As global markets experience broad-based gains with U.S. indexes nearing record highs, investors are navigating a landscape marked by geopolitical tensions and economic uncertainties. Amid this environment, identifying stocks trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies. In such conditions, a good stock is often characterized by strong fundamentals and resilience in the face of broader market fluctuations, providing a potential cushion against volatility while offering room for growth as the market stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.27 | 49.9% |

| Accent Group (ASX:AX1) | A$2.47 | A$4.94 | 50% |

| EnomotoLtd (TSE:6928) | ¥1472.00 | ¥2935.42 | 49.9% |

| Infomart (TSE:2492) | ¥287.00 | ¥570.08 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.25 | HK$54.43 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$15.72 | A$31.34 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Audinate Group (ASX:AD8) | A$8.83 | A$17.54 | 49.7% |

Let's uncover some gems from our specialized screener.

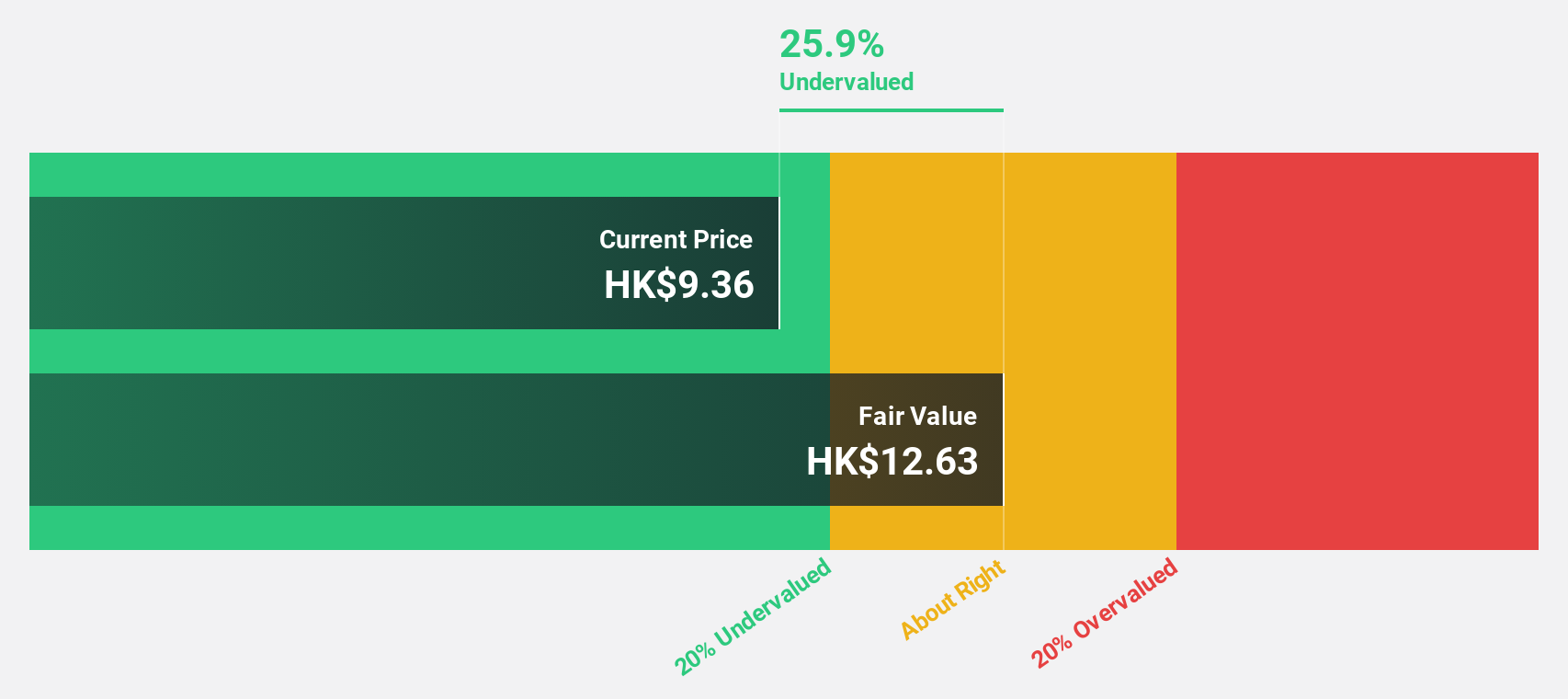

Meituan (SEHK:3690)

Overview: Meituan is a technology retail company in the People's Republic of China with a market cap of approximately HK$1.02 trillion.

Operations: The company generates revenue through two main segments: Core Local Commerce, which contributes CN¥228.13 billion, and New Initiatives, accounting for CN¥77.56 billion.

Estimated Discount To Fair Value: 41.1%

Meituan's recent earnings report shows a substantial increase in net income to CNY 12.86 billion from CNY 3.59 billion a year ago, highlighting strong cash flow generation. The stock is trading at HK$168.7, significantly below its estimated fair value of HK$286.35, suggesting it may be undervalued based on discounted cash flow analysis. Despite insider selling and lower forecasted return on equity, expected annual profit growth remains robust at 28.6%, outpacing the Hong Kong market average.

- In light of our recent growth report, it seems possible that Meituan's financial performance will exceed current levels.

- Dive into the specifics of Meituan here with our thorough financial health report.

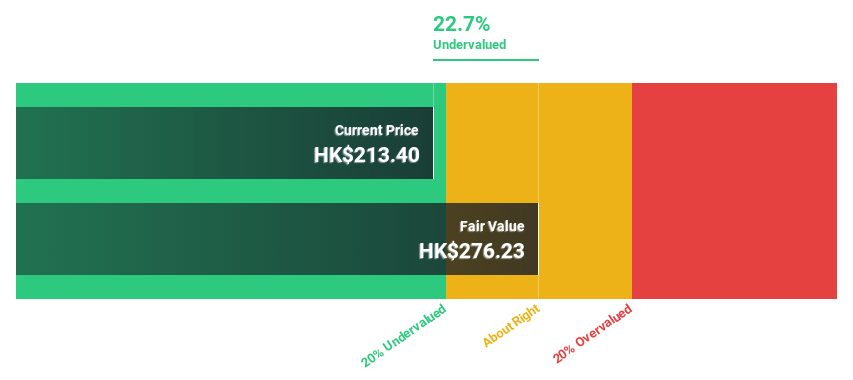

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd., along with its subsidiaries, offers investment banking services both in Mainland China and internationally, with a market cap of HK$200.19 billion.

Operations: CSC Financial's revenue segments include investment banking services provided both domestically in China and internationally.

Estimated Discount To Fair Value: 24.5%

CSC Financial's stock, trading at HK$10.44, is undervalued relative to its estimated fair value of HK$13.82, according to discounted cash flow analysis. Despite revenue and net income declines in 2024, the company anticipates robust annual earnings growth of 38.6%, surpassing Hong Kong market averages. However, recent board changes and share price volatility may pose risks. The interim dividend announcement reflects stable cash flow management amidst these challenges.

- Our growth report here indicates CSC Financial may be poised for an improving outlook.

- Take a closer look at CSC Financial's balance sheet health here in our report.

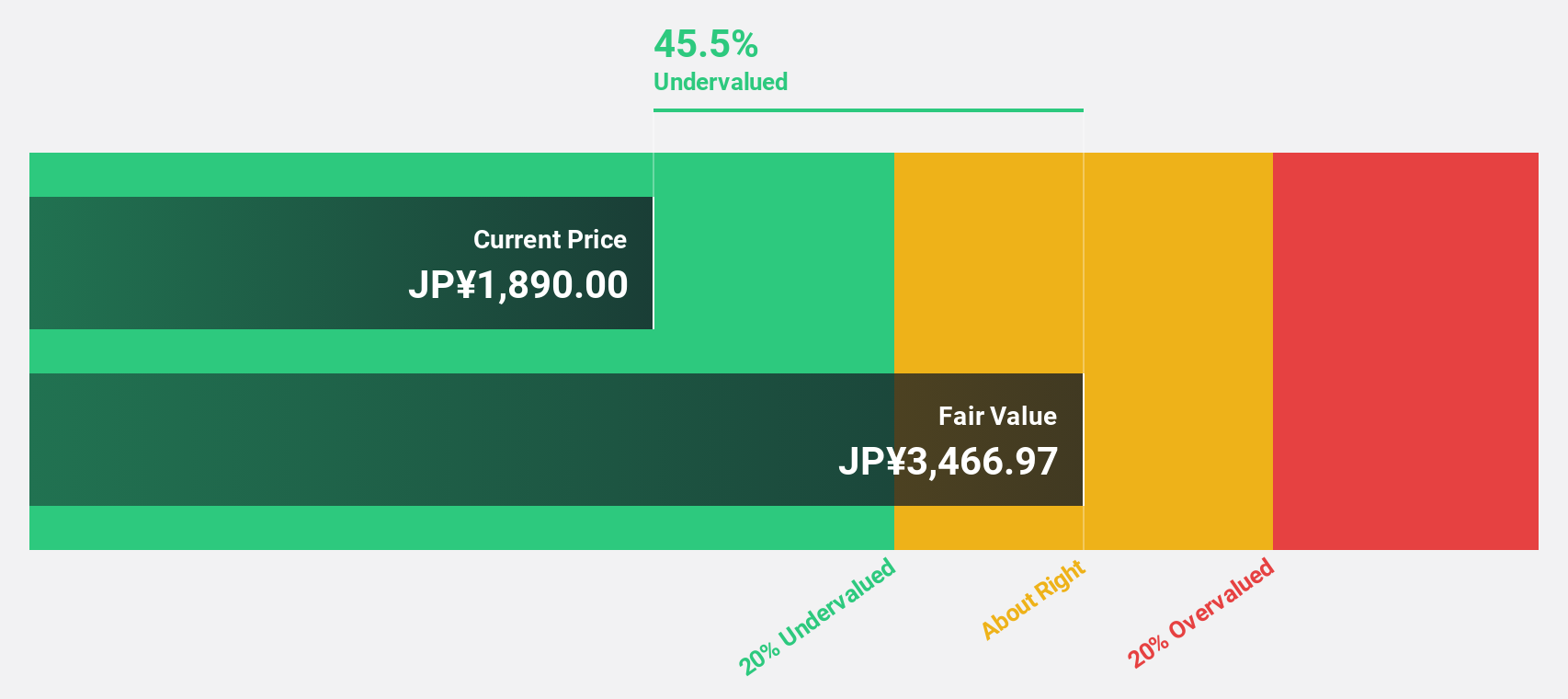

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market cap of ¥302.42 billion.

Operations: The company's revenue is primarily derived from its segments: Shukrei at ¥27.89 billion, KCC Co., Ltd. at ¥19.67 billion, Kotobuki Confectionery/Tajima Kotobuki at ¥13.87 billion, Kujukushima at ¥6.75 billion, and Sales Subsidiaries at ¥7.15 billion.

Estimated Discount To Fair Value: 41.9%

Kotobuki Spirits is trading at ¥1,943, significantly below its estimated fair value of ¥3,595.54 based on discounted cash flow analysis. Analysts project the stock price to rise by 30.7%, with earnings forecasted to grow 13.1% annually—outpacing the Japanese market's average growth rate of 7.9%. The company expects net sales of ¥70 billion and an operating profit of ¥17.53 billion for fiscal year ending March 2025, reflecting strong financial performance prospects despite moderate earnings growth expectations.

- Our expertly prepared growth report on Kotobuki Spirits implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Kotobuki Spirits.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 906 more companies for you to explore.Click here to unveil our expertly curated list of 909 Undervalued Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kotobuki Spirits might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2222

Flawless balance sheet with solid track record.