- China

- /

- Construction

- /

- SHSE:600769

Unveiling Hidden Gems With Potential This December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with U.S. small-cap stocks like those in the Russell 2000 Index hitting record intraday highs, investors are keenly observing the impact of domestic policies and geopolitical factors on market sentiment. In this dynamic environment, identifying promising small-cap stocks requires a focus on companies that demonstrate resilience and adaptability amid economic shifts and policy changes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Wuhan Xianglong Power IndustryLtd (SHSE:600769)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Xianglong Power Industry Co. Ltd operates in the water supply and construction sectors in China, with a market capitalization of CN¥4.60 billion.

Operations: Wuhan Xianglong Power Industry Co. Ltd generates revenue primarily from its water supply and construction operations in China. The company's net profit margin has shown notable fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

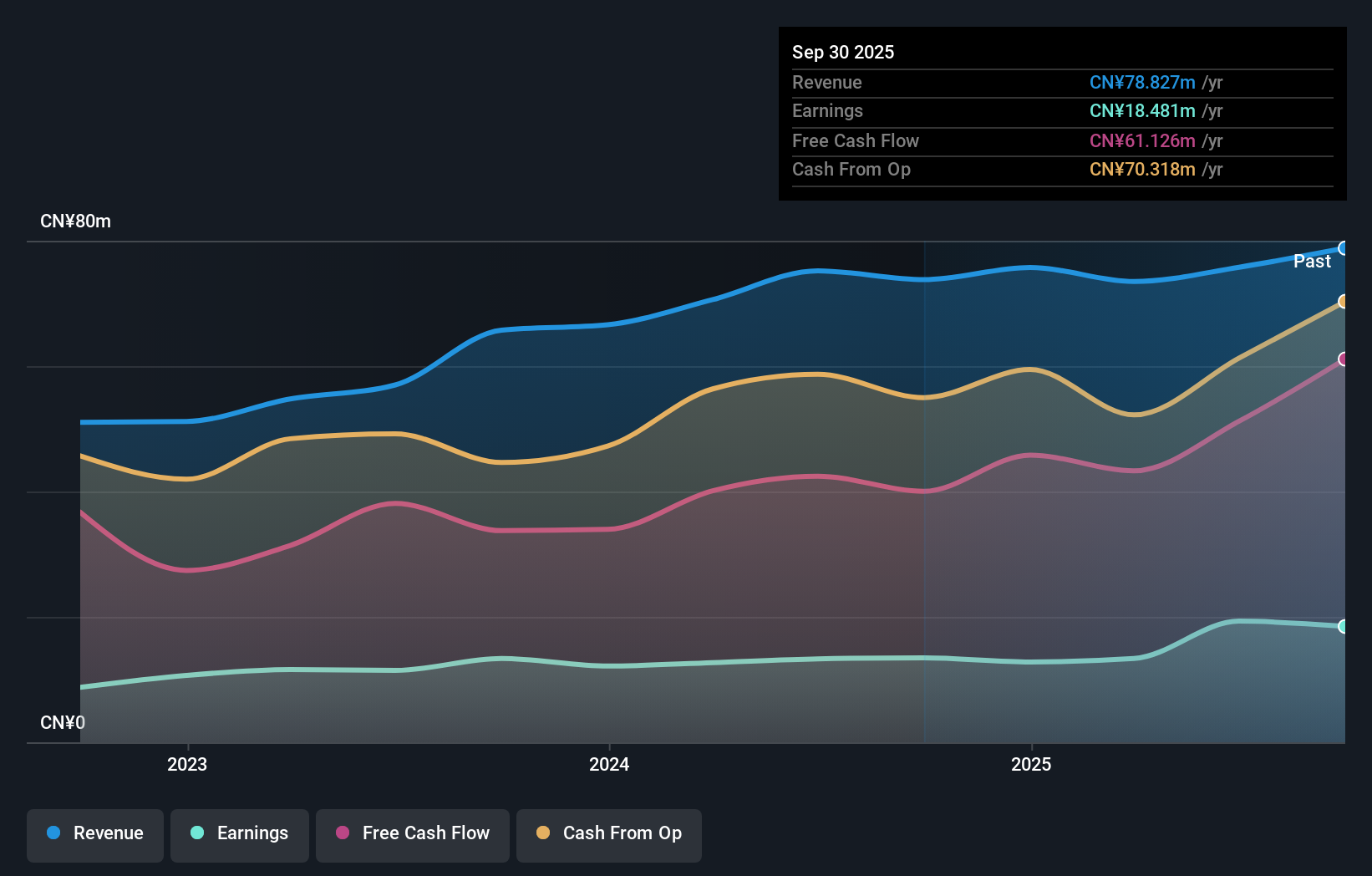

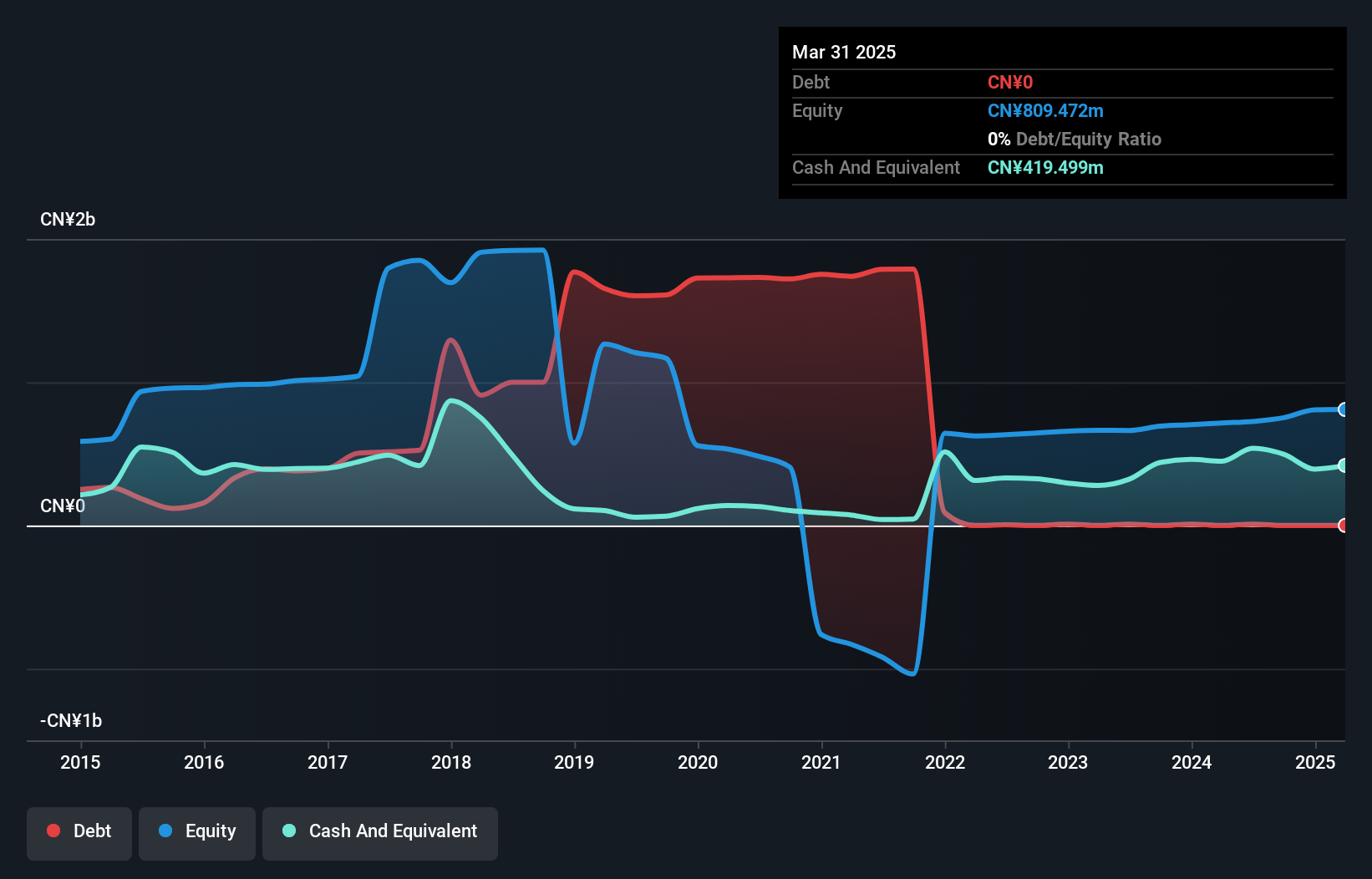

Wuhan Xianglong Power Industry Ltd, a dynamic player in the construction sector, has shown resilience with its earnings growth of 0.7% over the past year, outpacing the industry's -4.1%. The company is debt-free and boasts high-quality earnings, enhancing its financial stability. Recent figures indicate a positive trajectory with sales reaching CNY 58.67 million for nine months ended September 2024, up from CNY 51.48 million last year. Net income also rose to CNY 11.54 million from CNY 10.23 million previously, while basic earnings per share improved to CNY 0.0308 from CNY 0.0273 a year earlier.

Shenzhen Soling IndustrialLtd (SZSE:002766)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Soling Industrial Co., Ltd specializes in offering car-road-cloud solutions and has a market capitalization of CN¥4.96 billion.

Operations: Shenzhen Soling Industrial Co., Ltd has a market capitalization of CN¥4.96 billion.

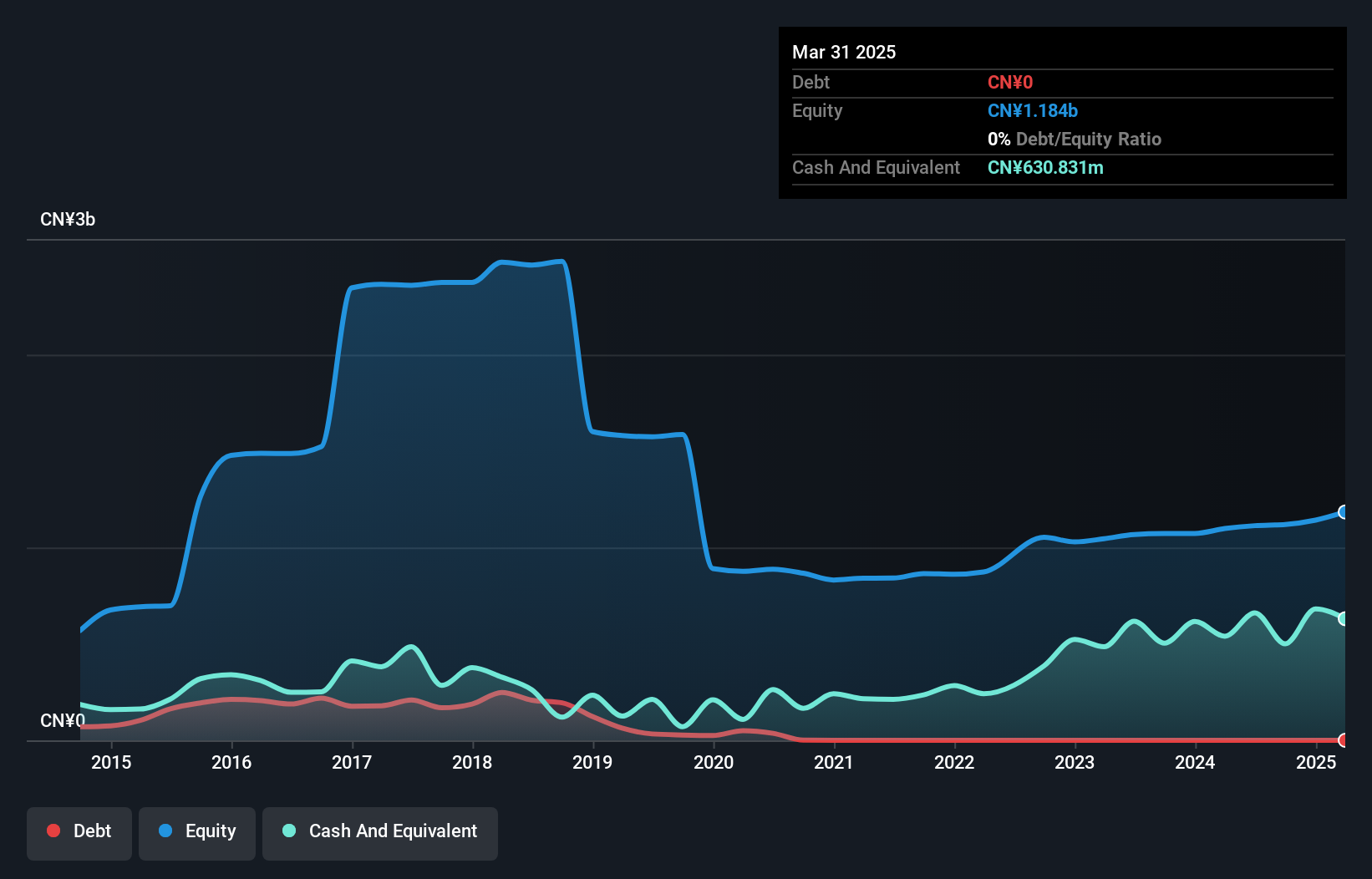

Shenzhen Soling Industrial's recent performance highlights its dynamic nature within the auto components sector, with earnings growth of 124.6% over the past year, outpacing industry averages. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 137.9%. For the nine months ending September 2024, sales reached ¥1.03 billion up from ¥729.84 million last year, while net income rose to ¥44.07 million compared to ¥19.38 million previously. Basic earnings per share increased to ¥0.0519 from ¥0.023 a year earlier, reflecting robust financial health and potential for future expansion.

Youngy Health (SZSE:300247)

Simply Wall St Value Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is involved in the manufacture, export, and sale of sauna products in China with a market capitalization of CN¥3.40 billion.

Operations: Youngy Health generates revenue primarily from the manufacture, export, and sale of sauna products. The company's net profit margin is 12.5%, reflecting its efficiency in converting sales into actual profit.

Youngy Health, a nimble player in its field, has seen a significant earnings surge of 169.9% over the past year, outpacing the Leisure industry's -0.7%. With no debt on its books now compared to a 1.7 debt-to-equity ratio five years ago, financial stability seems assured. The company's net income for the first nine months of 2024 reached CN¥36.44 million, up from CN¥25.69 million last year, showcasing robust growth despite some volatility in share price recently and large one-off gains impacting earnings by CN¥17.5 million until September 2024 end.

- Click to explore a detailed breakdown of our findings in Youngy Health's health report.

Understand Youngy Health's track record by examining our Past report.

Make It Happen

- Click here to access our complete index of 4635 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Xianglong Power IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600769

Wuhan Xianglong Power IndustryLtd

Engages in the water supply and construction businesses in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives