- Japan

- /

- Hospitality

- /

- TSE:6249

Spotlight On WELLNEO SUGAR And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets experience a surge in optimism driven by hopes for softer tariffs and advancements in artificial intelligence, major indices like the S&P 500 are reaching record highs. In this buoyant environment, dividend stocks such as WELLNEO SUGAR offer investors potential stability and income, making them an attractive option amid fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

WELLNEO SUGAR (TSE:2117)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WELLNEO SUGAR Co., Ltd. manufactures and sells sugar and other food products primarily in Japan, with a market cap of ¥72.80 billion.

Operations: WELLNEO SUGAR Co., Ltd.'s revenue is primarily derived from its Sugar segment, generating ¥86.61 billion, and its Food & Wellness segment, contributing ¥8.13 billion.

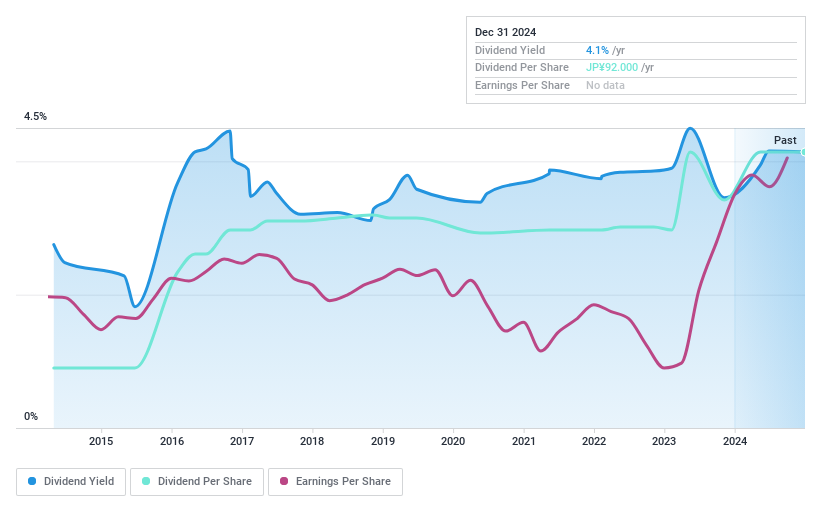

Dividend Yield: 4.1%

WELLNEO SUGAR's dividend yield stands at 4.14%, placing it in the top 25% of dividend payers in Japan, yet its history shows volatility with drops over 20%. Despite this, dividends are well-covered by earnings (56.7%) and cash flows (36.3%). Recent guidance indicates a year-end dividend increase to JPY 56 per share from JPY 46 last year, reflecting potential growth amid an unstable track record.

- Click here and access our complete dividend analysis report to understand the dynamics of WELLNEO SUGAR.

- According our valuation report, there's an indication that WELLNEO SUGAR's share price might be on the cheaper side.

Kurabo Industries (TSE:3106)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurabo Industries Ltd. operates in textile, chemical, technology, food and service, and real estate sectors both in Japan and internationally with a market cap of ¥98.30 billion.

Operations: Kurabo Industries Ltd. generates revenue from several segments, including ¥50.12 billion from the Textile Business, ¥64.67 billion from Chemical Products, ¥22.39 billion from Environmental Mechatronics Business, ¥9.95 billion from Food and Services, and ¥4.20 billion from Real Estate.

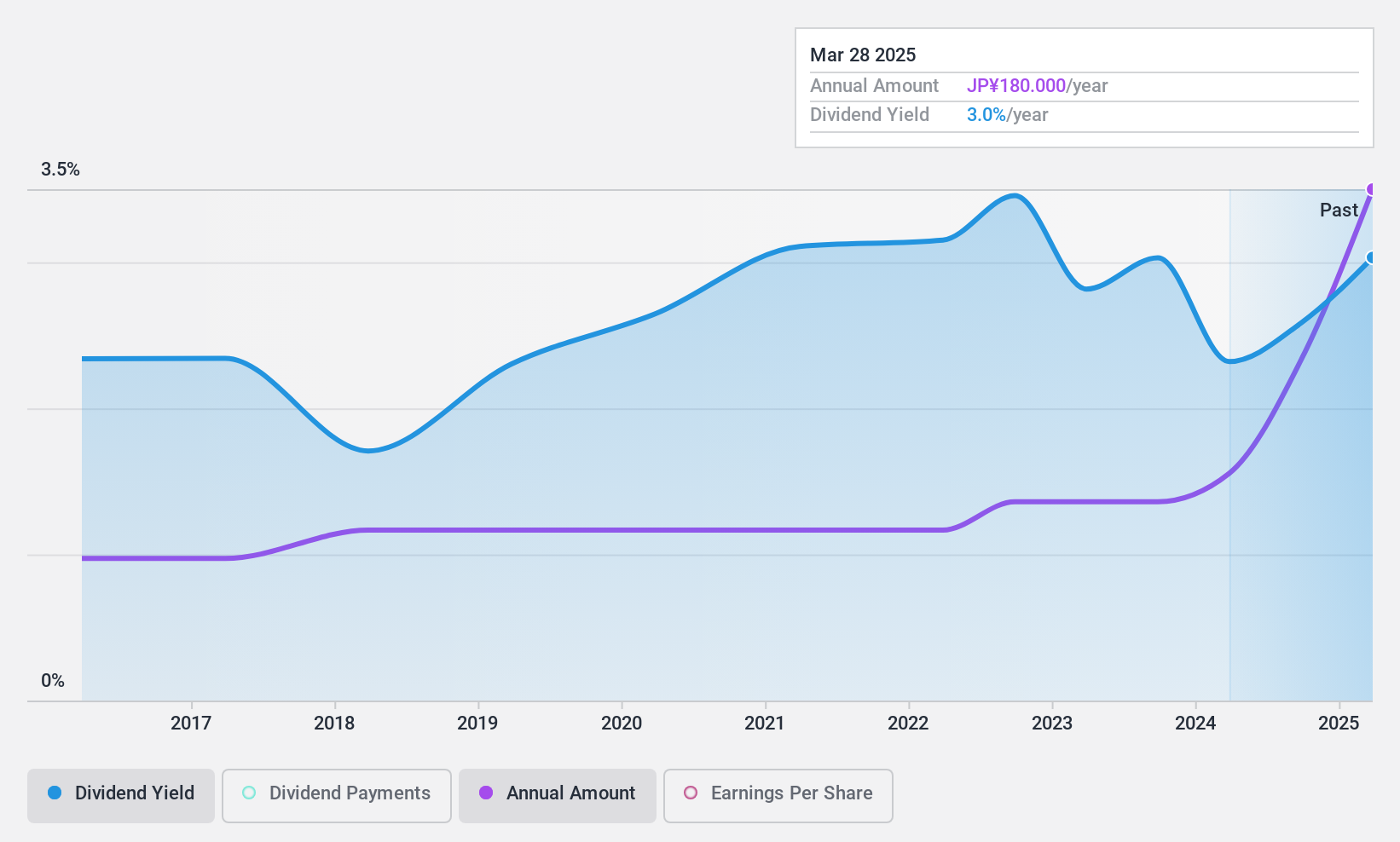

Dividend Yield: 3.2%

Kurabo Industries offers a stable dividend, covered by earnings (28.3% payout ratio) and cash flows (44.4% cash payout ratio), with a decade of reliable growth. Recent dividend increases to ¥90 per share for fiscal 2025 highlight its commitment to shareholder returns, although the yield of 3.21% is below Japan's top tier. The company completed a buyback of shares worth ¥2.27 billion, enhancing capital efficiency and supporting shareholder value despite recent share price volatility.

- Navigate through the intricacies of Kurabo Industries with our comprehensive dividend report here.

- Our valuation report unveils the possibility Kurabo Industries' shares may be trading at a discount.

Gamecard-Joyco HoldingsInc (TSE:6249)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gamecard-Joyco Holdings Inc. operates in the gaming business with a market capitalization of ¥36.86 billion.

Operations: Gamecard-Joyco Holdings Inc. generates its revenue primarily from its gaming operations.

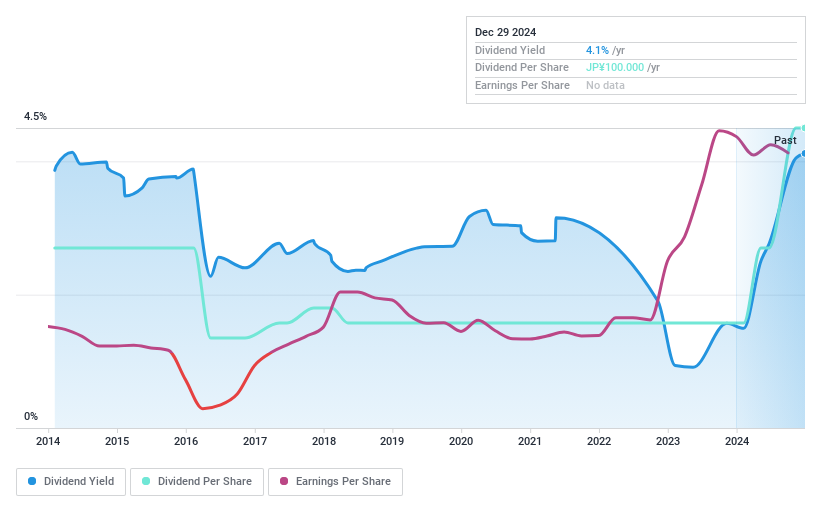

Dividend Yield: 4%

Gamecard-Joyco Holdings' dividend yield is in the top 25% of the JP market, but its payments have been volatile over the past decade. Despite this, dividends are well covered by earnings and cash flows, with a low payout ratio of 16.4%. The company recently completed a share buyback worth ¥1.32 billion to enhance shareholder returns and capital efficiency, although its share price has been highly volatile recently.

- Click here to discover the nuances of Gamecard-Joyco HoldingsInc with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Gamecard-Joyco HoldingsInc's share price might be too pessimistic.

Next Steps

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6249

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives