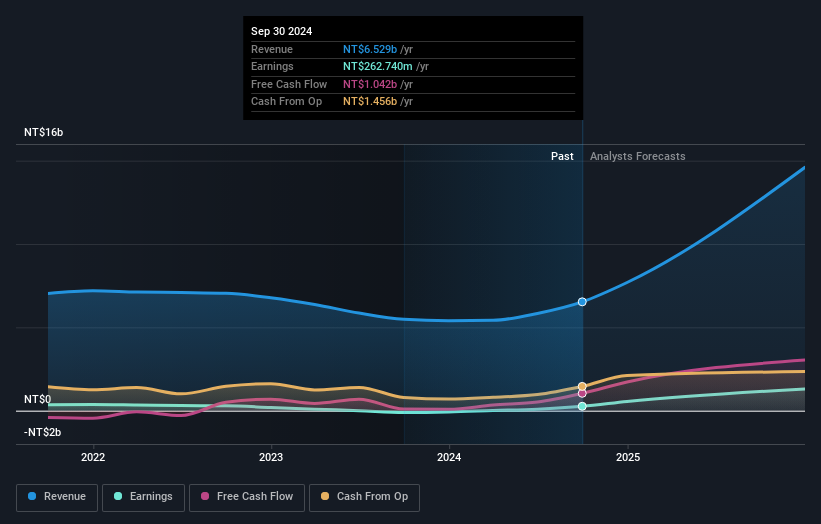

Elite Advanced Laser's recent performance showcases its dynamic growth, with earnings skyrocketing by 10,084% over the past year, outpacing the semiconductor industry's 13.5%. The company reported a net income of TWD 340.6 million for Q1 2025, a substantial leap from TWD 44.44 million in the previous year. Trading at 74% below its estimated fair value suggests potential undervaluation in the market. Despite an increased debt-to-equity ratio from 3.7 to 7.9 over five years, Elite boasts more cash than total debt and maintains positive free cash flow, indicating robust financial health amidst share price volatility.

- Navigate through the intricacies of Elite Advanced Laser with our comprehensive health report here.

Gain insights into Elite Advanced Laser's past trends and performance with our Past report.

Next Steps

- Get an in-depth perspective on all 3210 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2531

Takara Holdings

Primarily manufactures and sells alcoholic beverages, seasonings, and raw alcohol worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives