- China

- /

- Construction

- /

- SHSE:600133

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets continue to reach new heights, with U.S. small-cap indices like the Russell 2000 joining their larger peers in record territory, investors are increasingly interested in exploring opportunities within this dynamic segment. In such an environment, identifying stocks that demonstrate strong fundamentals and resilience amid economic shifts can be particularly rewarding for those looking to uncover potential growth stories.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Wuhan East Lake High Technology Group (SHSE:600133)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuhan East Lake High Technology Group Co., Ltd. operates in various sectors including high-tech industries and has a market capitalization of approximately CN¥11.50 billion.

Operations: The company generates revenue primarily from its high-tech industry operations, contributing significantly to its financial performance.

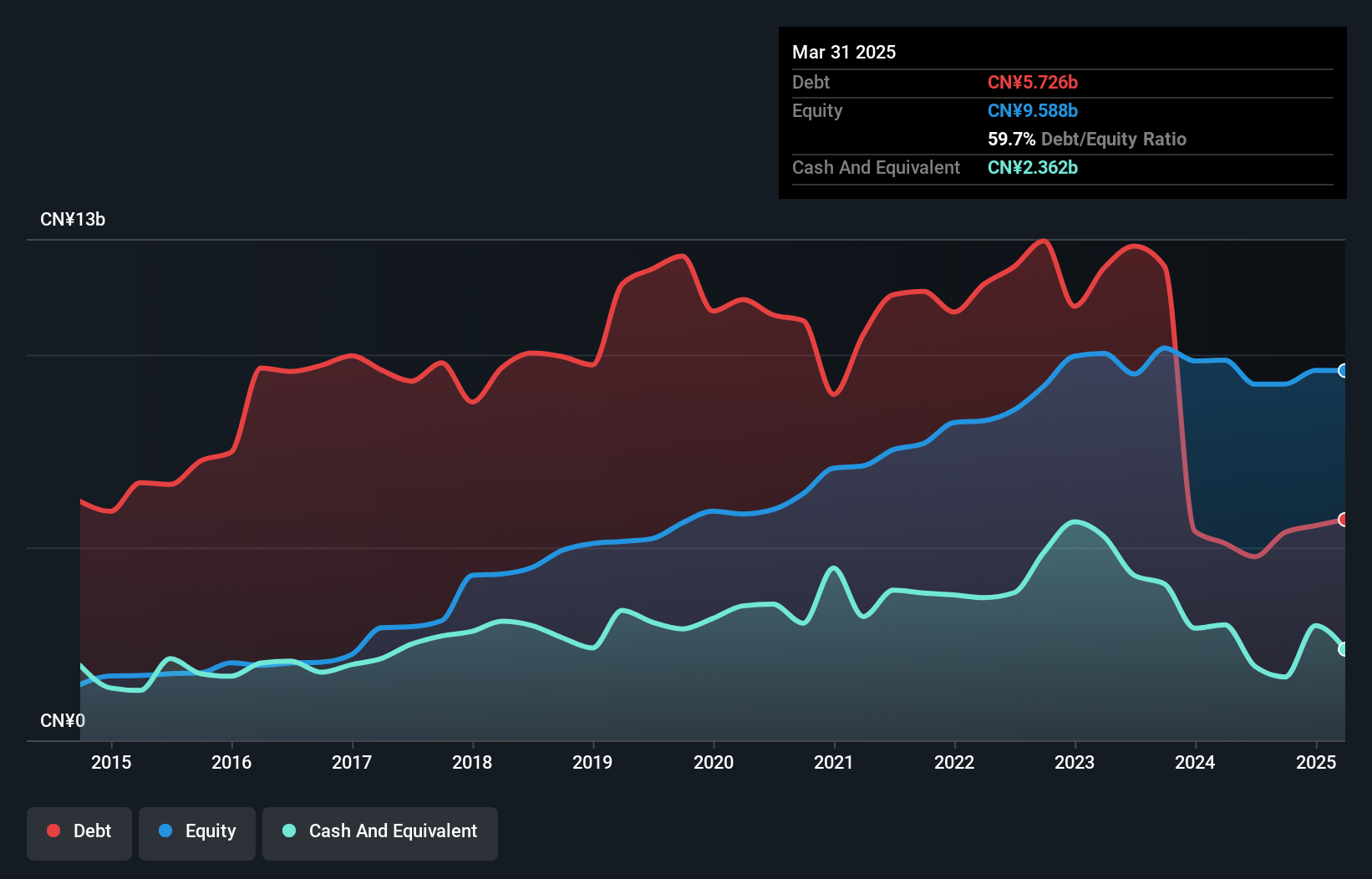

Wuhan East Lake High Technology Group, a smaller player in the market, showcases some intriguing aspects. Despite a high net debt to equity ratio of 40.6%, the company has managed to reduce this from 222.7% over five years, reflecting improved financial discipline. Its earnings growth of 107% outpaces the construction industry's decline of 4%. However, sales for the first nine months of 2024 fell significantly to CNY 1.24 billion from CNY 10.8 billion last year, with net income slightly down at CNY 218 million compared to CNY 238 million previously. The price-to-earnings ratio stands attractively low at 11.2x against the CN market's average of 36.3x, hinting at potential value opportunities amidst its challenges and industry context.

Zhejiang Hengtong HoldingLtd (SHSE:600226)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Hengtong Holding Co., Ltd. engages in the research, development, production, and sale of biological pesticides, veterinary drugs, and animal feed additives both in China and internationally, with a market cap of CN¥7.05 billion.

Operations: Zhejiang Hengtong Holding Co., Ltd. generates revenue through the sale of biological pesticides, veterinary drugs, and animal feed additives. The company's net profit margin has shown variations over recent periods, indicating fluctuations in its profitability.

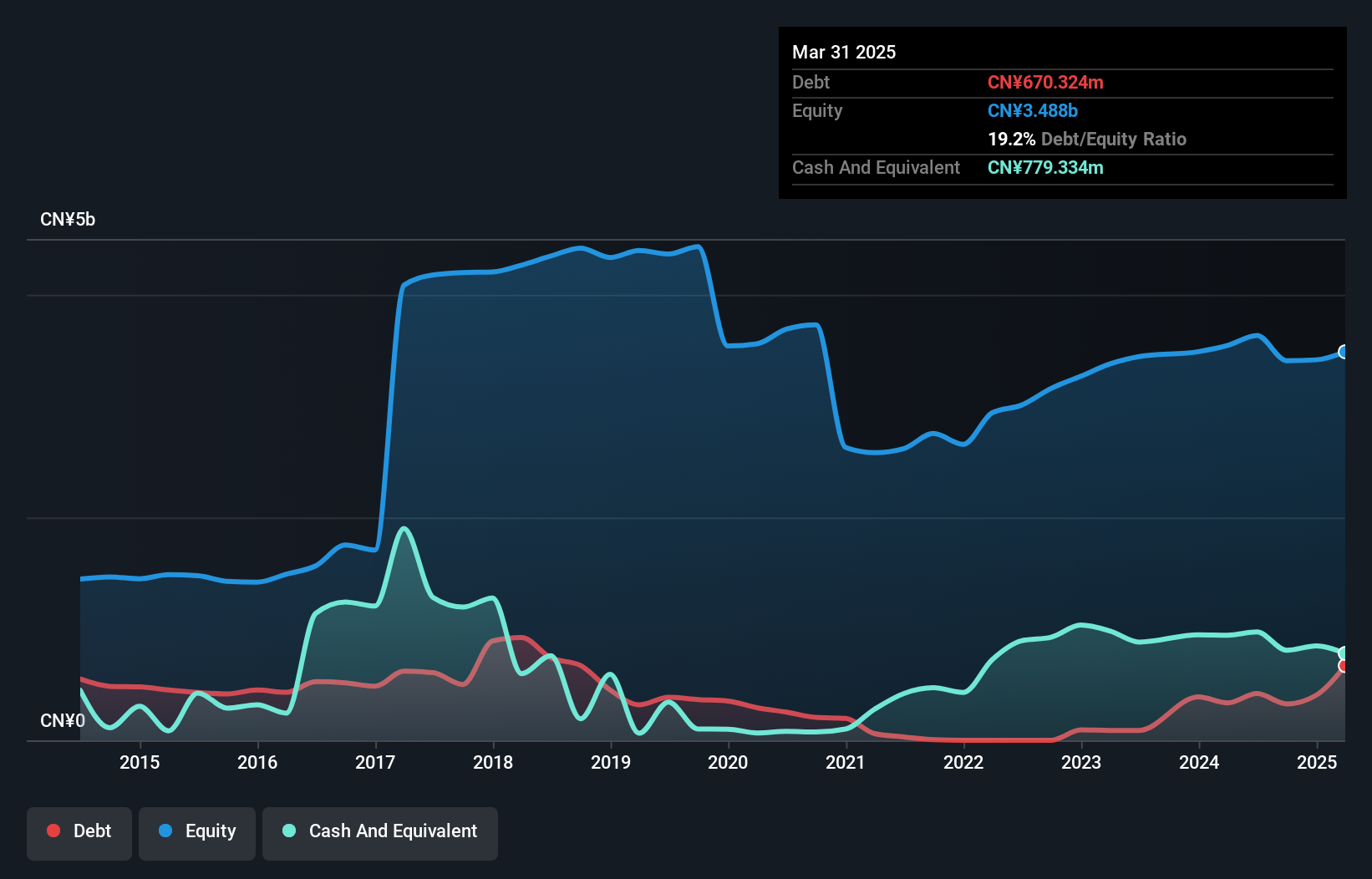

Zhejiang Hengtong Holding, a nimble player in the chemicals sector, showcases impressive earnings growth of 94.2% over the past year, outpacing its industry peers' -5%. With sales reaching CNY 908.2 million for nine months ending September 2024—more than double compared to last year's CNY 439.39 million—the company is on a solid trajectory. Despite an increase in debt to equity ratio from 8.3% to 9.6% over five years, it holds more cash than total debt and comfortably covers interest payments with profits. However, free cash flow remains negative at present levels, suggesting room for improvement in operational efficiency.

Unilumin Group (SZSE:300232)

Simply Wall St Value Rating: ★★★★★★

Overview: Unilumin Group Co., Ltd, with a market cap of CN¥7.45 billion, is engaged in the design, development, manufacturing, sales, and servicing of LED display and lighting solutions both in China and internationally.

Operations: The company's primary revenue streams come from the sale of LED display and lighting solutions. The cost structure includes expenses related to manufacturing, development, and servicing these products. Notably, its gross profit margin has shown fluctuations over recent periods.

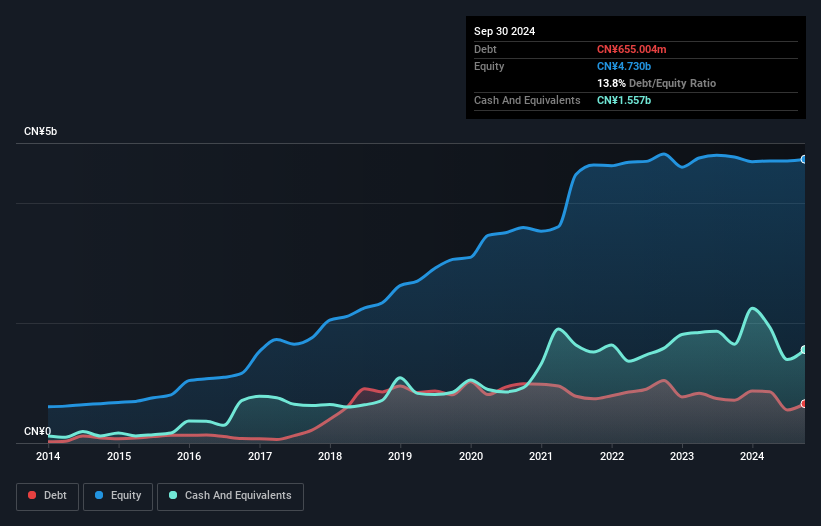

Unilumin Group, a small player in the electronics sector, has seen its earnings skyrocket by 9999.1% over the past year, significantly outpacing the industry growth of 1.8%. Despite this impressive surge, a one-off loss of CN¥119.8 million has impacted recent financial results. The company reported sales of CN¥5.42 billion for the nine months ending September 2024, up from CN¥5.07 billion last year; however, net income dropped to CN¥127.69 million from CN¥191 million in the previous period. Trading just below its estimated fair value suggests potential for future appreciation despite current challenges.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4630 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan East Lake High Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600133

Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group Co., Ltd.

Solid track record with adequate balance sheet.