The past year for Yakult HonshaLtd (TSE:2267) investors has not been profitable

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Yakult Honsha Co.,Ltd. (TSE:2267) share price slid 40% over twelve months. That's disappointing when you consider the market returned 30%. On the bright side, the stock is actually up 15% in the last three years.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Yakult HonshaLtd

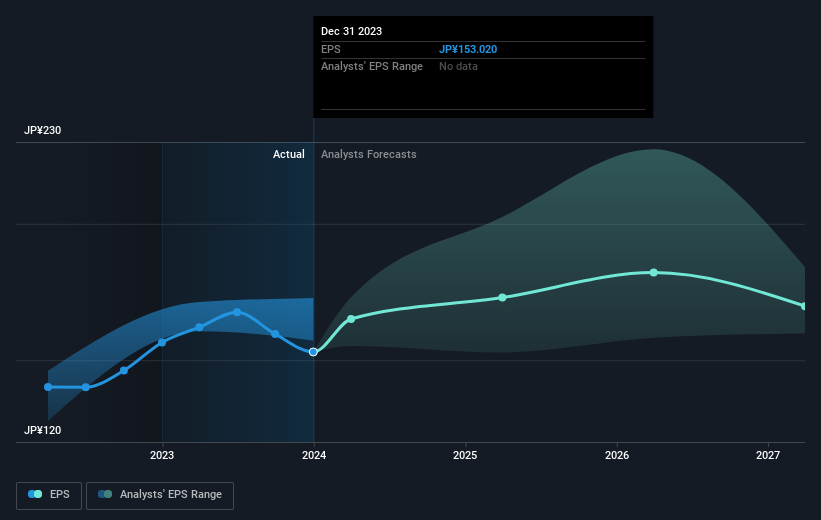

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Yakult HonshaLtd reported an EPS drop of 2.2% for the last year. This reduction in EPS is not as bad as the 40% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Yakult HonshaLtd's key metrics by checking this interactive graph of Yakult HonshaLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 30% in the last year, Yakult HonshaLtd shareholders lost 39% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Yakult HonshaLtd scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2267

Yakult HonshaLtd

Manufactures and sells food and beverage products in Japan, the Americas, Asia, Oceania, and Europe.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives