As global markets continue to reach record highs, driven by domestic policy shifts and geopolitical developments, investors are increasingly seeking stable income sources amidst the dynamic economic landscape. In this environment, dividend stocks like Ping An Bank offer potential for consistent returns, making them an attractive option for those looking to balance growth with income stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.71% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ping An Bank (SZSE:000001)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ping An Bank Co., Ltd. offers commercial banking products and services to individual, corporate, governmental, institutional, and small business clients in China and internationally, with a market cap of approximately CN¥220.84 billion.

Operations: Ping An Bank Co., Ltd.'s revenue is derived from providing a range of banking products and services to individual, corporate, governmental, institutional, and small business clients both domestically in China and internationally.

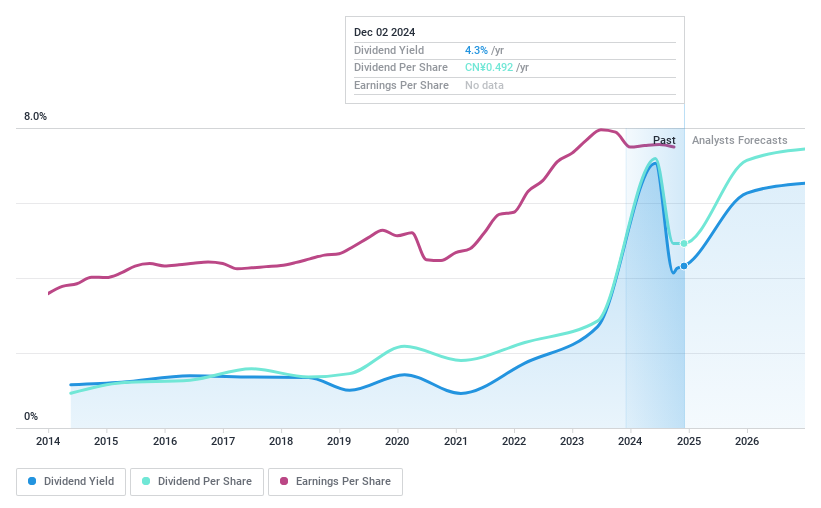

Dividend Yield: 4.3%

Ping An Bank's dividend yield of 4.32% ranks in the top 25% in China, and its dividends are well-covered by earnings with a current payout ratio of 42.9%, forecasted to improve to 29.7%. Despite trading at a significant discount to estimated fair value, the bank's dividend history is volatile, with past fluctuations over 20%. Recent earnings showed a slight decline in net interest income but stable net income year-over-year.

- Get an in-depth perspective on Ping An Bank's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ping An Bank is priced lower than what may be justified by its financials.

Nisshin Seifun Group (TSE:2002)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nisshin Seifun Group Inc. operates through its subsidiaries in various sectors including flour milling, processed foods, health foods, biotechnology, engineering, prepared dishes, and mesh cloth both in Japan and internationally with a market cap of approximately ¥543.47 billion.

Operations: Nisshin Seifun Group Inc.'s revenue is primarily derived from its Milling Business at ¥478.66 billion, followed by the Food Business at ¥205.57 billion, and Prepared Dishes and Other Prepared Foods at ¥158.31 billion.

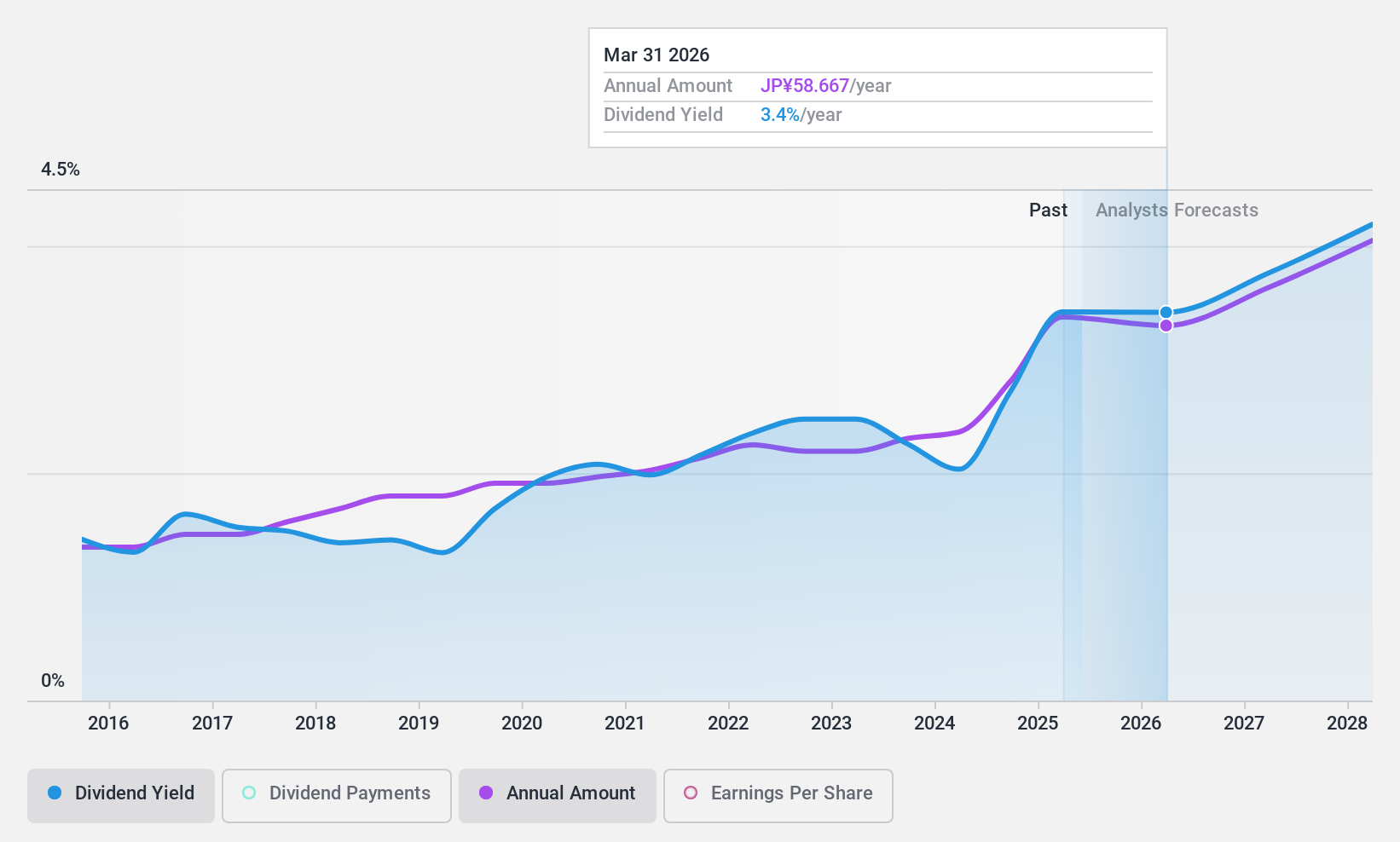

Dividend Yield: 3.3%

Nisshin Seifun Group's dividend yield of 3.25% is below the top tier in Japan, yet it maintains a stable and reliable dividend history over the past decade. Recent announcements indicate an increase in dividends, with JPY 25.00 per share for Q2 and JPY 30.00 expected for the fiscal year ending March 2025. The payout ratios suggest sustainability, with earnings coverage at 43.3% and cash flow coverage at 50.4%, supporting continued dividend payments amidst forecasted earnings growth of 4.44%.

- Dive into the specifics of Nisshin Seifun Group here with our thorough dividend report.

- Our valuation report unveils the possibility Nisshin Seifun Group's shares may be trading at a discount.

Yodogawa Steel Works (TSE:5451)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yodogawa Steel Works, Ltd. is a Japanese company that manufactures and sells steel products for industrial and consumer applications, with a market cap of ¥149.44 billion.

Operations: Yodogawa Steel Works, Ltd. generates revenue through the production and sale of steel products tailored for both industrial and consumer markets in Japan.

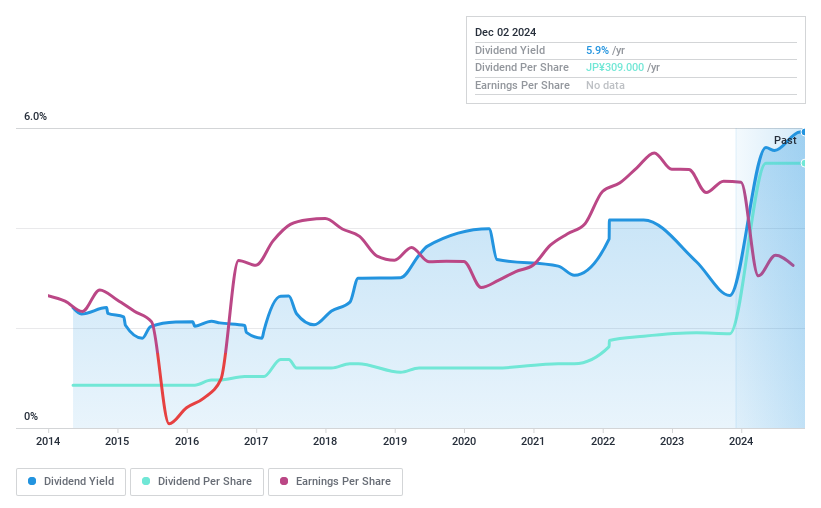

Dividend Yield: 5.9%

Yodogawa Steel Works offers a dividend yield of 5.92%, placing it among the top 25% of dividend payers in Japan. However, its dividends are not well supported by free cash flow, with a high cash payout ratio of 93.8%. The company's profit margins have decreased from last year, and its dividend history over the past decade has been volatile and unreliable. Despite this, dividends have grown over ten years but remain unsustainably covered by earnings.

- Click to explore a detailed breakdown of our findings in Yodogawa Steel Works' dividend report.

- Our valuation report unveils the possibility Yodogawa Steel Works' shares may be trading at a premium.

Where To Now?

- Gain an insight into the universe of 1962 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000001

Ping An Bank

Provides commercial banking products and services for individual and corporate customers, government agencies, institutions, and other small businesses in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.