- China

- /

- Commercial Services

- /

- SHSE:603568

3 Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets continue to reach new heights, with indices like the Dow Jones Industrial Average and S&P 500 hitting record intraday highs, investor sentiment is being shaped by both domestic policy decisions and geopolitical developments. In this environment of robust market activity, companies with significant insider ownership can offer unique insights into potential growth opportunities, as insiders often have a vested interest in the company's success and may provide stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| CD Projekt (WSE:CDR) | 29.7% | 28.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Weiming Environment Protection (SHSE:603568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Weiming Environment Protection Co., Ltd. operates in the environmental protection industry and has a market cap of CN¥34.80 billion.

Operations: The company's revenue primarily comes from its industrial segment, which generated CN¥7.45 billion.

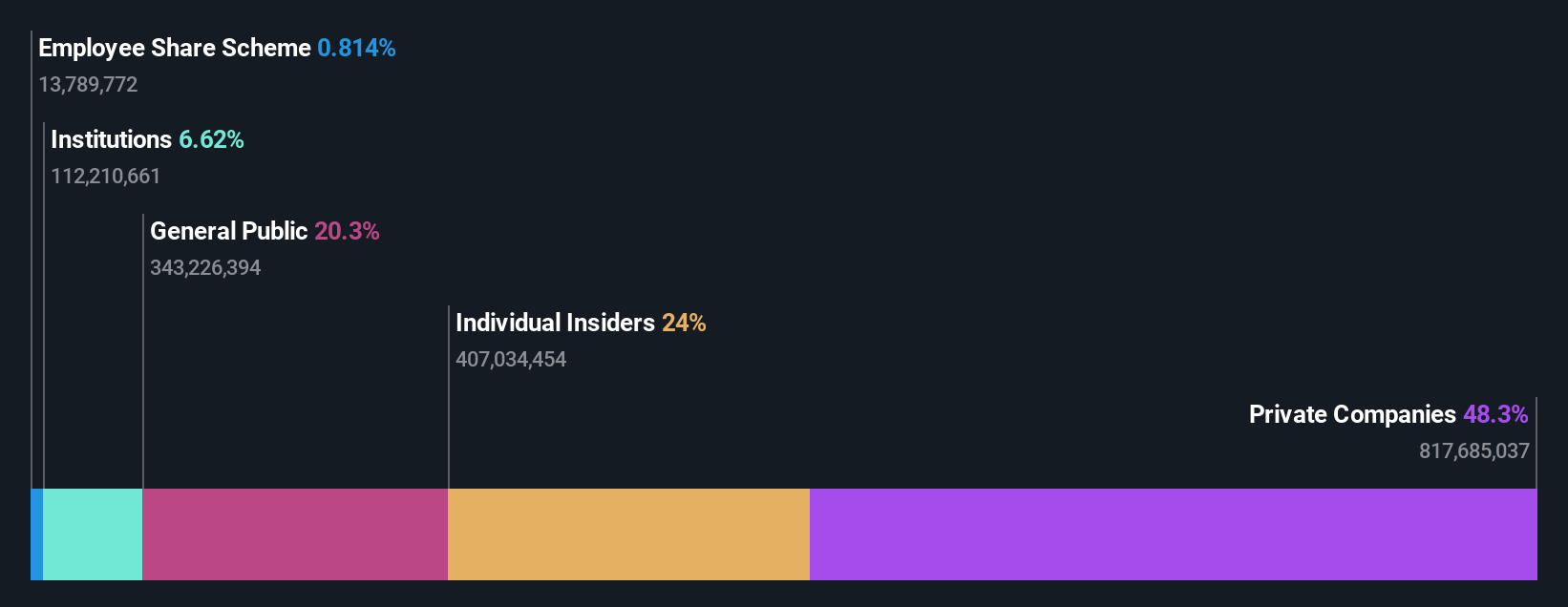

Insider Ownership: 24%

Revenue Growth Forecast: 34.5% p.a.

Zhejiang Weiming Environment Protection has demonstrated strong financial growth, with recent earnings showing a substantial increase in net income to CNY 2.11 billion. The company is trading at a favorable price-to-earnings ratio of 14.1x, below the Chinese market average, indicating good value compared to peers. Although its forecasted annual earnings growth of 23.1% is slightly below the market average, it still signifies significant potential for expansion in revenue and profitability.

- Click here to discover the nuances of Zhejiang Weiming Environment Protection with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Zhejiang Weiming Environment Protection is trading behind its estimated value.

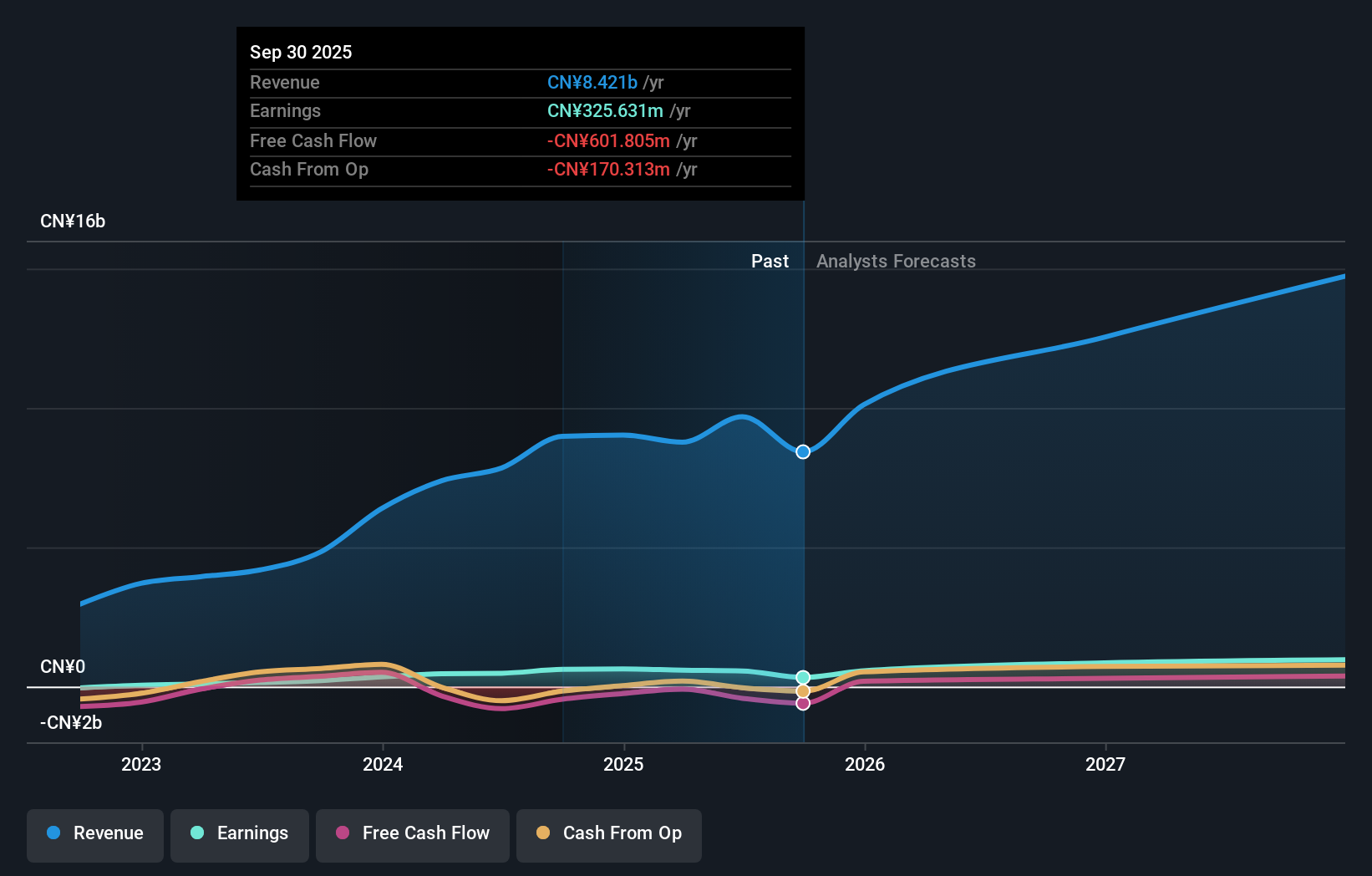

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arctech Solar Holding Co., Ltd. manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide, with a market cap of CN¥15.95 billion.

Operations: The company's revenue segments include solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for large-scale and commercial solar projects globally.

Insider Ownership: 37.9%

Revenue Growth Forecast: 20.8% p.a.

Arctech Solar Holding has shown impressive revenue growth, with recent earnings rising to CNY 427.28 million from CNY 157.39 million a year ago. The company's forecasted revenue growth of 20.8% annually surpasses the market average, highlighting its potential in the expanding solar energy sector in Europe following its strategic headquarters relocation to Spain. Despite high volatility and limited insider trading data, it remains valued attractively near its fair value estimate.

- Dive into the specifics of Arctech Solar Holding here with our thorough growth forecast report.

- According our valuation report, there's an indication that Arctech Solar Holding's share price might be on the cheaper side.

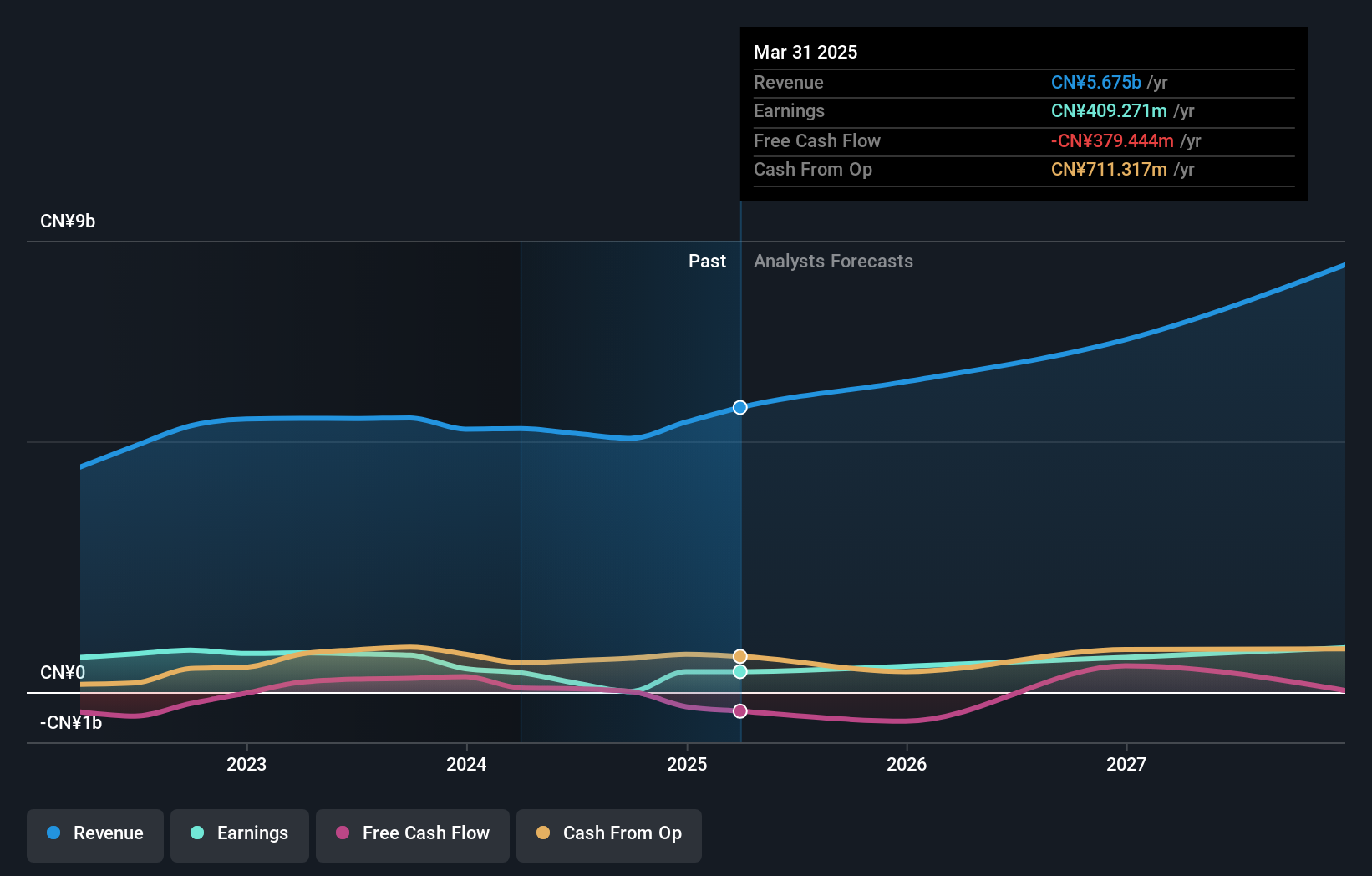

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of CN¥25.32 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue from its operating-system products in China, Europe, the United States, Japan, and other international markets.

Insider Ownership: 27.6%

Revenue Growth Forecast: 17.7% p.a.

Thunder Software Technology's earnings are projected to grow significantly, outpacing the Chinese market, despite recent declines in revenue and net income. Trading well below its estimated fair value suggests potential undervaluation. The strategic partnership with HERE Technologies enhances its position in intelligent navigation systems, potentially driving future growth. However, profit margins have decreased sharply from last year due to large one-off items impacting results. Insider trading data is limited, adding uncertainty to insider sentiment analysis.

- Click here and access our complete growth analysis report to understand the dynamics of Thunder Software TechnologyLtd.

- Our comprehensive valuation report raises the possibility that Thunder Software TechnologyLtd is priced lower than what may be justified by its financials.

Taking Advantage

- Click here to access our complete index of 1517 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Weiming Environment Protection might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603568

Zhejiang Weiming Environment Protection

Zhejiang Weiming Environment Protection Co., Ltd.

High growth potential with solid track record.