Uncovering Three Undiscovered Gems with Strong Financial Foundations

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by record highs in major indices like the Russell 2000 and geopolitical developments, investors are increasingly turning their attention to small-cap stocks that demonstrate resilience and potential for growth. In this environment, identifying stocks with strong financial foundations becomes crucial, as they offer stability and the possibility of capitalizing on market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Time Publishing and Media (SHSE:600551)

Simply Wall St Value Rating: ★★★★★★

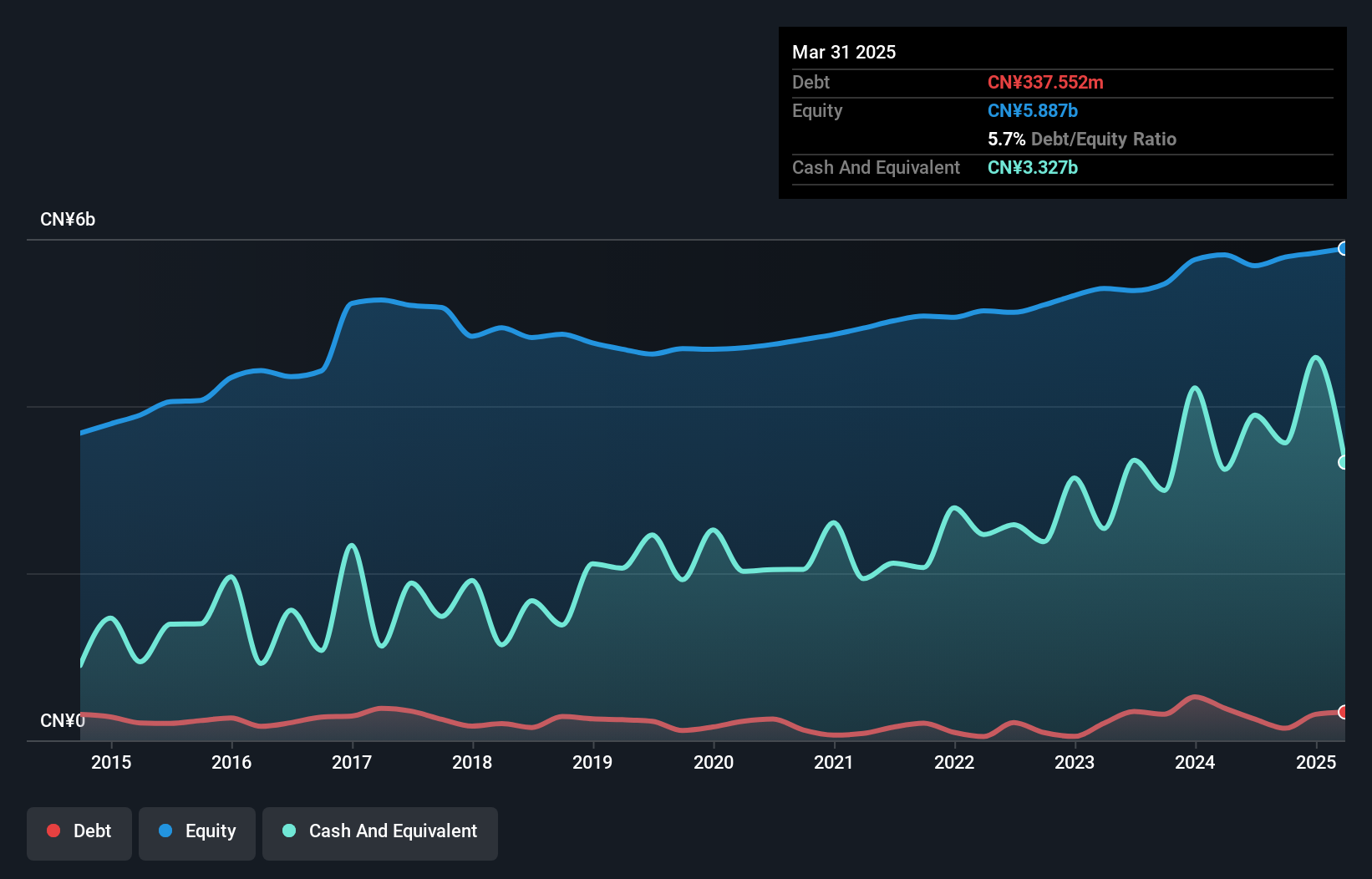

Overview: Time Publishing and Media Co., Ltd. is a Chinese company that specializes in publishing books and periodicals, with a market capitalization of CN¥6.03 billion.

Operations: Time Publishing and Media generates revenue primarily from publishing books and periodicals. The company reported a market capitalization of CN¥6.03 billion.

Time Publishing and Media, a relatively small player in its industry, showcases impressive earnings growth of 46.7% over the past year, outpacing the media sector's downturn of 10.2%. Despite a net income of CN¥261.47 million for the first nine months ending September 2024—slightly down from CN¥262.26 million last year—the company reported significant one-off gains amounting to CN¥98.5 million, which likely skewed its financial results positively. Trading at 75% below estimated fair value presents potential upside for investors seeking undervalued opportunities in publishing and media sectors amidst evolving market dynamics.

Zhang Jia Gang Freetrade Science&Technology GroupLtd (SHSE:600794)

Simply Wall St Value Rating: ★★★★★★

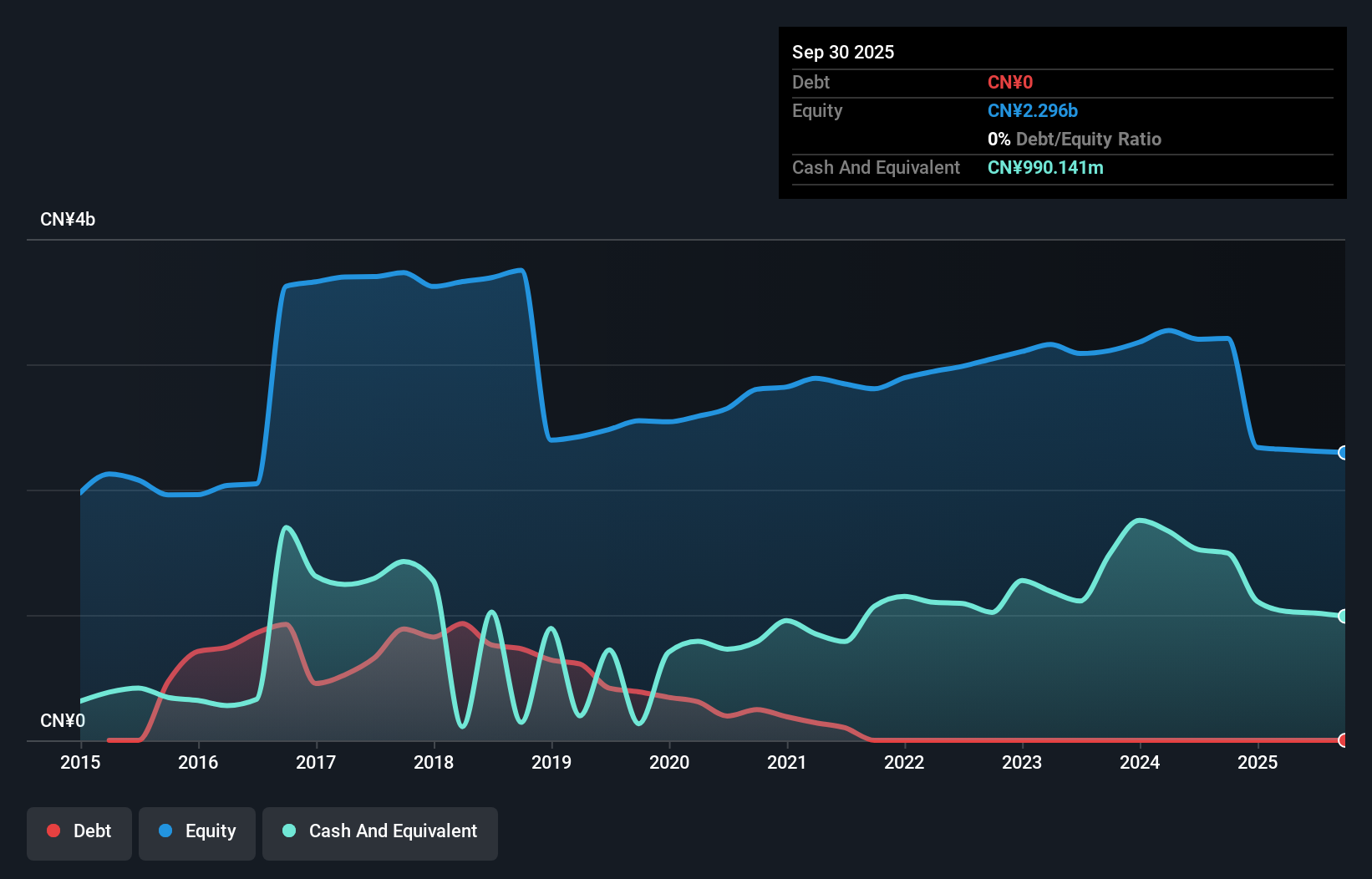

Overview: Zhang Jia Gang Freetrade Science & Technology Group Co., Ltd. operates in the port terminal business in China through its subsidiaries and has a market capitalization of CN¥4.60 billion.

Operations: The company generates revenue primarily through its port terminal operations in China. It has a market capitalization of CN¥4.60 billion.

Zhang Jia Gang Freetrade Science & Technology Group, a company with a modest market capitalization, is trading at 93% below its estimated fair value. Over the past year, earnings grew by 2.3%, outpacing the Trade Distributors industry's -16.9%. The firm has successfully reduced its debt to equity ratio from 19.3% to 7.4% over five years and boasts high-quality earnings alongside positive free cash flow. Despite sales dropping to CNY 714 million for nine months ending September 2024 from CNY 1,200 million previously, net income showed resilience at CNY 184 million compared to last year's CNY 199 million.

Jiangsu Yinhe ElectronicsLtd (SZSE:002519)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yinhe Electronics Co., Ltd. operates in the new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment sectors both in China and internationally, with a market cap of CN¥6.69 billion.

Operations: The company generates revenue from its involvement in the new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment sectors. It has a market capitalization of CN¥6.69 billion.

Jiangsu Yinhe Electronics, a smaller player in the electronics sector, has shown promising signs with earnings growth of 10.7% over the past year, outpacing the industry's 1.8%. The company is debt-free now, contrasting its debt to equity ratio of 15.2% five years ago. Its price-to-earnings ratio stands at 34.5x, which is competitive against the broader CN market's 36.3x. Despite sales dipping to CNY 813 million from CNY 842 million last year, net income rose to CNY 141.95 million from CNY 126.82 million, reflecting strong operational efficiency and high-quality earnings potential moving forward.

- Dive into the specifics of Jiangsu Yinhe ElectronicsLtd here with our thorough health report.

Learn about Jiangsu Yinhe ElectronicsLtd's historical performance.

Where To Now?

- Embark on your investment journey to our 4635 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Time Publishing and Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600551

Time Publishing and Media

Time Publishing and Media Co., Ltd. publishes various books and periodicals in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives