Three Stocks That May Be Priced Below Their Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive economic indicators and geopolitical developments, investors are navigating a complex landscape marked by both opportunities and uncertainties. Amidst this environment, identifying stocks that may be priced below their estimated value can offer potential for growth, particularly when broader market sentiment is buoyant.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| Giant Biogene Holding (SEHK:2367) | HK$48.30 | HK$96.33 | 49.9% |

| PharmaResearch (KOSDAQ:A214450) | ₩213500.00 | ₩425786.18 | 49.9% |

| Stille (OM:STIL) | SEK220.00 | SEK437.81 | 49.7% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| EnomotoLtd (TSE:6928) | ¥1460.00 | ¥2918.40 | 50% |

| Mobvista (SEHK:1860) | HK$8.55 | HK$15.99 | 46.5% |

| EQL Pharma (OM:EQL) | SEK77.00 | SEK153.58 | 49.9% |

| Sands China (SEHK:1928) | HK$20.30 | HK$40.57 | 50% |

| Hesai Group (NasdaqGS:HSAI) | US$8.18 | US$16.30 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea, with a market cap of ₩2.06 trillion.

Operations: PharmaResearch Co., Ltd. and its subsidiaries focus on the biopharmaceutical sector, primarily serving the South Korean market.

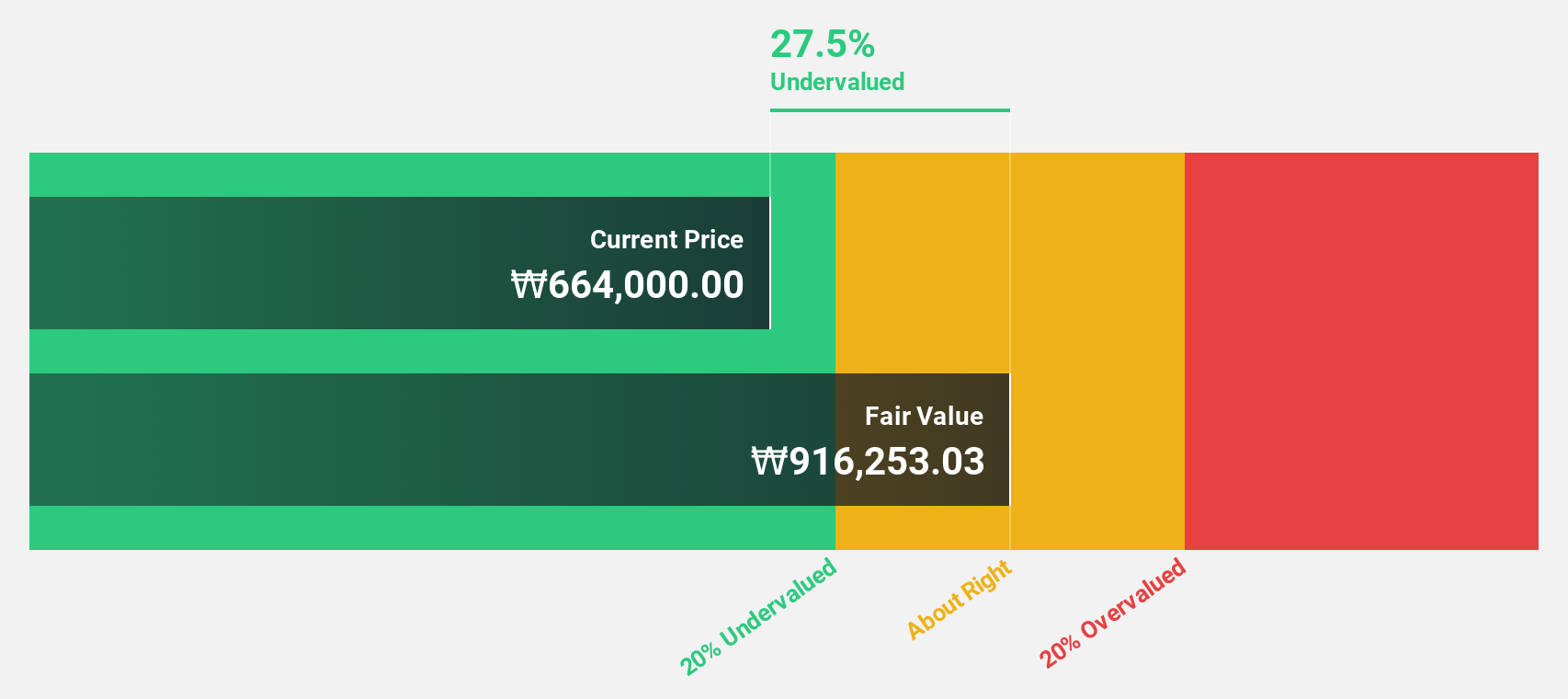

Estimated Discount To Fair Value: 49.9%

PharmaResearch appears undervalued, trading at 49.9% below its estimated fair value of ₩425,786.18. Despite a recent private placement raising nearly ₩200 billion, the company's earnings are forecast to grow significantly at 27.94% annually, although slightly slower than the market average. Revenue growth is expected to outpace the KR market substantially at 24.2% per year. Analysts agree on a potential stock price rise of 32.4%, highlighting its strong relative value compared to peers and industry standards.

- Our growth report here indicates PharmaResearch may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in PharmaResearch's balance sheet health report.

Sands China (SEHK:1928)

Overview: Sands China Ltd. develops, owns, and operates integrated resorts and casinos in Macao with a market cap of HK$160.57 billion.

Operations: The company's revenue segments include The Venetian Macao at $2.93 billion, The Londoner Macao at $2.11 billion, The Parisian Macao at $961 million, The Plaza Macao at $776 million, Sands Macao at $319 million, and Ferry and Other Operations contributing $109 million.

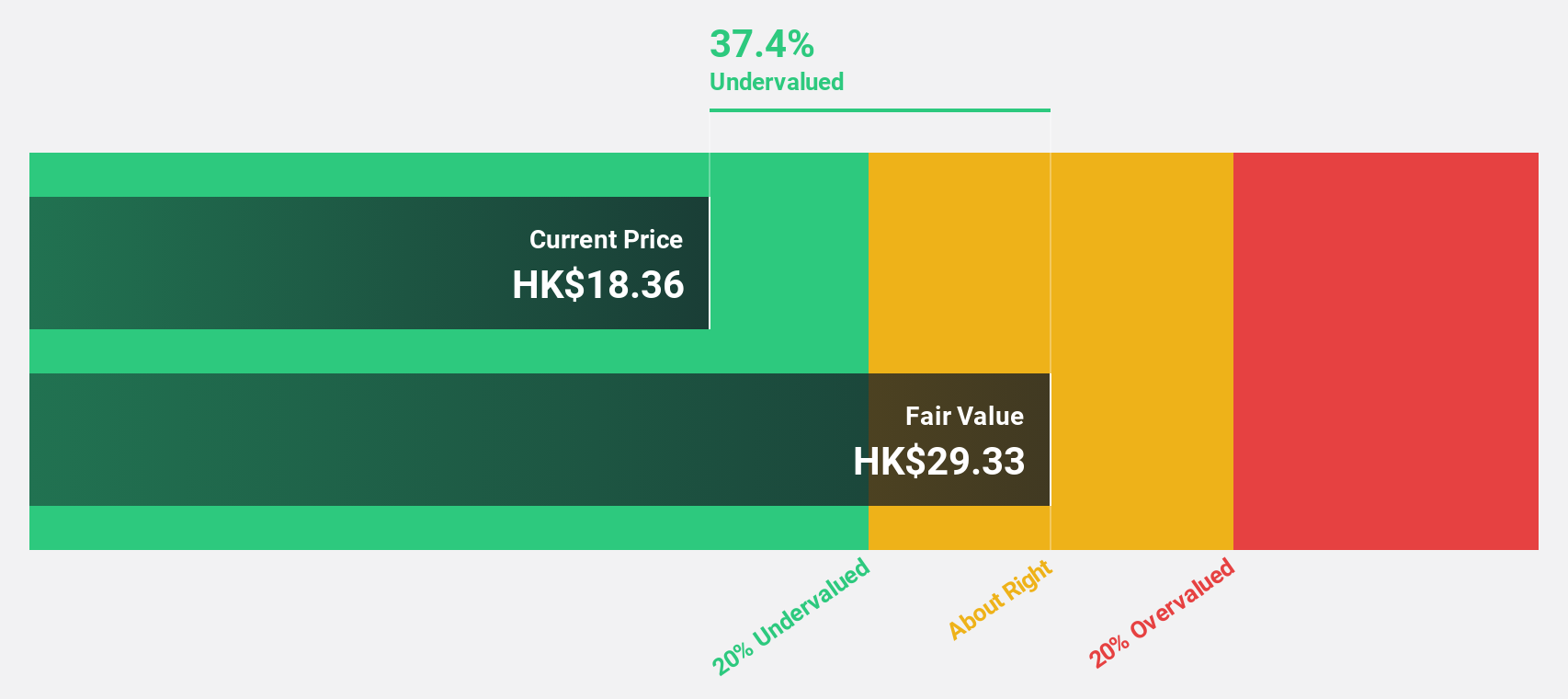

Estimated Discount To Fair Value: 50%

Sands China trades at HK$20.3, significantly below its estimated fair value of HK$40.57, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 19.17% annually, outpacing the Hong Kong market average of 11.3%. Despite high debt levels and recent refinancing through a HK$19.5 billion credit facility, analysts anticipate a stock price rise of 28.9%, supported by strong revenue growth forecasts and robust return on equity projections in three years' time.

- Our comprehensive growth report raises the possibility that Sands China is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Sands China stock in this financial health report.

Hunan Jiudian Pharmaceutical (SZSE:300705)

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥12.57 billion.

Operations: The company's revenue is primarily derived from its Medicine Manufacturing segment, which generated CN¥2.95 billion.

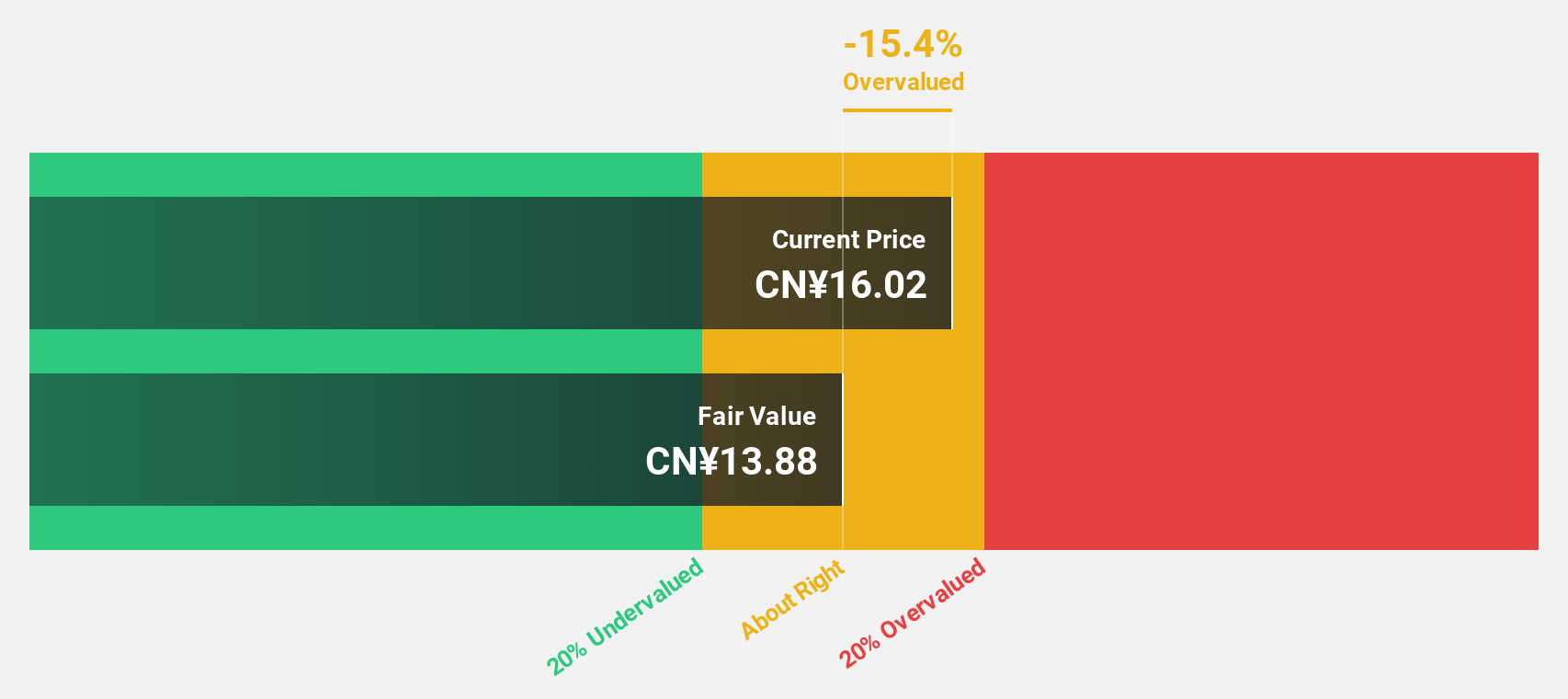

Estimated Discount To Fair Value: 49.3%

Hunan Jiudian Pharmaceutical is trading at CN¥26.39, well below its estimated fair value of CN¥52.08, indicating potential undervaluation based on cash flows. Recent earnings showed significant improvement with net income rising to CN¥449.73 million from CN¥309.99 million year-over-year. Earnings are projected to grow significantly at 25.49% annually over the next three years, although slower than the Chinese market average of 26.2%. Despite past shareholder dilution and an unstable dividend history, analysts agree on a potential stock price increase of 25.4%.

- The analysis detailed in our Hunan Jiudian Pharmaceutical growth report hints at robust future financial performance.

- Navigate through the intricacies of Hunan Jiudian Pharmaceutical with our comprehensive financial health report here.

Where To Now?

- Click through to start exploring the rest of the 904 Undervalued Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Jiudian Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300705

Hunan Jiudian Pharmaceutical

Researches, develops, produces, and sells pharmaceutical products in China and internationally.

Flawless balance sheet and undervalued.