- China

- /

- Medical Equipment

- /

- SHSE:688050

3 Growth Companies With Insider Ownership Up To 21%

Reviewed by Simply Wall St

As global markets continue to reach record highs, with major indices like the Dow Jones Industrial Average and S&P 500 Index posting significant gains, investor sentiment remains buoyed by domestic policy developments and geopolitical events. Amidst this backdrop of market optimism, identifying growth companies with substantial insider ownership can be an attractive strategy for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| CD Projekt (WSE:CDR) | 29.7% | 28.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Here we highlight a subset of our preferred stocks from the screener.

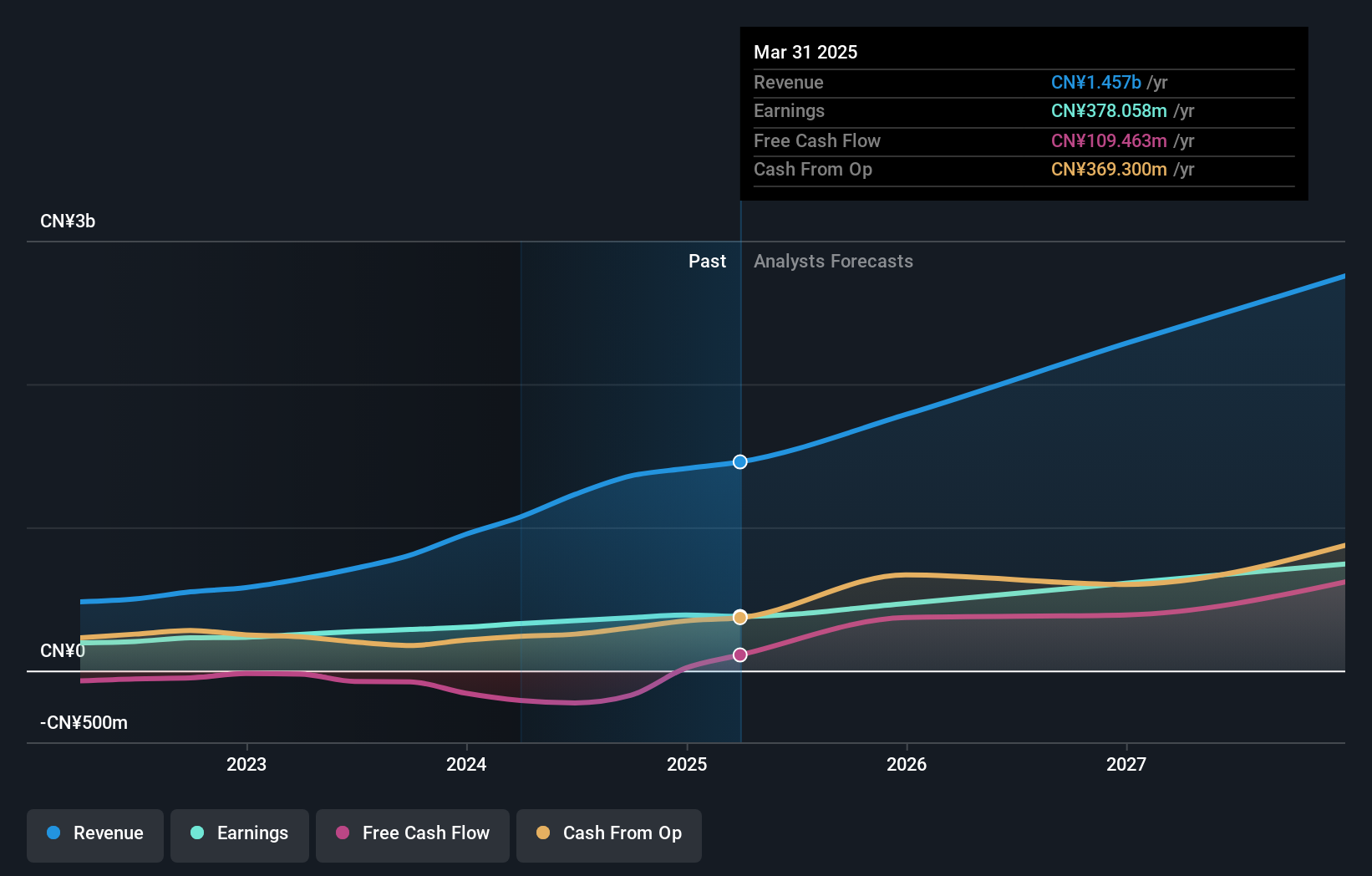

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Lion Electronics Co., Ltd specializes in the R&D, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor RF chips in China with a market cap of CN¥17.86 billion.

Operations: The company generates revenue from its semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips.

Insider Ownership: 18.8%

Hangzhou Lion Electronics Ltd. is poised for significant growth, with revenue expected to increase by 23.7% annually, outpacing the Chinese market's average. Despite a recent net loss of CNY 54.34 million for the first nine months of 2024, the company has initiated a share repurchase program worth CNY 50 million to bolster employee incentives. While profitability is anticipated within three years, its forecasted return on equity remains low at 5.2%.

- Unlock comprehensive insights into our analysis of Hangzhou Lion ElectronicsLtd stock in this growth report.

- The analysis detailed in our Hangzhou Lion ElectronicsLtd valuation report hints at an inflated share price compared to its estimated value.

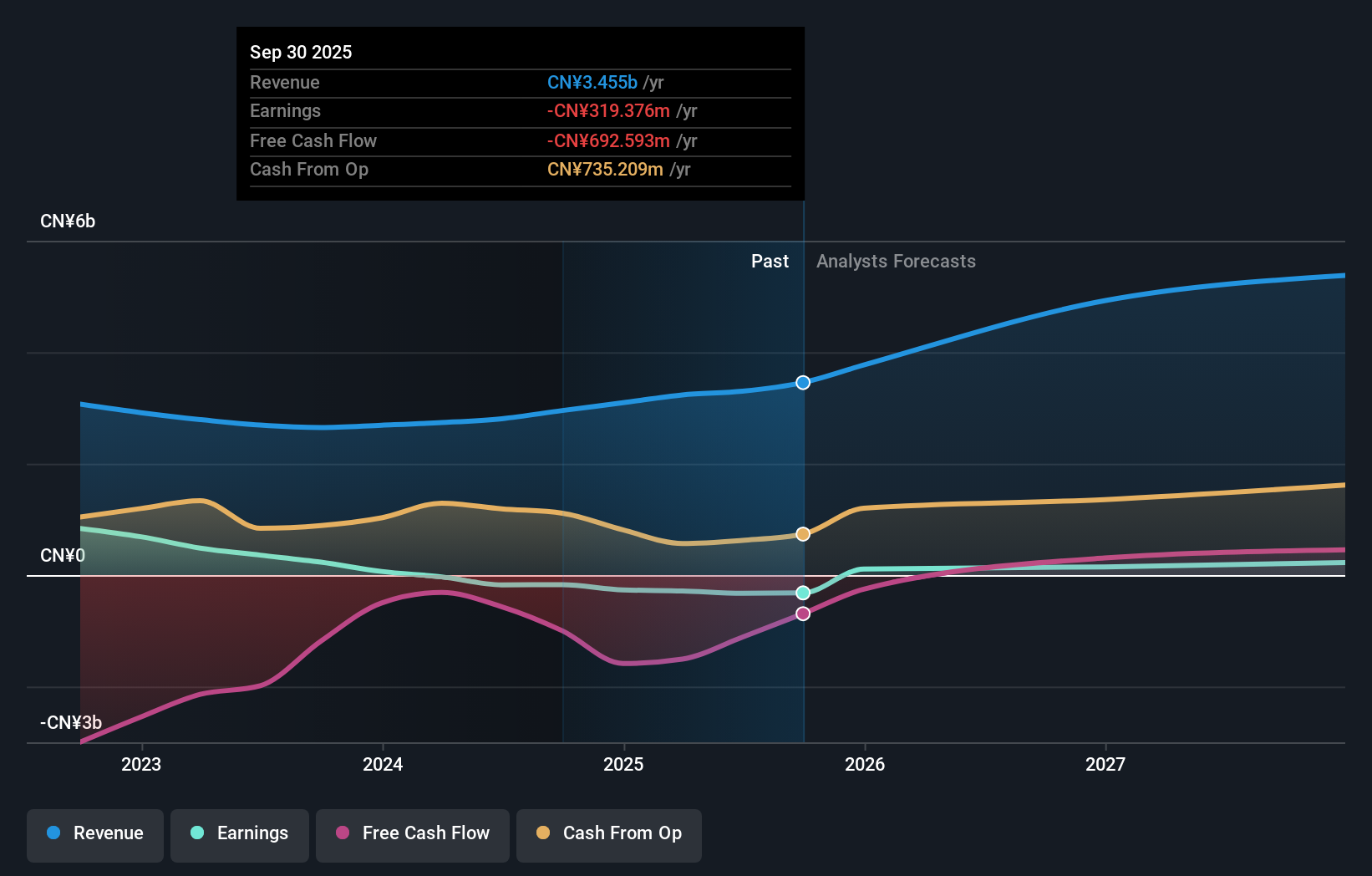

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector and has a market capitalization of CN¥17.30 billion.

Operations: The company generates revenue primarily from its Medical Products segment, amounting to CN¥1.36 billion.

Insider Ownership: 21.5%

Eyebright Medical Technology (Beijing) is experiencing robust growth, with earnings and revenue forecasted to grow significantly above the Chinese market average. The company reported sales of CNY 1.08 billion for the first nine months of 2024, up from CNY 668.1 million a year earlier, alongside a net income increase to CNY 317.59 million from CNY 251.97 million. Despite high non-cash earnings quality, return on equity is expected to remain moderate at 18.1%.

- Dive into the specifics of Eyebright Medical Technology (Beijing) here with our thorough growth forecast report.

- Our valuation report here indicates Eyebright Medical Technology (Beijing) may be overvalued.

Jiangsu Nata Opto-electronic Material (SZSE:300346)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Nata Opto-electronic Material Co., Ltd. operates in the optoelectronic materials industry and has a market cap of CN¥21.31 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Materials segment, which generated CN¥1.60 billion.

Insider Ownership: 19.1%

Jiangsu Nata Opto-electronic Material shows strong growth potential with revenue forecasted to increase by 21.8% annually, outpacing the Chinese market's average. Recent earnings for the first nine months of 2024 reported sales of CNY 1.76 billion, up from CNY 1.28 billion year-over-year, and net income rose to CNY 265.61 million from CNY 215.37 million. Despite a volatile share price and low future return on equity at 14.3%, earnings are expected to grow significantly at 24.5% per year over the next three years.

- Take a closer look at Jiangsu Nata Opto-electronic Material's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Jiangsu Nata Opto-electronic Material is trading beyond its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 1517 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eyebright Medical Technology (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688050

Eyebright Medical Technology (Beijing)

Eyebright Medical Technology (Beijing) Co., Ltd.

High growth potential with excellent balance sheet.